As the DeFi market continues to expand at an incredible pace, it does appear that DeFi Crypto Coins are a sound investment. There is always risk in the equation but the rewards appear to be great as bullish sentiment once again takes hold of the market. We’ve already covered a considerable number of coins over the past few weeks that have shown positive price movements. New partnerships and developments are almost a constant happening in the DeFi markets and this can only bode positive news.

So let’s take a look at the 5 DeFi Crypto Coins which we believe will provide the strongest opportunities for growth in July 2021. As always these are just opinions and this is not to be taken as investment advice.

1. DeFi Coin (DEFC): One Of The Strongest DeFi Crypto Coins Out There

Hot off the press, the DeFi Coin (DEFC) certainly looks to make a bang. Recently listed on Vindax.com, DEFC has already made considerable strides rising to $0.29 against the USDT trading pair.

This is a gain of 16% over the past few hours which is an excellent leg upwards. DEFC is a DeFi based project where information is provided to enable holders of the token to identify the right DeFi projects for investment.

The central aim of the coin and the DeFi Coins ecosystem is to educate about DeFi and the best opportunities and provide a venue to buy, sell and trade cryptocurrencies.

There are three other key features of the DeFi Coin (DEFC) Protocol: automatic liquidity pools, manual burning strategy and static rewards.

As the native digital token of the protocol DeFi Coin (DEFC), it is also used to access the utility of the network and can be exchanged with others on the network using its own self-custody wallet.

If you bought DEFC over-the-counter you would have made a gain of at least 100%. For more information about DEFC and how and where to buy the token, visit deficoins.io/buy-token or you can send an email direct to customer support at: [email protected]

A BUY recommendation is in order here.

