EUR/USD resumes its downfall as Europe gets into play in the last full session of the week. The excellent Non-Farm Payrolls helped the dollar against some currencies, and the euro was one of them. The ECB left the door open for QE and said it is “watching” EUR/USD. This weighed on the euro. Before American traders celebrate the 4th of July, pressure mounts on the common currency.

Here is a quick update on what’s moving the pair.

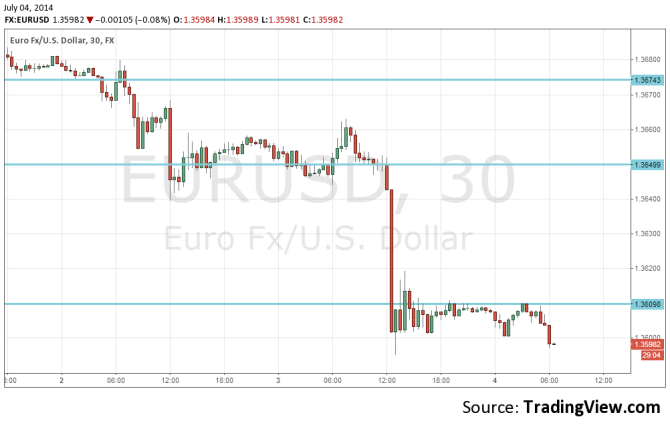

- EUR/USD traded steadily in the Asian session just under 1.3610 and resumes the falls in the European session..

- Current range: 1.3585 to 1.3610.

Further levels in both directions:

- Below: 1.3585, 1.3550, 1.35, 1.3450, and 1.34.

- Above: 1.3610, 1.3650, 1.3677, 1.37, 1.3740 and 1.3785.

- 1.3585 is the initial support line, with 1.35 being the final frontier.

- 1.3610 is immediate resistance

EUR/USD Fundamentals

- 6:00 German Factory Orders. Exp. -1%. Actual -1.7%.

- 8:10 Euro-zone retail PMI.

*All times are GMT.

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- Dovish Draghi: The ECB did not alter monetary policy and this was expected. However, Mario Draghi did say that they are watching EUR/USD with “much attention” and that QE is certainly on the cards. Is the threat real? In any case, the euro seems unable to recover from the NFP, something that other currencies managed to do quite well.

- Strong NFP: The US gained 288K jobs in June. The unemployment rate dropped from 6.3% to 6.1%, without a drop in the unemployment rate. The good news makes the first 6 months of job gains the best since 1998. Is it enough to push the Fed to action? Not so fast: the new jobs are not paying that much, so inflation remains subdued.

- German numbers slip: Weak German data continues to be a concern with a lip in retail sales, a rise in unemployment and bigger than expected drop in factory orders reported just now. While worries are gradually accumulating regarding French growth, doubts are mounting regarding the ability of Germany to pull everybody out.

- US releases improve after GDP: Last week’s US GDP release for Q1 was a disaster, as the economy contracted by a staggering 2.9% in Q1. However, the markets remained calm, and the US dollar escaped without much damage against most of its major rivals. More recent releases have been better, notably consumer confidence and housing data. Pending Home Sales jumped 6.1%, crushing the estimate of 1.4%. This was the strongest gain since May 2013. This reading followed New Home Sales and Existing Home Sales, which both beat their estimates.