- The false breakdowns announced a new leg higher.

- The median line acts as a magnet and attracts the price.

- Taking out 1.0664 signaled further growth.

The EUR/USD price is trading in the green at 1.0678 at the time of writing. The pair looks positive to hit new highs near 1.0700 area. The US dollar is in a corrective phase; hence, the Euro can post a meaningful recovery.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

After the last drop, the currency pair was somehow expected to correct higher. Yesterday, the Eurozone Final CPI and Final Core CPI came in line with expectations. Today, the Eurozone Current Account was reported at 29.5B below the expected 45.2 B and 39.3B in the previous reporting period.

The US Unemployment Claims are expected to jump from 211K to 215K in the last week, which could be bad for the USD. Furthermore, the Philly Fed Manufacturing Index is expected to be at 1.5 points, versus 3.2% in the previous reporting period. Existing Home Sales could drop from 4.38M to 4.20M, while the CB Leading Index may report a 0.1% drop.

Positive US figures should lift the USD. Also, the FOMC members’ speeches could change the sentiment in the short term. Tomorrow, German PPI could bring some action.

EUR/USD Price Technical Analysis: Leg Higher

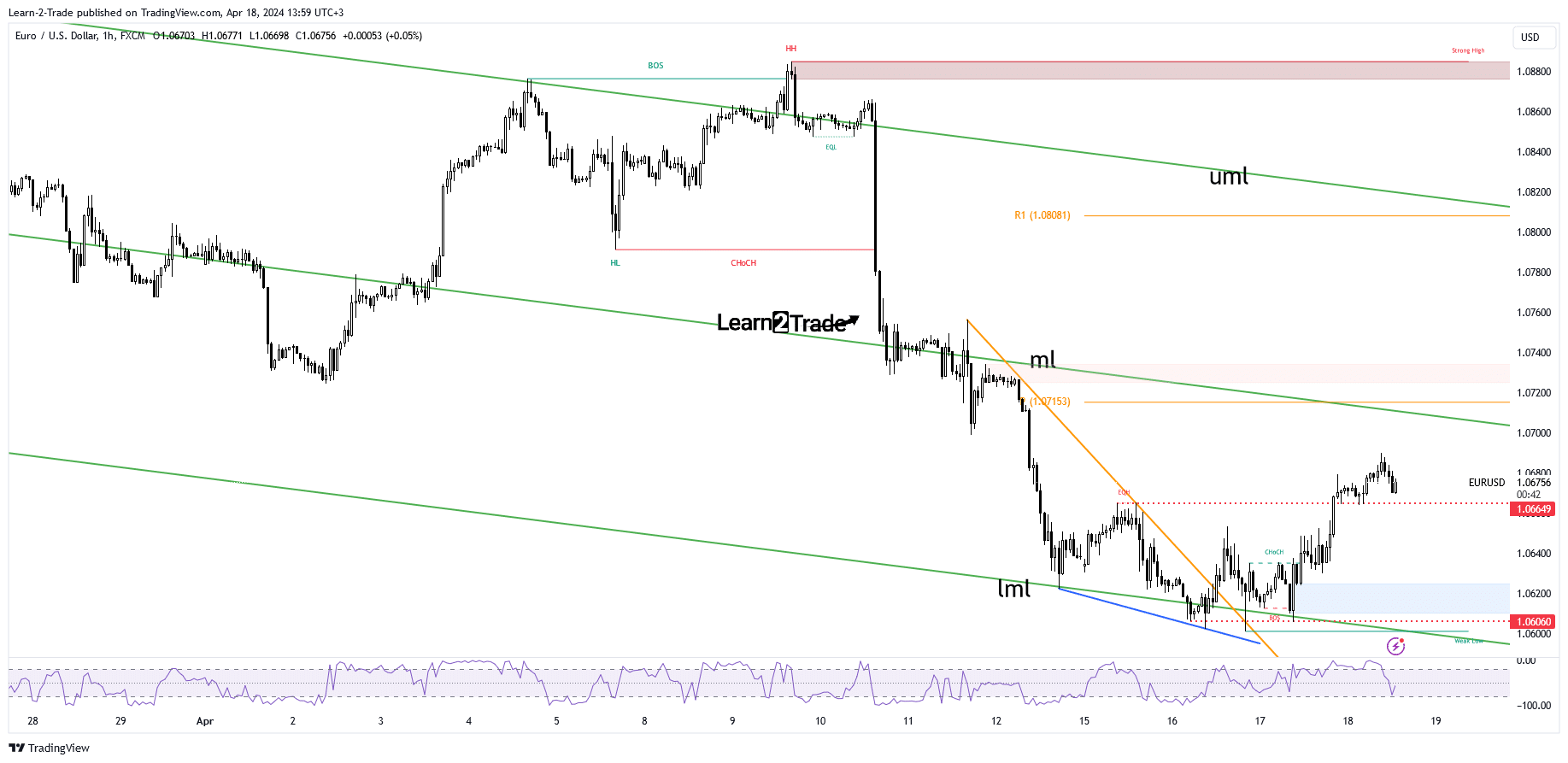

Technically, the EUR/USD price found support on the lower median line (lml) of the descending pitchfork, and now it has turned to the upside. The false breakdowns announced exhausted sellers and a potential swing higher.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

The pair has passed above 1.0664, signaling further growth. The 1.0700 psychological level is seen as the next potential target and obstacle. In addition, the median line (ml) and the weekly pivot point represent resistance levels as well.

The median line acts as a magnet and attracts the price. The current rally towards this dynamic resistance is natural after failing to take out the lower median line.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.