The Australian dollar suffered the strength of the US Dollar on a hawkish hike by the Fed and growing concerns over trade. What’s next? The RBA stands out in the upcoming week. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The US Fed hiked for the second time this year and signaled another two hikes, above previous expectations. The message that Fed Chair Powell conveyed was a very upbeat one. Alongside an increase in inflation and an excellent retail sales report, the greenback advanced nicely. In addition, the growing trade tensions between the US and the rest of the world began weighing on risk currencies such as the Aussie. In Australia, the jobs report came out slightly below expectations, at an increase of 12K. Chinese industrial output also advanced at a slightly slower pace, 6.8% y/y. Despite the disappointing data, the bigger driver of the pair was the US Dollar.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

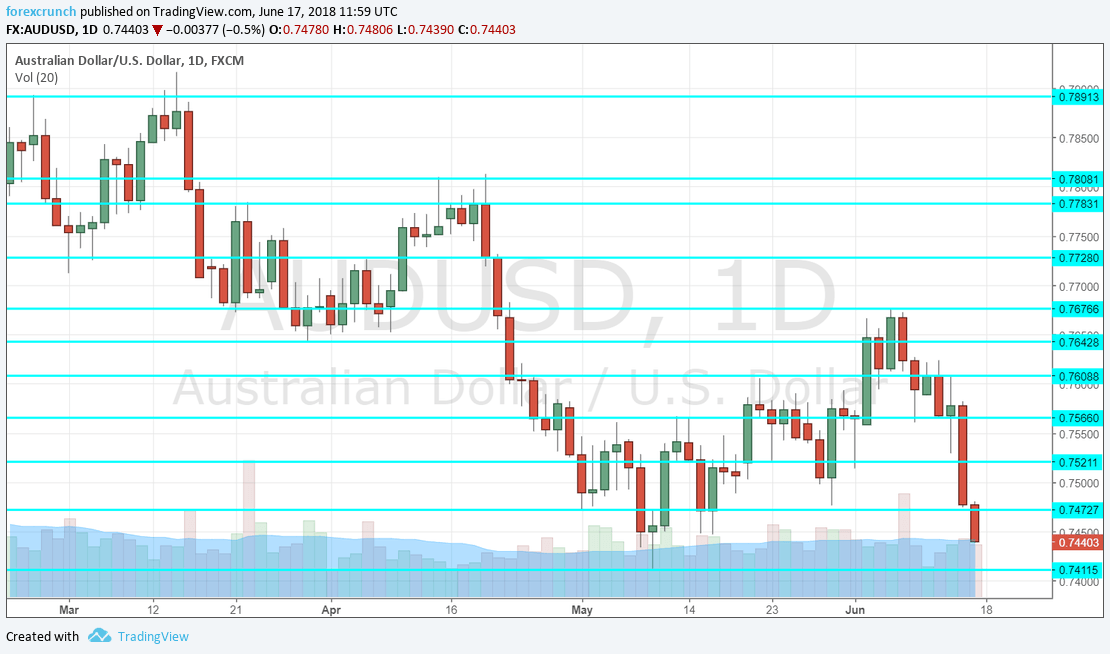

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Monday, 14:30. The composite index increased by 0.2% last month, and a similar rise is likely now. The economy is humming along quite well, at least for now.

- Monetary Policy Meeting Minutes: Tuesday, 13:30. The accounts from the recent RBA meeting could shed some more light on the central bank’s plans. They have not changed interest rates in nearly two years and the recent June decision was broadly a repeat of the previous statement. The meeting minutes could reveal concerns about trade, views about China, and more.

- HPI: Tuesday, 1:30. The quarterly House Price Index provides a broad view of the housing sector despite its late release. The HPI jumped by 1% in Q4 2017 and a drop of 0.9% is on the cards now.

- MI Leading Index: Wednesday, 00:30. The Melbourne Institute’s composite index moved up by 0.2% last time, exactly like the CB’s measure. Also here, a repeat would not be surprising.

- Phillip Lowe talks: Wednesday, 1:30. Fed Chair Jerome Powell, ECB President Mario Draghi, Bank of Japan Governor Haruhiko Kuroda, and RBA Governor Phillip Lowe will all participate in a panel discussion in Portugal, at the ECB’s conference. It will be interesting to hear if any of them and especially Powell, express concern over the deteriorating trade relations in the world. The Fed Chair only mentioned that some business contacts are worried but did not provide his own opinion.

- RBA Bulletin: Thursday, 1:30. This data dump by the RBA provides further insights about the economy. However, the RBA Monetary Statement tends to have a broader impact.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD started off the week with an attempt to move above 0.7610 (mentioned last week). The failure to do so sent the pair tumbling down.

Technical lines from top to bottom:

0.7730 capped the pair in early April. 0.7675 provides some support in March and is another stepping stone.

Further below, 0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7610 was the peak of an upwards move in late May.

0.7560 is the next level to watch after it was the recovery level in early May. 0.7520 was a swing low in late May.

0.7470 was an initial low in late April and it is followed by 0.7410, an old line from 2017. Further down, 0.7375 is notable.

I remain bearish on AUD/USD

The trade wars find the Australian economy in the middle. A stock market sell off could exacerbate the falls.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!