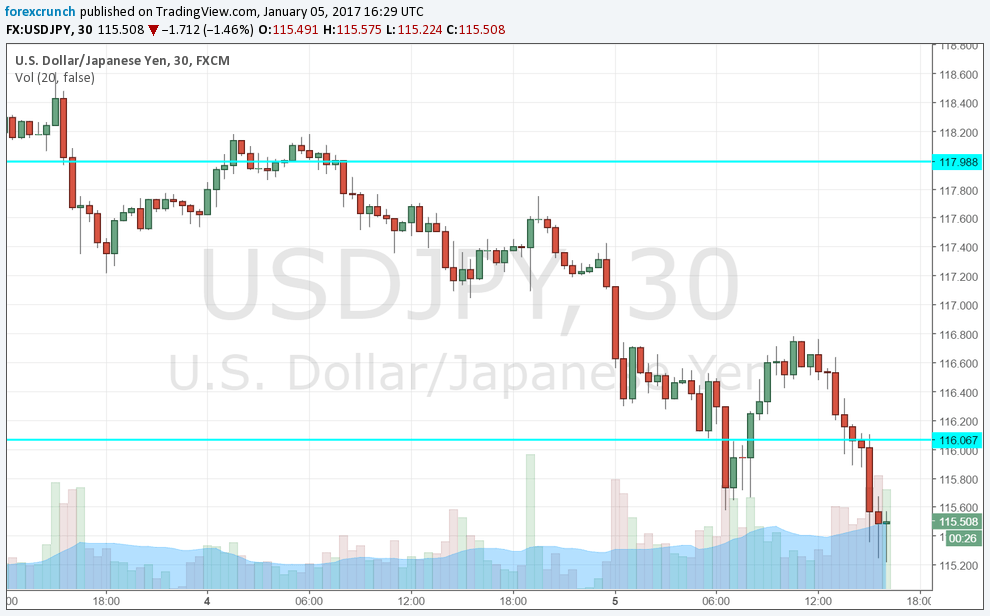

The US dollar is more than correcting its previous gains. It is free-falling. EUR/USD tops 1.06, USD/JPY is trading at the 115 handle and GBP/USD is above 1.24. This is more than the normal pendulum swing: the greenback is trading below its end-2016 levels.

What is going on? Here are 3 reasons for the crash in the first week of 2017, a week that actually began on a positive note for the greenback:

- Necessary correction: Since Donald Trump was elected two months ago, corrections in the USD were minimal. The greenback got a second boost from the FED with its hawkish hike and a minor holiday week slide that ended in January. After the strong run, especially against the euro and the yen, a retracement is only natural.

- FED getting ahead of itself: Markets were surprised by the unprecedented upgrade of rate hike forecast as seen in the “dot-plot.” Yellen and her colleagues tend to downgrade forecasts when reality bites but in their December meeting, they pushed up expectations from two to three hikes. The meeting minutes revealed the reason. About half of the members based their assessments on the potential for fiscal stimulus that Trump promises. The new administration is still waiting for the inauguration on January 20th, and Trump made too many contradicting promises. It is, therefore, surprising that the cautious members of the FED priced in election promises. Markets had thought that the dot-plot was based on present and past economic data, not elections promises. This took some of the sting out of their hawkish hike.

- Weak data: Data coming out of the US was mixed, but missed where it matters: in the hints for the Non-Farm Payrolls. ADP showed a significant slowdown in job gains in December: 153K against 215K in November in the private sector. Even when adding a grain of salt to ADP data, this is still a big slide. A second worry came from the ISM Non-Manufacturing PMI. The services sector is the largest in the US, and the top figure was a beat. However, the employment component fell by 4.4 points, a worrying sign for the Non-Farm Payrolls.

The next move of the dollar depends on the most important data point: the Non-Farm Payrolls. See how to trade the NFP with EUR/USD.

After that, the dollar will mostly depend on The Donald.