- Crypto industry moves beyond national structures.

- Libra must build the trust that Facebook lost.

- Altcoins segment signals possible trend reversal.

After two days of statements in the House of Representatives, the market is cleared of doubts and it dawns reacting to the rise.

The main objections raised by government representatives to David Marcus, head of the Libra project for Facebook, have referred to privacy and management of sensitive financial data.

After the scandals for the mishandlings of user data, Facebook must redouble its efforts to be reliable to enter the banking business.

The rest of the objections have referred to the threat that Libra could pose to the stability, supervision and governability of monetary management, not only in the United States but on a global scale.

Meltem Demirors, Chief Strategy Officer at CoinShares, says:

“If we don’t let the cryptocurrency business develop here, they will develop it elsewhere.”

One of the most clairvoyant statements, in my opinion regarding the future of Libra and the Crypto industry:

This simple concept is crucial because it sheds light on the impossibility of avoiding the development and implementation of a technology called to change the rules of the game in many areas, including finance. Those who adapt will survive and those who don’t will succumb sooner or later.

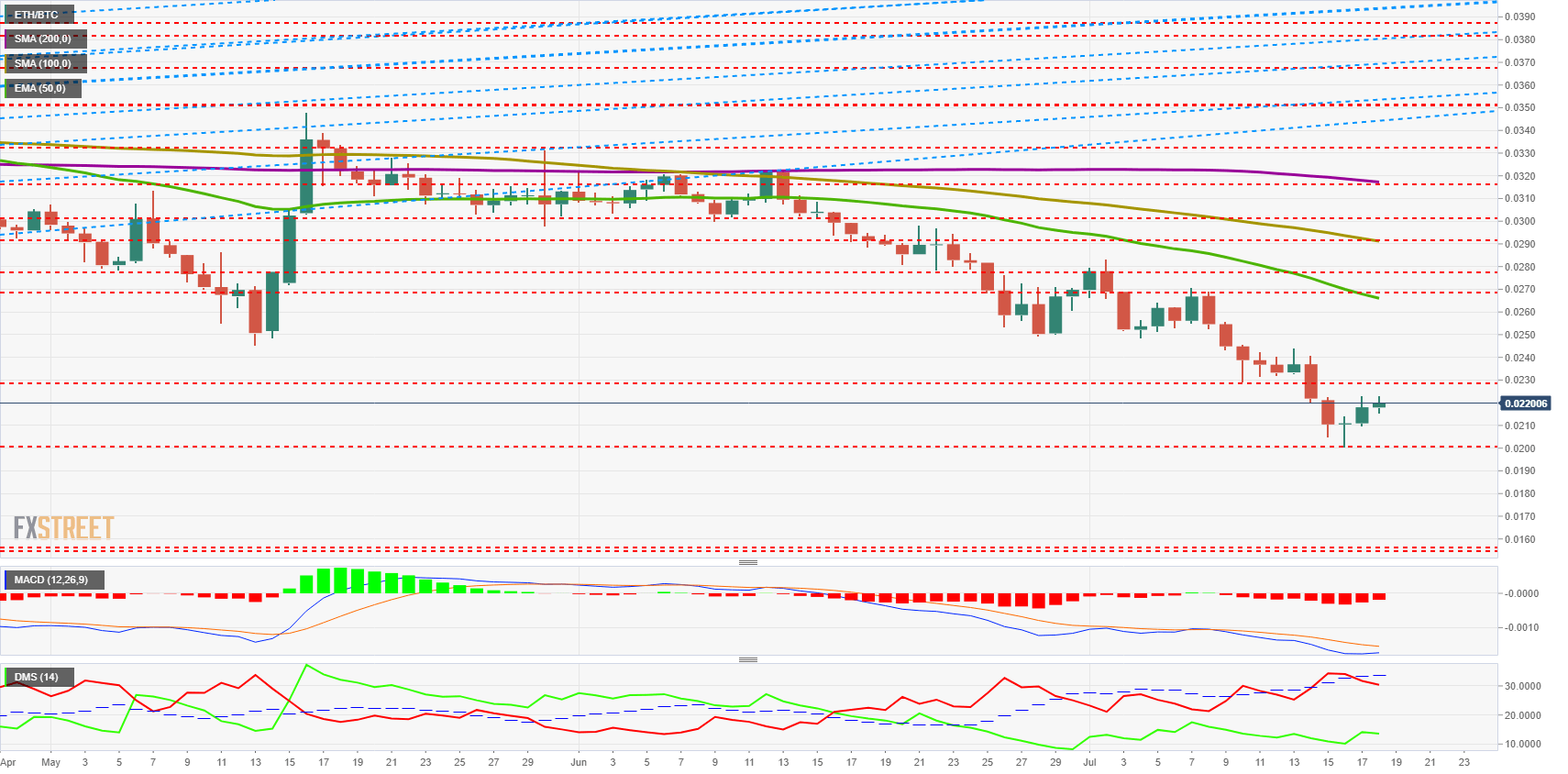

ETH/BTC Daily Chart

Yesterday, I published a short analysis highlighting the possible formation of a “morning star” figure. The figure was half-hearted and lost much potential. Today Ethereum continues to do better than Bitcoin and can finish the job if it manages to close above level 0.0228.

Above the current price, the first resistance level is at 0.0228 (price congestion resistance), then the second at 0.0268 (EMA50 and price congestion resistance) and the third one at 0.0277 (price congestion resistance).

Below the current price, the first support level for the ETH/BTC pair is at 0.020 (price congestion support and relative minimum), then the second at 0.0159 (price congestion support).

Below this support level, there is nothing but the 0.0000 level.

The MACD on the daily chart shows a very favorable profile for a bullish cross to occur in the next few hours, but it does not give us information about the impact on the price.

The DMI on the daily chart shows the bears losing strength after yesterday’s move, while the bulls bounce up from minimum levels but far from being able to dispute control to the bears.

