Idea of the Day

The biggest risk for FX today stands with the ECB meeting. There is a small risk of some further technical policy measures, but on the main rates no changes are anticipated. The bigger risks lie with the press conference for two reasons. The first is that hints of further measures to come push the euro lower, something that will be welcomed by peripheral countries where the higher currency further limits their export competitiveness. Secondly, money market rates have been moving higher as banks repay long-term loans to improve their balance sheets ahead of ECB stress tests. It is possible that the ECB introduces some technical measures to try to counteract this, but the options are limited because it is ECB measures that have instigated the loan repayments. The single currency is opening firmer this morning, reflecting the positive underlying fundamentals, but tread warily into the press conference today.

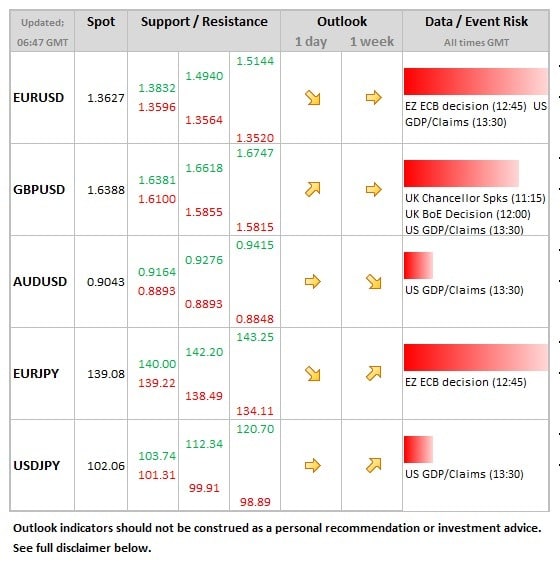

Data/Event Risks

EUR: The ECB meeting today is not seen changing policy, but the press conference will grab the attention. The main issue is whether Draghi hints at further measures to come, which could serve to cap further euro strength, or if strong hints, knock the euro lower.

GBP: The Bank of England meeting should be a non-event. Also, the Chancellor releases his Autumn Statement, with Office for Budget Responsibility announcing their latest forecasts for the economy, which will see substantial upward revision to growth forecasts for this year and next. Market risk is low, especially given that much of the details already in the press.

Latest FX News

EUR: Finding some bids at the early part of the European session, with a push above the 1.36 level. Note that money market rates are rising as banks repay long-term loans ahead of stress tests and this is one factor providing support to the single currency.

GBP: Once again opening up just below the 1.64 level ahead of the Chancellor’s Autumn Statement. The data has been largely supportive, although the weaker services PMI data knocked some of the wind from sterling on Wednesday.

AUD: A close shave with the 0.90 level during Wednesday, the tone dented by the weaker GDP data seen earlier in the day.

CHF: We’ve seen EURCHF move lower for the past 5 sessions, currently near a two month low at 1.2260. Year-end factors adding to better tone to CHF, with USDCHF having moved below the 0.90 level overnight.

Further reading:

This Friday’s NFP is important, but it’s not the most crucial one

BOC sends the Canadian dollar to new lows