2. Uniswap (UNI): The Unicorn Continues Its Rise From The Defi Crypto Coins

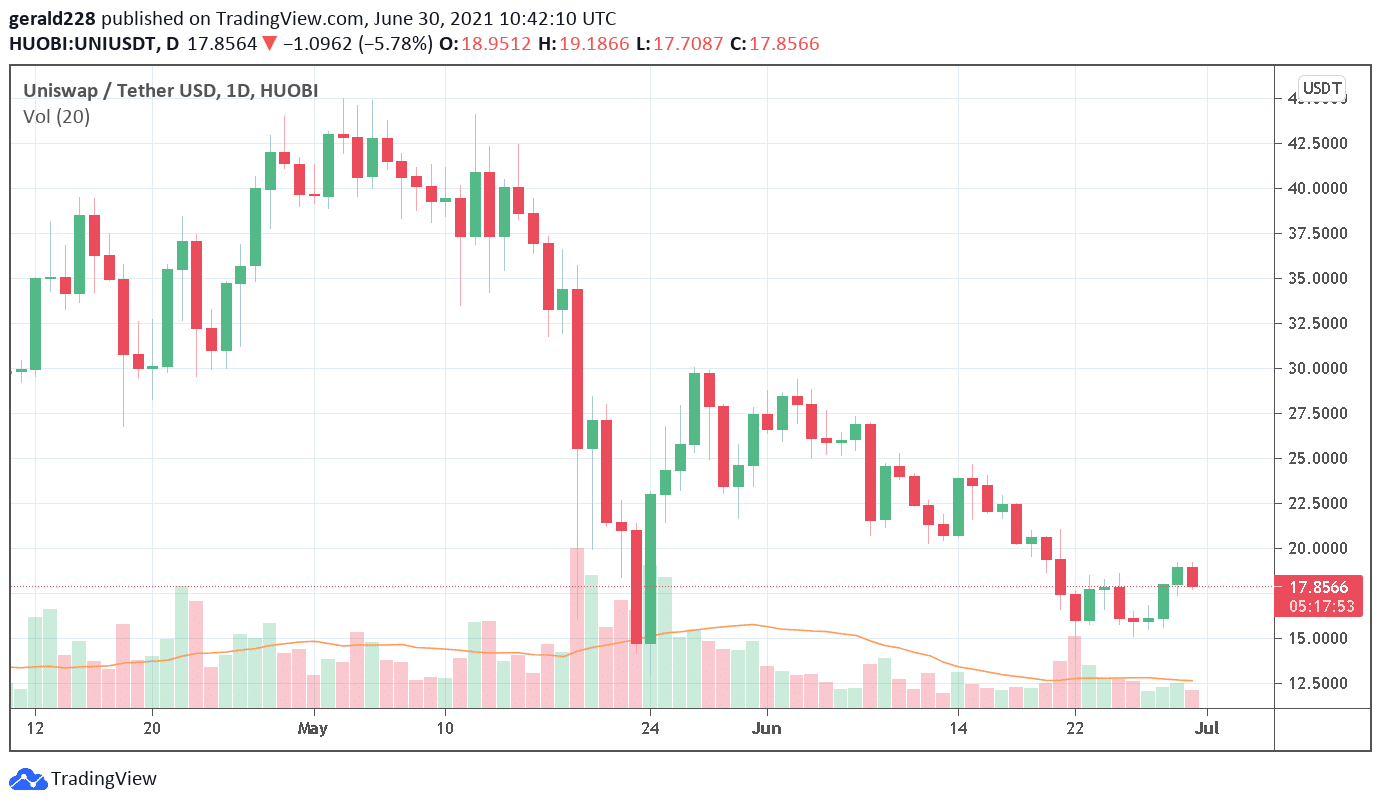

Uniswap is one of the top DeFi exchanges out there. Based on the ERC20 token it continues to grow from strength to strength with partnerships and alliances almost happening on a daily basis. Although it suffered a considerable decline alongside other coins in the May and June crashes, the situation appears to be bullish once again.

UNI reached a high point of $43 on the 3rd of May but it’s been downhill ever since. The price careened downwards to a low of 14.40 on 30 May but saw a strong rebound on 29 June to settle at the $19.26 level.

A slight retracement to the $17.70 mark was experienced in the past 24 hours but overall the trend appears to be bullish and an assault on the $20 mark would not be amiss. A BUY recommendation is in order here especially with the positive recent news from CoinMarketCap and Uniswap in a partnership.