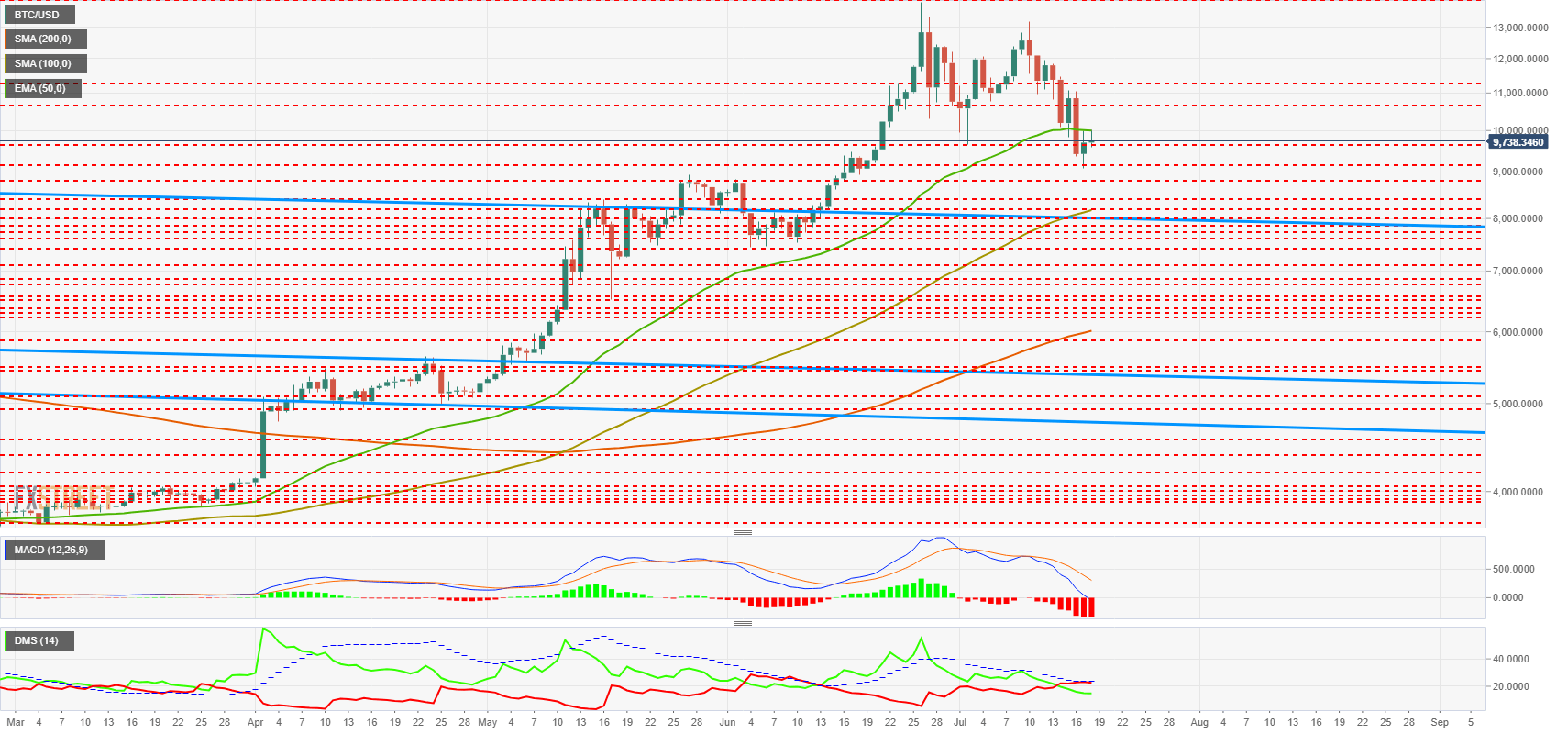

BTC/USD Daily Chart

The BTC/USD pair is currently trading at $9,738 after seeing the $10,000 rise limited by the presence of the EMA50 at this magical level.

Above the current price, the first resistance level is at $10,000 (EMA50 and price congestion resistance), then the second at $10,800 (price congestion resistance) and the third one at $11,280 (price congestion resistance).

Below the current price, the first level of support is at $9,750 (price congestion support), then the second at $9,150 (price congestion support) and the third one at $8,800 (price congestion support).

The MACD on the daily chart shows an extreme bearish profile, with maximum inclination and openness, which justifies today’s rises as a regulation of excesses.

The DMI on the daily chart shows how the bears took control a few days ago but have not managed to cross up the ADX line. This setup limits the bearish potential, which can give us an idea of how much Bitcoin could fall if the trend were genuinely bearish.

