The fallout from the dovish Fed decision continues and some see a long term change to the downside. What’s next? Here is the analysis from Morgan Stanley:

Here is their view, courtesy of eFXnews:

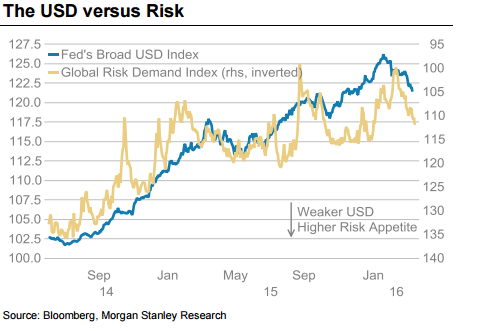

More short-term USD weakness.

“The dovish Fed – discouraging USD bulls – has led to a de-positioning move supporting the once shunned currencies. GBP, AUD and many emerging market currencies fall into this category.

In this respect, the falling USD has the characteristics of a pain trade that seems to have further to run,” argues Morgan Stanley.

“Central banks determine the short-term cost of capital, and thus steer money market flows.

However, long-term FX trends are driven by relative investment return differentials. When it comes to capital flows, other factors such as growth and productivity differentials come into play and here the US still leads,.

“For the USD to experience a long-term trend change requires more than a dovish Fed, in our view. It requires growth and output gap differentials shrinking. Markets may now be caught by surprise should US data strengthen, supported by easier financial conditions and a buoyant household sector running solid balance sheets,” MS adds.

What will Draghi and Kuroda say? “A higher JPY and higher EUR are the flipside of USD weakness and with inflation chronically weak in Japan and the Euro-area, the BOJ and ECB responses have come into discussion again.

The dovish Fed may trigger a chain reaction of other central banks eventually taking additional easing steps. Risk should traditionally do well in anticipation of a further expansion of global liquidity. But surprising for us has been Europe’s equity markets trading south and not north following the Fed,” MS answers.

Beyond short term, the current USD fall will run out of steam.

“The catalysts for a turnaround back to a USD rally will be either strong US data confirming the need for tighter monetary policy in the US this year or other central banks globally fighting back against their own currency strength,” MS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.