The Australian dollar was hit hard alongside stocks as Trump’s new suggested tariffs rocked markets quite hard. How low can it go? The Australian calendar is quite light, leaving room for trade to dominate the scene once again. Here are the highlights of the week and an updated technical analysis for AUD/USD.

After the US had already detailed tariffs on $50 worth of goods on China and the latter announced it would retaliate, the Administration is considering additional duties on no less than $200 billion worth. The news rattled markets and triggered a sharp risk-off atmosphere, sending the Aussie to the lowest levels in over a year. RBA Governor Lowe did not add much in a panel conversation nor via the Meeting Minutes.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

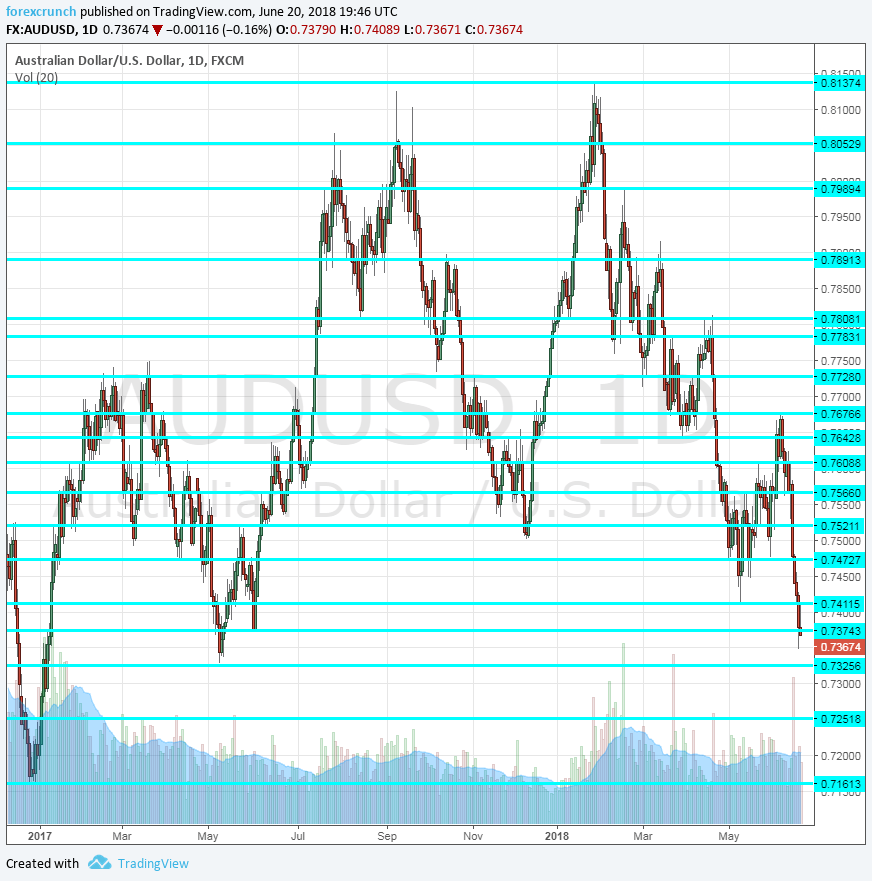

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- HIA New Home Sales: Timing yet unknown. The Housing Industry Association reported a sharp drop of 4.2% in sales of new homes in April, the fourth consecutive fall. We could see an increase now.

- Private Sector Credit: Friday, 1:30. Credit in the Private Sector rose by 0.4% in April, as expected yet below the level in March. The number for April could be a repeat of May’s figure.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD started the week with fall that eventually extended below the 0.7375 level mentioned last week.

Technical lines from top to bottom:

Further below, 0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7610 was the peak of an upwards move in late May.

0.7560 is the next level to watch after it was the recovery level in early May. 0.7520 was a swing low in late May.

0.7470 was an initial low in late April and it is followed by 0.7410, an old line from 2017. Further down, 0.7375 is notable.

0.7325 was a support line back in May 2017 and is now coming into play. 0.7250 served as a pivotal line in early 2017 and the last line to watch is 0.7160 that was the swing low back then.

I remain bearish on AUD/USD

While the Australian economy is doing alright, the trade war between the world’s two largest economy catches Australia in the middle. There are no immediate indicators pointing to an optimistic scenario.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!