The Canadian dollar bowed to the greenback’s strength and lost a lot of ground. Inflation data and GDP are the main events. Here’s an outlook for the Canadian events and an updated technical analysis for USD/CAD.

Last week BOC Governor Mark Carney made a speech in Toronto asking businesses to boost investments and enter emerging markets. He also recommended on Canada’s relatively healthy economic situation compared to the debt-fuelled foreign markets. Canadian consumers should restrain their debts while businesses should invest in enhancing productivity in the market. Will Canadian growth process continue?

Updates: Canadian Wholesale Sales rose by 0.9%, more than expected, but CPI rose by only 0.1%, and so did Core CPI. The pair is now in the 1.03 to 1.0360 range, also pushed down by some good European news. Canadian retail sales beat expectations by rising by 1%. Core sales rose by 0.7%. USD/CAD moved lower but bounced at 1.02 before moving higher on the European pull back. USD/CAD is lower, once again, under 1.0263, enjoying some European stability. The Canadian dollar rode on thin volume before Christmas and dropped under 1.02 ahead of Canadian GDP. US figures were a mixed bag.

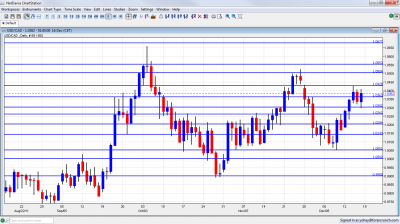

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 13:30. Wholesale sales increased 0.3% in September following the same rise in August. This was the fifth consecutive increase. Economists expected a bigger addition of 0.6%. The main causes for this increase were higher prices in the food and the miscellaneous sub sectors. Another increase of 0.6% is predicted.

- Inflation data: Tuesday, 12:00. Consumer prices increased by 0.2% in October the same as in the previous month but higher than the 0.1% addition predicted. However the increase was still moderate reducing the annual inflation rate to 2.9%. Core inflation grew by 0.3% down from 0.5% in the previous month more than the 0.2% rise expected. Core CPI is expected to rise by 0.2% while CPI is predicted to increase by 0.3%.

- Retail sales: Wednesday, 13:30. Canadian consumers increased their shopping in September despite the worrisome global financial uncertainty. Retail sales expanded by 1.0% doubling the forecast and following 0.6% climb in the previous month. Meantime core retail sales edged up by 0.5% above the 0.4% increase expected and after gaining 0.4% in August. The elevated figures suggest that Canadian economy is in a good position and is not in an immediate risk of recession. Both Retail sales and Core sales are expected to rise by 0.4%.

- GDP: Friday, 13:30. The Canadian economy grew by 0.2% in November, a bit lower than the 0.3% expansion predicted and the 0.4% climb in the previous month. On a quarterly base GDP increased by 3.5% in the third quarter following 0.5% contraction in the second quarter indicating a rise in exports and better market conditions. A smaller gain of 0.1% is predicted.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD moved up early in the week, and was capped by the 1.03 line (discussed last week). After breaking above this line, it became support of a range between 1.03 and 1.0430, with 1.0360 being pivotal.

Technical lines, from top to bottom:

1.0750 was the border of a long term trading range that characterized the pair and is the new high spot. 1.0677 is a strong resistance line that accompanies the pair for a long time. It worked well during October and also in the past, and remains of high importance.

1.0550 is a minor line on the way up – a line which can slow the pair. 1.0500 is another minor line of resistance. It was a pivotal around the same time and was a point of resistance before the pair fell.

1.0430 provided support when the pair was trading at higher ground during November and was tested successfully also in December, making it stronger. 1.0360 capped the pair in September and October and also provided support. It is weaker now.

The round number of 1.03 was the peak of a move upwards seen in November and has found new strength after working as a distinct line separating ranges. 1.0263 is the peak of recent surges during October, November and December, but was shattered after the move higher.

The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. 1.0143 was a swing low in September and worked as resistance in the past. It capped a small recovery attempt in November.

1.0050 worked as support in November, was a swing low in December and had the opposite role back in 2010. It worked as a great cushion for the pair in November.

The very round number of USD/CAD parity is a clear line of course, and it will be closely watched on a potential downfall. Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June.

I am bearish on USD/CAD.

The global meltdown, seen especially around the euro but also affected the price of oil. Things will likely stabilize now. The encouraging signs seen in the US, Canada’s main trade partner, provide hope for Canada as well, and can push the loonie higher.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.