After Draghi hit the euro hard, the common currency remains vulnerable, but against which currency?

The team at Deutsche Bank has answers:

Here is their view, courtesy of eFXnews:

In a note to clients, Deutsche Bank discuses which crosses are most susceptible to idiosyncratic euro weakness with ECB easing and in particular FX sensitive deposit rate cuts, back in play.

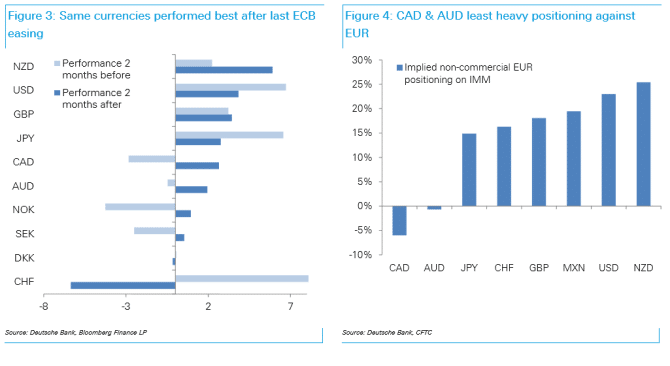

“The euro’s G4 peers have been most sensitive to Euro Area monetary policy, measured both by correlations to short end rates and performance after the ECB easing in January.

The dollar bloc has been more dominated by commodity prices and domestic cycles, which explains the differentiated performance of AUD and CAD before and after ECB QE, and falling correlations to EONIA. Meanwhile, the kiwi’s strong showing in that period took place before the milk price shock had taken effect.

The Swiss franc was, and is, in the same camp, the SNB’s policy mistake notwithstanding,” DB notes.

“Positioning points otherwise, though. Derived from the IMM, there are relatively heavy euro shorts vs. the dollar, pound, yen (and kiwi), but net longs against the aussie and loonie,” DB adds.

Thus, DB thinks that choice boils down to a view on the world.

“Short euro/dollar bloc would do well if risk and commodity prices bounce, i.e. due to last week’s China easing. The kiwi is probably the exception, not just due to positioning but dovish risks to RBNZ monetary policy repricing.

A risk-off world would favor more GBP and JPY.

A balanced basket, and one broadly in line with our discretionary views, would be short EUR vs. GBP, JPY and AUD,” DB advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.