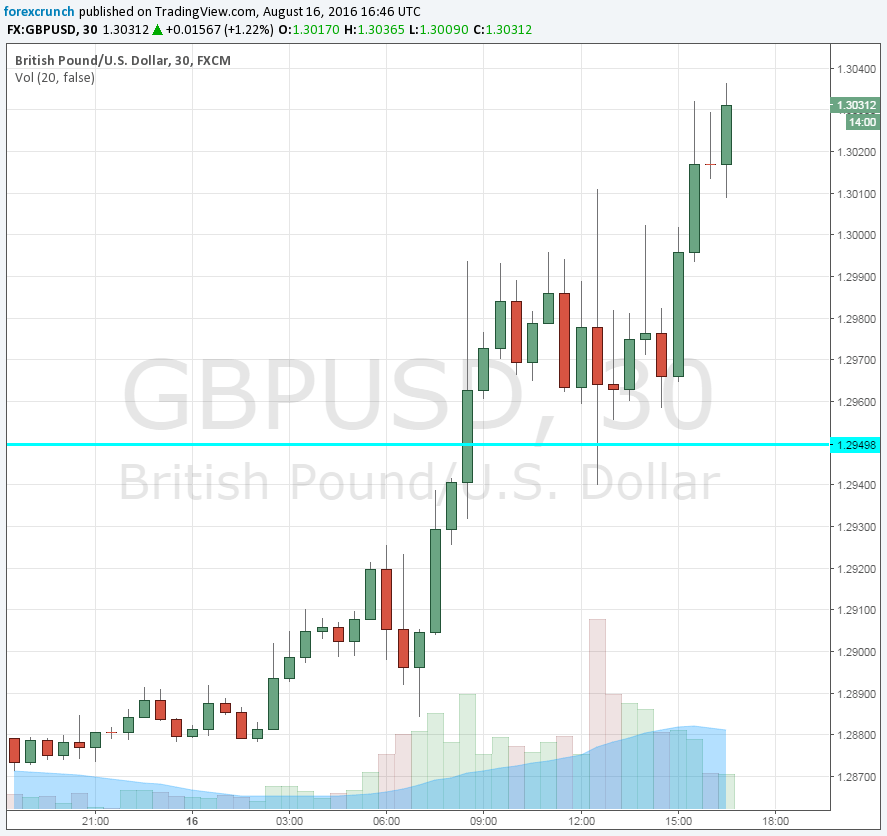

The pound continues its recovery and has topped 1.30, reaching 1.3035. This is over 160 pips on the day. Cable stalled under the round number but eventually made the break higher.

The two forces driving the pair higher could eventually push it lower. Here is why.

- High UK inflation: The report showed a beat in headline CPI at 0.6% and a leap in producer prices worth 3.3%. The rise in PPI will eventually show up in CPI as producers push the higher costs to the consumers. This is a result of the lower exchange rate: import prices saw a significant bump to the upside. However, with lower growth prospects and higher uncertainty, not all these associated costs will make it to the end-point. Companies may decide to absorb some of the cost. More importantly, the BOE clearly noted that the fall of the exchange rate would cause slightly higher inflation. Carney and his colleagues see this rise as temporary or transitory and will see through it. So, the bump, which was not entirely unexpected, will not deter them from cutting rates again in November. The bigger data point is retail sales, due on Thursday.

- US dollar weakness: The greenback continues suffering from lower expectations for a rate hike. The big disappointment from the retail sales report was not alleviated by the housing and inflation figures which were OK and not healthy. Nevertheless, the US dollar remains the cleanest shirt in the dirty pile. While a recession is on the cards in the UK, there is no similar conceivable case for this in the US. The dollar sees the ebb and flow, and this could reverse, as it did late on Friday.

All in all, the case for a surging pound against the dollar could be temporary.

In any case, resistance awaits at 1.3060 followed by 1.3150. Support below 1.30 is at 1.2850.

More: Textbook-like GBP weakness – Morgan Stanley