EUR/USD continues trading in the wide 1.0450 to 1.1050 range and sometimes in a more narrow range. What could take the pair down?

The team at SEB weighs in:

Here is their view, courtesy of eFXnews:

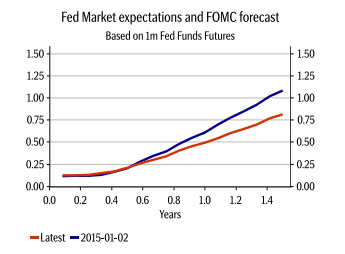

As US macroeconomic data have been a weaker than expected since the beginning of 2015, this has delayed expectations on Fed tightening according to market pricing, notes SEB Group.

“Usually we would expect this would be fairly well reflected in the EUR/USD exchange rate. However, because of extensive bond purchases by the ECB and probably several other reasons including offshore dollar funding, a lower oil price and capital flows of reserve managers, the dollar remains in demand. Consequently, EUR/USD has instead been consolidating in recent weeks rather than correcting higher,” SEB argues.

“As EUR/USD currently trades around 1.07 despite waning expectations on Fed tightening, we have lowered our EUR/USD forecast for the end of this year to 0.95 from parity. Subsequently we expect the combination of more positive news on the US economy later this year and the Fed delivering two hikes in 2015 (in September and December to 0.6%) and even more to 1.50% in the following year to benefit the dollar,” SEB projects.

“As a result, EUR/USD may easily move below parity as the ECB continues to expand its balance sheet. Also, it is hard to imagine Greece’s problems will recede unless it defaults on its debt, which would create additional euro-related uncertainty,” SEB adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.