Fears of German recession are not the only reason behind lower forecasts for EUR/USD.

The team at Goldman Sachs lists several reasons why euro/dollar should further fall and update their 3, 6 and 12 month forecasts to the downside.

Here is their view, courtesy of eFXnews:

Goldman Sachs cuts its EUR/USD forecast and now expects the pair to trade at 1.23, 1.20 and 1.15, in 3, 6 and 12 months from 1.29, 1.25 and 1.20 previously. GS expects EUR/USD to fall to parity by the end of 2017.

“Overall, we think current levels in EUR/$ do not yet reflect the kind of balance sheet expansion that ECB President Draghi has mentioned. As the market becomes more comfortable that the ECB will bring its balance sheet back to early-2012 levels, we think we will see more Euro weakness,” GS projects.

“In addition, our European Economists see downside risks to the ECB’s inflation and growth forecasts, which points to the potential for more easing beyond the measures that have already been announced,” GS adds.

“We think a large portion of foreign portfolio inflows into the Euro area since Mr. Draghi’s “whatever it takes” speech is likely to be unhedged. This means that the underlying long Euro position is likely to be sizeable, which is ignored by simple positioning metrics like the CFTC’s CoT report,” GS argues.

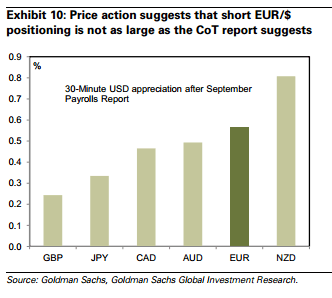

“The price action around last week’s US non-farm payrolls (NFP) also tends to support this view. Exhibit 10 shows the reaction of G10 currencies versus the Dollar in the 30 minutes around last week’s positive surprise on payrolls (the positive bars show how much the Dollar appreciated against each currency in the 30 minutes after the payrolls release). There is no sign that the Dollar lagged in its rise against the Euro, which we would see as a sign that short Euro positioning is stretched,” GS clarifies.

“As a result, Euro downside remains our top conviction view,” GS concloudes.

For lots more FX trades from Credit Agricole and other major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.