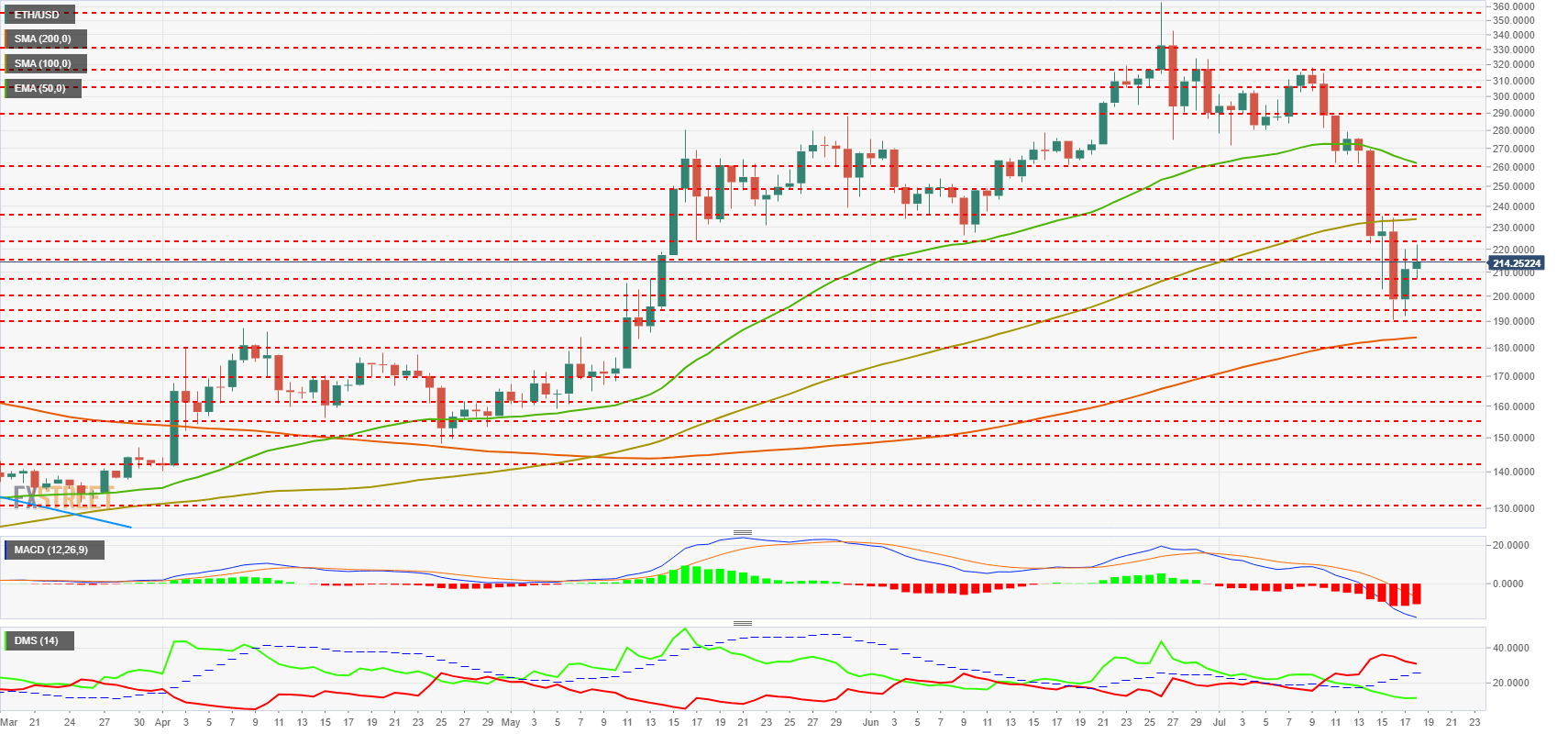

ETH/USD Daily Chart

The ETH/USD pair is trading at the $214.4 price level after reaching the $225 price congestion resistance in the Asian session. The pair remains in a clear consolidation phase, although it should start doing much better than Bitcoin.

Above the current price, the first resistance level is at $225 (price congestion resistance), then the second at $235 (SMA100 and price congestion resistance) and the third one at $250 (price congestion resistance).

Below the current price, the first level of support is at $207 (price congestion support), then the second at $200 (price congestion support) and the third one at $195 (price congestion support).

The MACD on the daily chart shows that the pair continues to be in a clear downtrend, albeit already in an advanced phase and that it can start accumulation movements.

The DMI on the daily chart shows how the bears control the situation. The bulls do not trust today’s rally and remain at low levels.