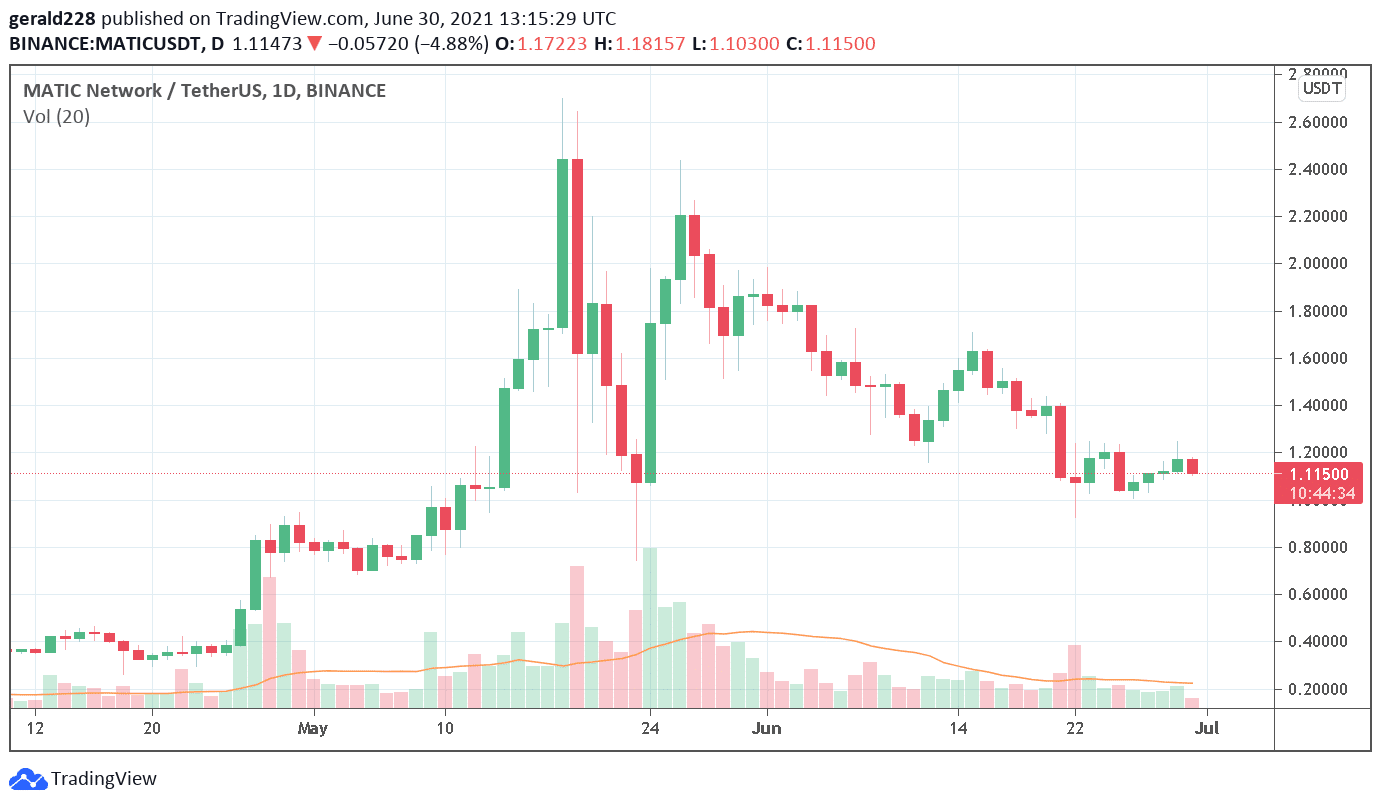

3. Polygon (MATIC) Looking To Reach New Highs After A Slump

Polygon has also been one of the DeFi coins that has seen a considerable battering in the past weeks. It reached a high of $2.39 on May 5 but then fell back considerably even falling below the psychologically significant $1.05 level on June 22 in another big crypto crash. It recovered somewhat to close at the $1.19 level on 29 June but has since seen a slight retracement to the $1.12 level where it currently lies.

As a long-term investment, MATIC still remains head and shoulders above the rest when compared to most coins with a 6000%+ increase YTD. It may be experiencing slight bearish sentiment at the moment, but unless it drops below the $1.10 level it should still rise over the next week. One should BUY MATIC although some caution is recommended.

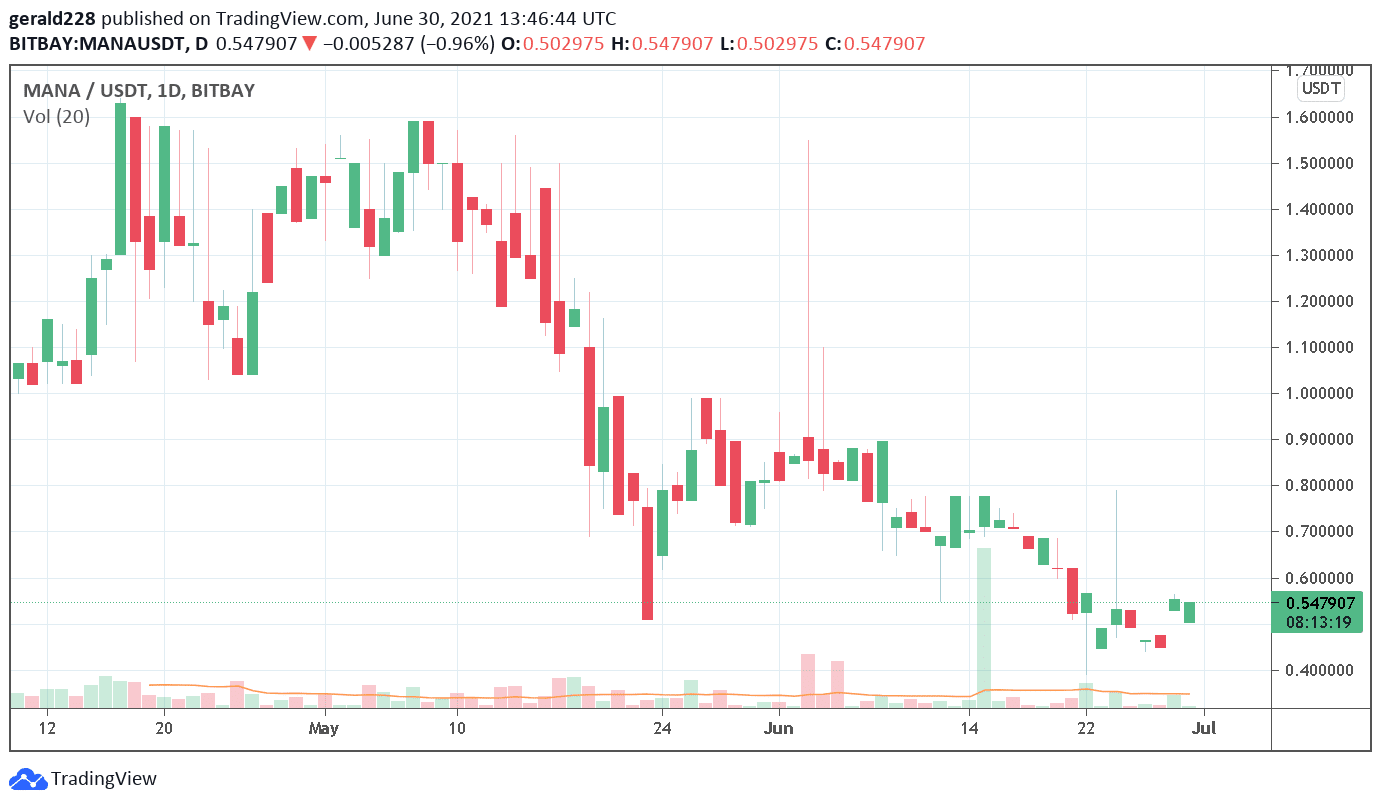

4. Decentraland (MANA) Recovering Slowly But Surely

MANA was another of those DeFi coins that was decimated in the recent crypto crash. The price fell from a high of $1.59 in early May only to crash to the $0.43 level on 22 June. It has recovered some of its lustre of late and appears bullish, having risen by around 20% from that low to the $0.54 mark.

