AUD/USD posted sharp gains last week, climbing 130 points. The pair closed the week at 0.7686. This week’s key events are Retail Sales and the cash rate. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, controversial moves by Donald Trump, such as the spat with Mexico and a travel ban on Moslem refugees has hurt the greenback. US job numbers were mixed, as Nonfarm Payrolls was better than expected but wage growth was weaker than expected. In Australia, Business Confidence improved but Building Approvals contracted.

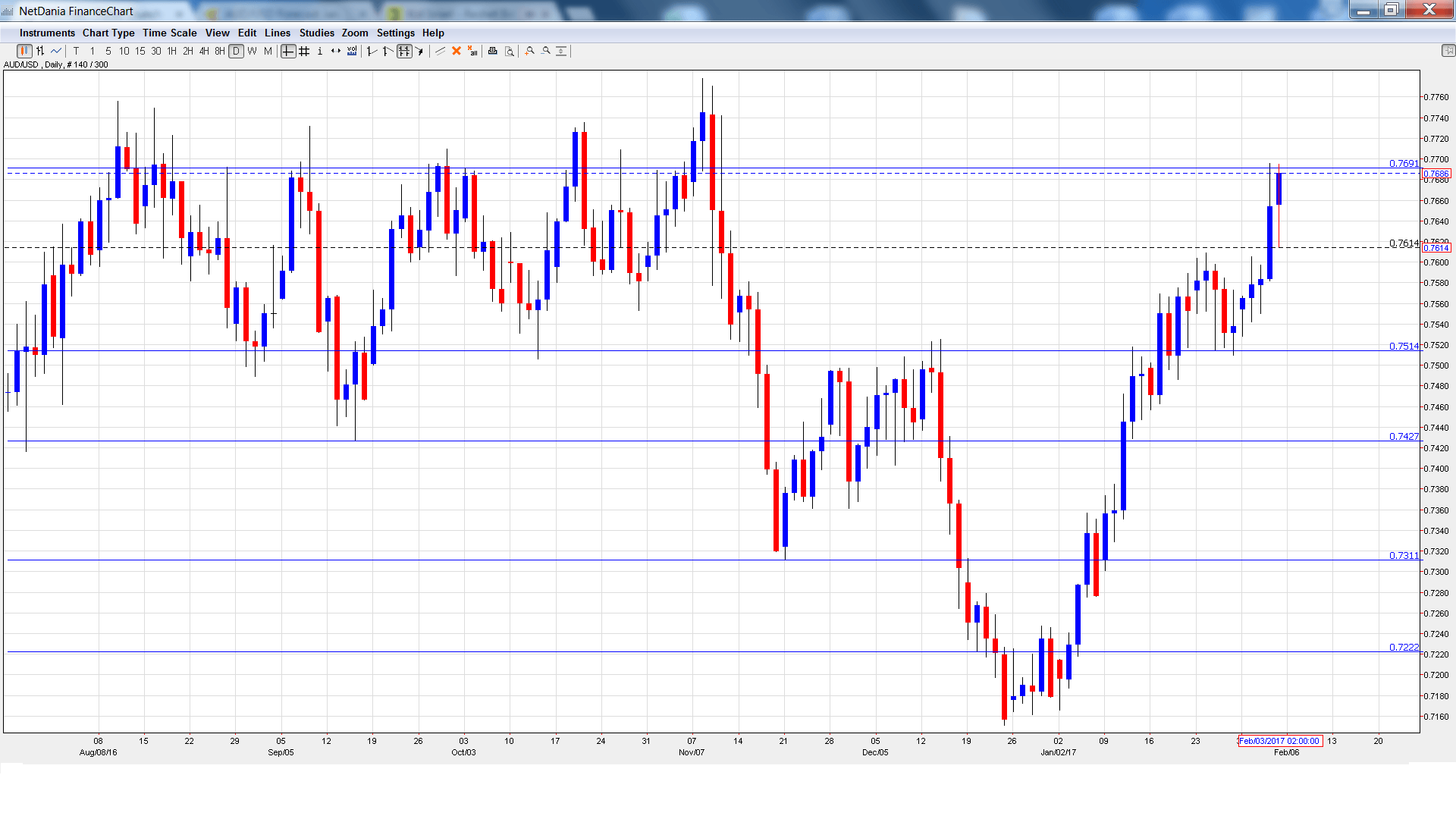

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- MI Inflation Gauge: Monday, 00:00. The indicator is released monthly. In December, the index posted a solid gain of 0.5%, its highest gain in six months.

- Retail Sales: Monday, 00:30. Retail Sales is one of the most important indicators and should be considered a market-mover. In November, the indicator dropped to 0.2%, short of the forecast of 0.4%. The estimate for December stands at 0.3%.

- AIG Construction Index: Tuesday, 22:30. The index has recorded three straight readings below the 50-point level, pointing to ongoing contraction in the construction sector. Will we see any improvement in the December report?

- Cash Rate: Monday, 3:30. The RBA has pegged the benchmark rate at 1.50% since July, and no change is expected in the February decision. Analysts will be combing through the rate statement, looking for the factors that influenced the rate decision. A dovish statement could send the Aussie lower.

- HIA New Home Sales: Thursday, 00:00. This index provides a snapshot of the strength of the housing sector. The indicator rebounded in December, posting a strong gain of 6.1%.

- NAB Quarterly Business Confidence: Thursday, 00:30. This important indicator improved to 5 points in Q3, its highest level since 2014. Will the upward trend continue in the fourth quarter?

- RBA Governor Philip Lowe Speech: Thursday, 9:00. Lowe will speak at an event in Sydney. The markets will be looking for hints regarding the RBA’s future monetary policy.

- RBA Monetary Policy Statement: Friday, 00:30. This statement is released on a quarterly basis. It contains details of the RBA’s view of economic conditions and inflation, and could provide clues about future interest rates moves.

- Chinese Trade Balance: Friday, Tentative. The indicator slipped to $275 billion in December, well short of the forecast of $345 billion. This marked the weakest surplus since March 2016. The markets are expecting a stronger surplus in the January report, with an estimate of $295 billion.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7554 and quickly dropped to a low of 0.7528. It was all uphill from there, as the pair climbed to a high of 0.7696, testing resistance at 0.7691 (discussed last week). AUD/USD closed the week at 0.7686.

Live chart of AUD/USD:

Technical lines from top to bottom:

We begin with resistance at 0.8066, a low point in May 2010.

0.7938 is next.

0.7835 has held firm since April 2016.

0.7691 was a cap for much of October.

0.7513 was a cushion in April 2015.

0.7427 is next.

0.7311 marked a low point in November.

0.7223 is the final support level for now.

I am neutral on AUD/USD

The US economy remains headed in the right direction, and inflation levels have moved higher. This could lead to higher interest rates in the first half of 2017. However, there is uneasiness in the markets about Donald Trump, whose economic stance remains unclear.

Our latest podcast is titled Worrying wages and shining gold

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.