The Canadian dollar made significant gains against the greenback just before the holidays. The upcoming week features no significant economic indicators, so the outlook focuses on technicals.

Canadian GDP disappointed by remaining unchanged in October, the first month of Q4. On the other hand, fresh retail sales figures came out better than expected, providing hope.

Updates: The elevated tensions with Iran pushed oil prices higher and this helped the Canadian dollar. USD/CAD broke to lower ground, hitting 1.0135. Also better than expected consumer confidence in the US helped.

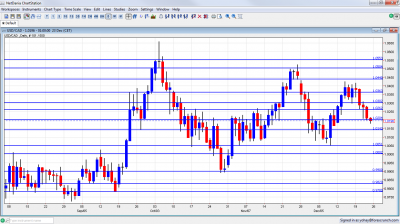

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

USD/CAD Technical Analysis

Dollar/CAD made another move on high ground, above 1.04, but then began the downfall. 1.03, mentioned last week, capped an attempt to recover, and the pair eventually closed just under 1.02.

Technical lines, from top to bottom:

1.0550 is a minor line on the way up – a line which can slow the pair. 1.0500 is another minor line of resistance. It was a pivotal around the same time and was a point of resistance before the pair fell.

1.0430 provided support when the pair was trading at higher ground during November and was tested successfully also in December, making it stronger. 1.0360 capped the pair in September and October and also provided support. It is weaker now.

The round number of 1.03 was the peak of a move upwards seen in November and has found new strength after working as a distinct line separating ranges. 1.0263 is the peak of recent surges during October, November and December, but was shattered after the move higher.

The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is a line of struggle now. 1.0143 was a swing low in September and worked as resistance in the past. It capped a small recovery attempt in November.

1.0050 worked as support in November, was a swing low in December and had the opposite role back in 2010. It worked as a great cushion for the pair in November.

The very round number of USD/CAD parity is a clear line of course, and it will be closely watched on a potential downfall. Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June.

0.9830 provided support for the pair during September. 0.9780, where the current run began is the next and important support line.

I remain bearish on USD/CAD.

With no disasters expected from Europe during this holiday week, and some more encouraging signs in the US, the Canadian dollar has room for small gains in the last week of 2011.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.