As more investors pile into DeFi projects, tokens such as MANA can only increase in value. The use case for Decentraland remains strong and the hype continues to guide the market. A BUY recommendation is also in order here with July looking to be an interesting month for DeFi crypto tokens.

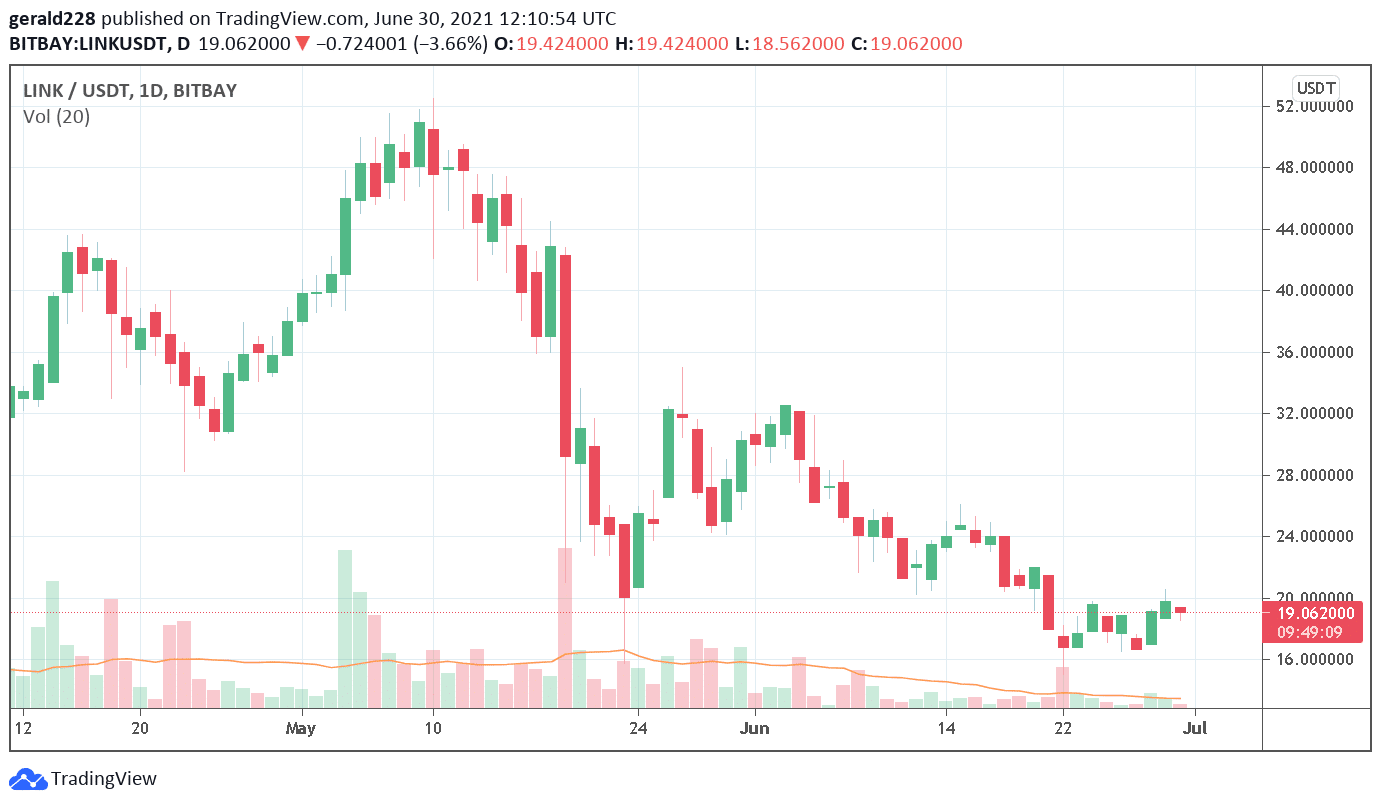

5. Chainlink (LINK) Looking to recover from May slump in July

Almost all crypto coins suffered a 50-70% decline in May with Chainlink certainly not left unscathed. However, the DeFi based exchange project is entering a new bullish phase with lower lows and higher highs. It has settled just below the psychologically significant $20 mark but is expected to start going up to test the 200 day Moving Average over the next few days.

Although there has been a slight retracement over the past 24 hours, there is certainly a possibility that the bullish sentiment in the markets will prevail over the short term. Coins like MATIC which offer strong fundamentals are always a BUY recommendation and this one is nothing less.

Capital at risk