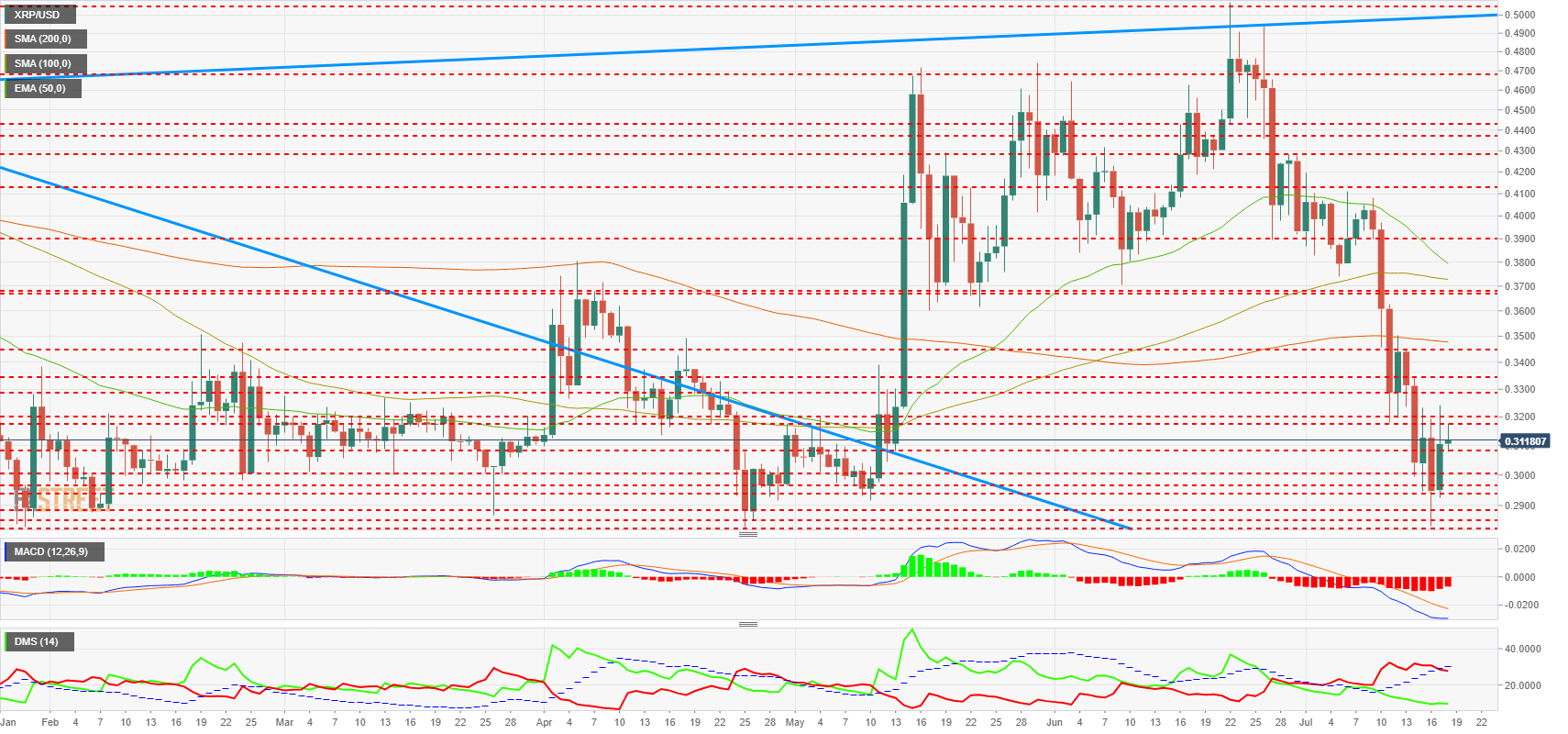

XRP/USD Daily Chart

The XRP/USD is trading at $0.312 and shows a structure conducive to initiating an uptrend. Volatility can increase at these levels, a typical strategy for shaking weak hands.

Above the current price, the first resistance level is at $0.0318 (double price congestion resistance), then the second at $0.0329 (price congestion resistance) and the third one at $0.0335 (price congestion resistance).

Below the current price, the first level of support is at $0.308 (price congestion support), then the second at $0.30 (price congestion support) and the third one at $0.296 (price congestion support).

The MACD on the daily chart shows the fast average fully horizontal and preparing a bullish cross. It is in an initial phase, which supports the increased volatility in the coming days.

The DMI on the daily chart shows bears crossing down the ADX line indicating the possible end of the XRP weakness. The bulls are not reacting for now and remain at minimum levels.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel