- Investors dumped risk assets on Friday amid fears of an escalation in the Middle East war.

- In March, Australians lost 6,600 jobs.

- Markets are placing a 65% chance on the first RBA rate cut in December.

The AUD/USD outlook takes a bearish turn as the risk-sensitive Aussie fluctuates following unsettling reports of Israel’s attack on Iran. Moreover, the currency grapples with the fallout from a lackluster jobs report.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Investors dumped risk assets on Friday amid fears of an escalation in the Middle East war. Notably, there were reports that Israel had retaliated after Iran’s recent attack. As a result, investors were worried that the war might worsen. This sent them to more traditional safe-haven currencies like the yen and the Swiss franc. Meanwhile, risk-sensitive currencies like the Aussie and the Kiwi suffered. Although the move was sharp, it reversed soon after, as Iran denied reports of the attack.

At the same time, investors were reeling from poor employment reports from Australia. In March, Australians lost 6,600 jobs, a sharp reversal from February’s blockbuster figure. Meanwhile, the unemployment rate rose to 3.8%. Such a miss in employment should have pushed up rate cut expectations.

However, a Reserve Bank of Australia cut remains far off. The easing in the labor market is a relief for the central bank, but it is slow. Therefore, markets are placing a 65% chance on the first rate cut in December.

This outlook keeps the RBA behind the Fed as markets expect the first US cut in September. Nevertheless, monetary policy outlooks keep changing with incoming data.

AUD/USD key events today

Traders will focus on developments in the Middle East war, as no key reports come from Australia or the US.

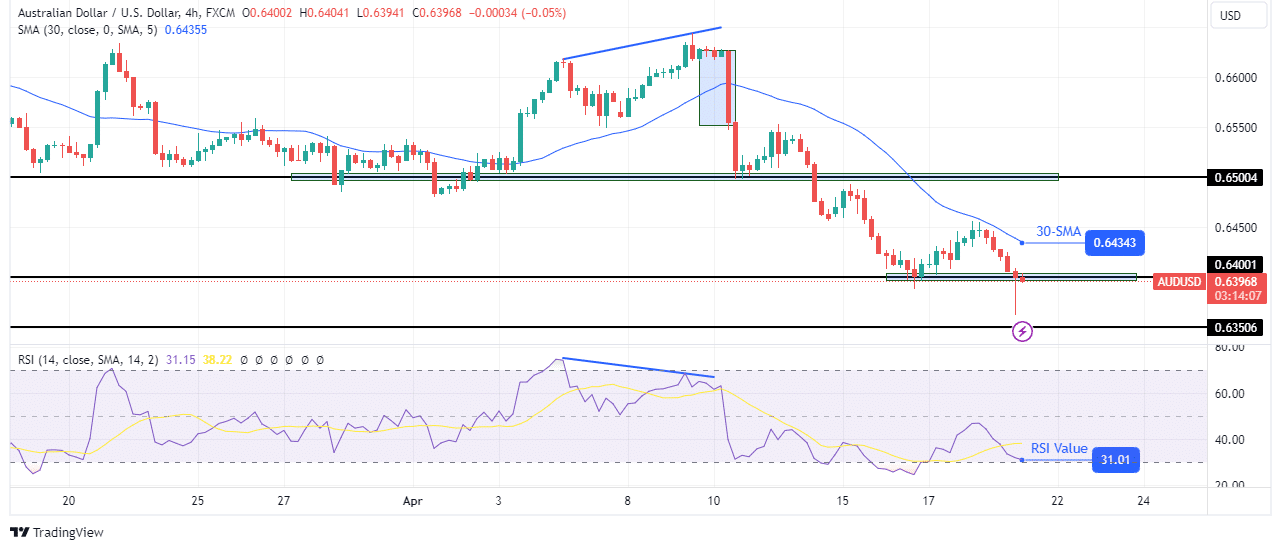

AUD/USD technical outlook: Large wick signals rejection below 0.6400

On the technical side, the AUD/USD price is on a downtrend, with the price trading below the 30-SMA and the RSI almost oversold. However, the decline has paused at the 0.6400 critical support level. Bears tried to break below this level but failed when the price reversed to make a big wick. This is a sign that bulls have rejected the move lower.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

However, given the bearish bias, the price might make another attempt to break below. If it fails, it might pull back to retest the 30-SMA resistance before targeting the 0.6350 key level.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.