Brexit had no impact on the jobs market, not yet: Claimant Count Change falls by 8.6K, much better than expected. The rest of the figures, for the month of June (pre-Brexit) came out as expected. The unemployment rate is 4.9%, wages are up 2.4% and 2.3% excluding bonuses.

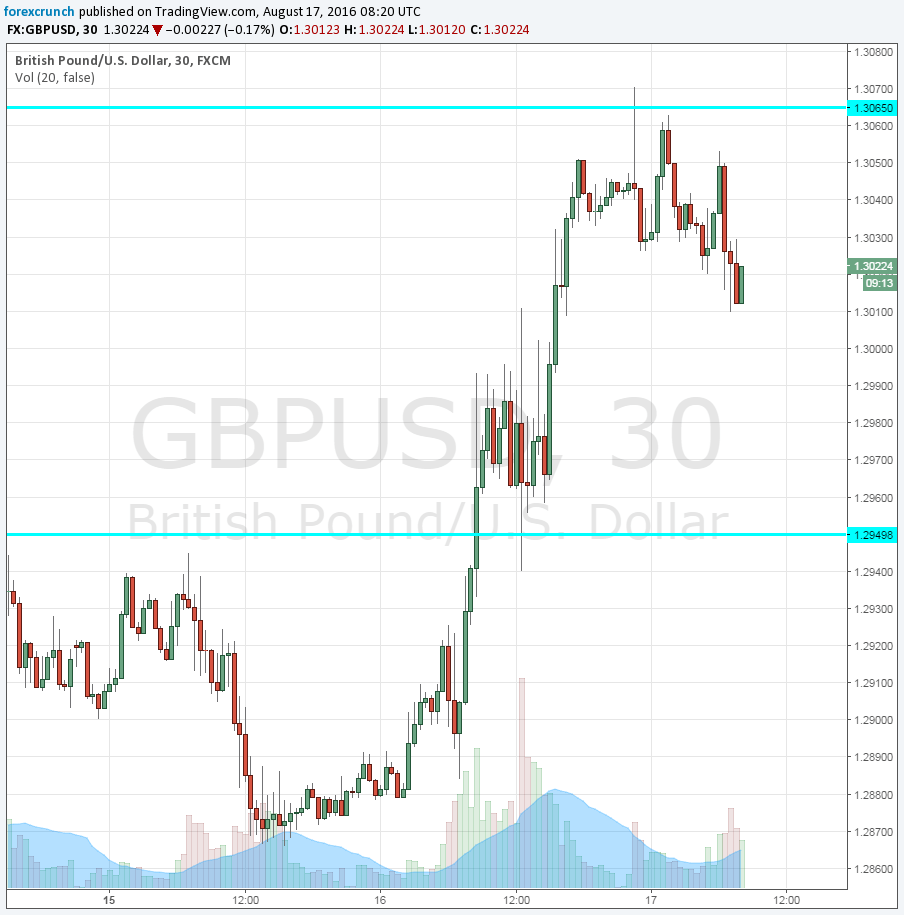

GBP/USD is rising, challenging resistance at 1.3060. Will it move to even higher ground? Further resistance awaits at 1.3150.

The United Kingdom was expected to report a rise of 9.5K in the number of jobless claims in July, the first full month after the historic Brexit decision. That is more than 0.4K seen in June (before revisions). The unemployment rate for June was predicted to remain unchanged at 4.9%. Average hourly earnings for June as well were expected to advance 2.4% y/y after 2.3% beforehand. Also, wages excluding bonuses were projected to accelerate from 2.2% to 23%.

GBP/USD traded steadily above 1.30, sliding from the highs seen yesterday, which saw higher than expected inflation data