In the highly anticipated Fed decision, Danske is in the “no hike” camp. What does this imply for trading the greenback against the euro, yen and pound?

Here are scenarios for different tones from the central bank:

Here is their view, courtesy of eFXnews:

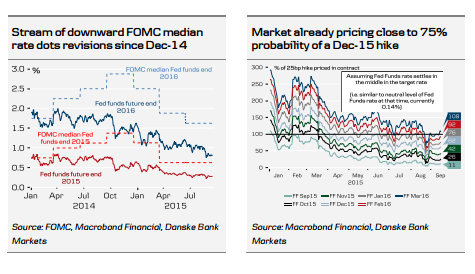

Given that we look for no hike in September and consequently think the FOMC will take the 2015 median Fed Funds ‘dot’ down to signal just one hike this year and lower the end 2016 median rate ‘dot’, we believe the USD will come under pressure near term given that the market is pricing a non-negligible probability of a hike this month (some 25%).

Looking at the betas from our Danske Bank Short-Term Financial Models, we observe that EUR/USD appears most sensitive to relative rates (2Y swap spread) among the G3 currencies and although a positive beta to risk appetite (Vix volatility), as mentioned above, complicates the near-term outlook, we judge that EUR/USD on the margin is in for a short-term bounce on a softer Fed. Given that both JPY and EUR currently trade as safe havens and that beta to risk appetite (Vix volatility) is identical for EUR/USD and USD/JPY (but opposite sign), we also expect USD/JPY to remain under pressure in the very short term.

However, a lower beta on relative rates suggests that USD/JPY downside risk is somewhat less compared to the upside in EUR/USD. Besides beta coefficients, we also think that the current neutral speculative positioning in the JPY supports the case for a more modest downside potential in USD/JPY on a soft Fed. Moreover, we expect substantial policy support (at least rhetorical) in the event of a substantial decline in USD/JPY. This has at least been part of the Japanese policy makers’ reaction function so far. In the event of a Fed hike, a lower beta on 2Y swap rates (USD/JPY vis-Ã -vis EUR/USD) could be outweighed by less heavy positioning and we would expect the EUR and JPY to fall equally against the USD in this scenario.

Thus, clients should buy USD/JPY if one wants to position for a hawkish Fed and buy EUR/USD if positioning for a softer Fed (our call).

GBP/USD clearly stands out among the G3s with relatively low betas on both relative rates and risk. As such, the cross should react asymmetrically to the Fed in the sense that the market is likely to price in lower rates in both the US and the UK almost parallel on a softer Fed, while a September hike should lead to a lower GBP/USD driven by relative rates.

In this respect, a short GBP/USD position is a valid alternative to long USD/JPY when positioning for a hawkish Fed. However, we prefer USD/JPY from a risk/reward perspective.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.