- NAB Business Confidence: Tuesday, 1:30. Business confidence fell to -4 points in February, its lowest level since December 2012. Will we see another reading in negative territory?

- Westpac Consumer Sentiment: Wednesday, 0:30. Consumer confidence has been sputtering, with three declines in the past four months. The indicator declined by 3.8% in March, as consumers are jittery about current economic conditions. We now await the upcoming release.

- MI Inflation Expectations: Thursday, 1:00. Inflation expectations are carefully monitored, as they are a useful gauge of actual inflation levels. The indicator has been steady, with four readings of 4.0% in the past five months. The March release is next.

- Employment Data: Thursday, 1:30. The economy has registered four successive gains, including a reading of 26.7 thousand in February. The unemployment rate dropped to 5.1% in February, down from 5.3%. Analysts are projecting that unemployment will jump to 5.4% in March.

- Chinese GDP: Friday, 2:00. China’s economy posted a second straight gain of 6.0% in Q4. Investors are expecting a disastrous first quarter due to the CORVID-19 outbreak, with a forecast of -6.0%.

.

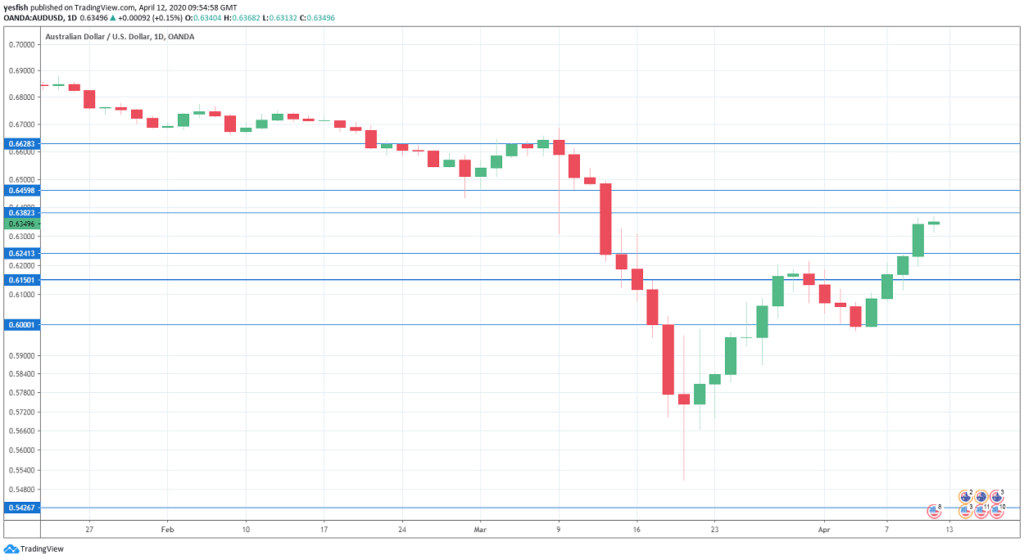

AUD/USD Technical Analysis

Technical lines from top to bottom:

With AUD/USD posting sharp gains last week, we start at higher levels:

0.6627 has held in resistance since early March. 0.6560 is next.

0.6456 is providing support.

0.6380 (mentioned last week) is an immediate resistance level.

0.6240 is providing support.

0.6150 has some breathing room in support after sharp gains by AUD/USD last week.

The round number of 0.6000, which has psychological significance, is the final support level for now.

.