- Markets expect the Bank of Japan to maintain rates tomorrow.

- The yen will remain weak if Japan maintains its gradual rate hike outlook.

- As the USD/JPY pair continues to climb, the risk of intervention grows.

The USD/JPY outlook remains bullish as the yen weakens in anticipation of the Bank of Japan’s policy decision. However, investors are treading cautiously as the risk of intervention looms large following the recent surge above the $155 level.

–Are you interested in learning more about STP brokers? Check our detailed guide-

On Thursday, the Bank of Japan started its policy meeting to decide on interest rates. When the meeting ends tomorrow, markets expect the central bank to hold rates. However, policymakers might give a hawkish message about the outlook for interest rates.

Notably, BoJ governor Kazuo Ueda has assumed a more hawkish tone in recent weeks due to the sharp decline in the yen. He has repeatedly said that the central bank might hike rates to support the weak currency. A weak yen drives trend inflation as it increases import prices. However, if the Bank of Japan maintains rates, the fundamentals supporting the yen’s decline will remain. The yen has weakened significantly due to the interest rate gap between the US and Japan. Therefore, as long as Japan maintains its gradual rate-hike outlook, the yen will remain weak.

Meanwhile, as Japan’s currency plummets, officials in the country have stepped up warnings of a looming intervention. Although such remarks kept it in a tight range below $155, the effect eventually faded. Markets were seeing this level as the line in the sand. However, they have now pushed it up to $160. As the USD/JPY pair continues to climb, the risk of intervention grows.

USD/JPY key events today

- Advance US GDP

- US jobless claims

- Pending US home sales

USD/JPY technical outlook: New swing high signals bullish momentum surge

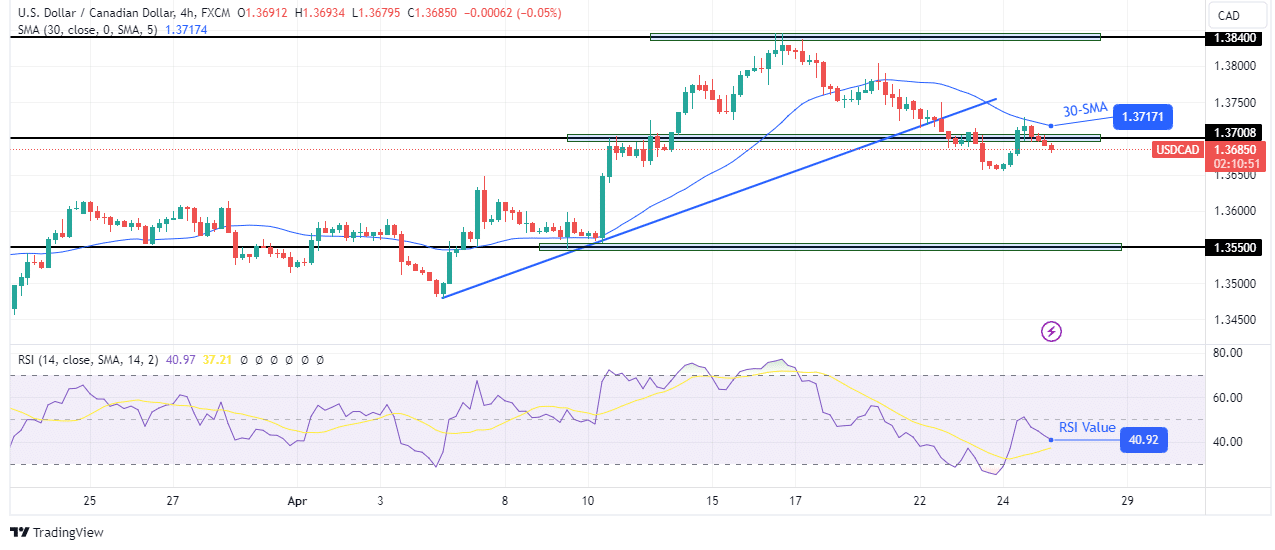

On the charts, the USD/JPY price has detached from the 30-SMA and made a new swing high, signalling a surge in bullish momentum. This can also be seen in the RSI, which is deep in overbought territory. The price trades in a bullish channel heading for the resistance line. However, bulls must break above the 156.00 key psychological level to reach channel resistance.

-Are you looking for automated trading? Check our detailed guide-

After such a strong bullish surge, the price might pause at 156.00, where bears might emerge for a pullback. Therefore, the USD/JPY pair might retest the 30-SMA before continuing higher or reversing the trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money