While the “to hike or not to hike” is the main question for today as it has been for weeks, the world will continue spinning afterwards.

The team at Goldman Sachs looks to the big decision and beyond:

Here is their view, courtesy of eFXnews:

“We expect the FOMC to remain on hold at Thursday’s highly anticipated meeting, with risks skewed to the dovish side…We adopted a December liftoff forecast following the June FOMC meeting, largely because this seemed to be Chair Yellen’s own baseline. Recent events have further strengthened our conviction that this week is too early for a rate hike

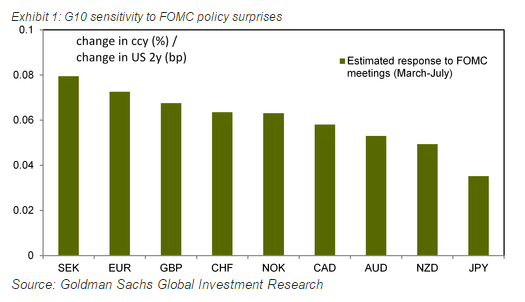

Into Thursday’s meeting. Given our expectations for a somewhat dovish impulse at this week’s FOMC meeting, we analyse the reaction of the USD vs G10 currencies around the FOMC meetings since March – of which March and June provided dovish surprises to the market.

We find that the EUR has been among the most sensitive to the (dovish) impulses of the Fed in the meetings March-July. The remaining four of the top five are European currencies that are generally more anchored to the EUR. Commodity currencies have been somewhat less sensitive, while the least sensitive currency has been JPY.

This suggests that the EUR and European currencies would be the best longs vs USD when playing for a dovish surprise. However, both the level and pace of appreciation of the USD is lower (and EUR/$ higher) going into this FOMC meeting, certainly compared with the March FOMC, which may mean a smaller reaction than earlier in the year. And as we discuss below, given the strength of the correlations between the EUR and risk assets, there are reasons to think that the sensitivity of these currencies may be different this time around.

Beyond Thursday’s meeting, we ultimately believe the continued strong performance of the US economy and the reduction of slack in the labour market will result in a tightening cycle that will prove market pricing to be too dovish. We continue to expect strong rises in the USD against most currencies, particularly EUR and JPY. Even if we were to receive a dovish impulse from the Fed causing a USD sell-off, we think the EUR and JPY will fall vs USD as both the ECB and BOJ take additional easing steps in coming months.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.