The Australian dollar has had its share of volatility in recent weeks, moving on the RBA, Chinese data, Australian figures, etc.

The team at NAB sheds a light on another factor: the Greek crisis. Here is the rationale and what we can expect for AUD/USD:

Here is their view, courtesy of eFXnews:

“The AUD/USD has been on a wild ride of late, rallying to a high of 0.8164 on 14 May, only to plunge to below 0.76 on 1 June before settling near 0.77 in front of Friday’s US payrolls report.

We don’t apologise for labouring the point about EUR volatility as a key current driver of present – and near future – AUD gyrations. With Greece having (legally) failed to pay the IMF on Friday, the proverbial can has just been kicked a very a short way down the road. There are no signs as yet of the Greek government being closer to agreeing to terms from its creditors for more aid. The period between now and 30 June, by when Greece will need to repay the IMF some €1.5bn, is likely to be fraught with fresh episodes of ‘existential angst’ with respect to default risk as well as Greece’s survival in the Euro.

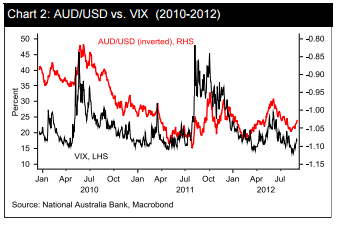

We’ve written at length on what the Greek crisis could mean for the AUD. A key takeaway is that were market volatility to repeat the spikes seen during the 2010 and 2011 crises, it would be consistent with a drop in AUD/USD of more than 10 cents. Hence we are more expectant of higher volatility pulling our short term ‘fair value’ estimate for AUD (currently above 80 cents) down toward spot, than spot retracing much higher.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.