- MI Inflation Gauge: Monday, 1:00. This inflation indicator helps analysts track inflation on a monthly basis, as CPI is only released each quarter. Inflation climbed 0.9% in July, its highest one-month gain since July 2009. Will the upswing continue in August?

- Company Operating Profits: Monday, 1:30. Company earnings rebounded in Q1, with a gain of 1.1%. This follows two successive declines. However, another decline is expected in Q2, with a forecast of -6.0%.

- AIG Manufacturing Index: Monday, 22:30. The Australian Industry Group index has improved in recent months, after falling to 35.8 in April. The index rose to 53.5 in July, up from 51.5 beforehand. The 50-level separates contraction from expansion. We now await the August data.

- Current Account: Tuesday, 1:30. Australia’s current account surplus climbed to A$8.4 billion in Q1, up sharply from A$1.0 billion in the previous quarter. The upswing is expected to continue, with an estimate of A$13.0 billion.

- RBA Rate Decision: Tuesday, 4:30. The RBA has sounded dovish about economic conditions, but no change is expected in the Cash Rate, which has been pegged at 0.25% since March. Investors will be keeping a close eye on the tone of the RBA statement.

- GDP: Wednesday, 1:30. Australia’s economy declined by 0.3% in the first quarter, reflective of the severe economic conditions to the Covid-19 pandemic. This marked the first decline since 2016. Analysts are braced for a sharp downturn in Q2, with an estimate of -6.0%. Two successive declines in GDP indicates that the economy is in recession.

- AIG Construction Index: Wednesday, 22:30. The index has been moving higher, but still remains in contraction territory, with readings below the 50-level. In July, the index rose to 42.7, up from 35.5 beforehand. Will the upswing continue in August?

- Retail Sales: Friday, 1:30. Retail sales rose 3.3% in June, as consumer spending remained solid, despite the economic downturn to the Covid-19. Another gain of 3.3% is projected for July.

- AIG Services Index: Friday, 22:30. The index has been in contraction territory since December 2019, as the services sector continues to struggle. The July release improved to 44.0, up from 31.5 beforehand. Will the upswing continue in August?

.

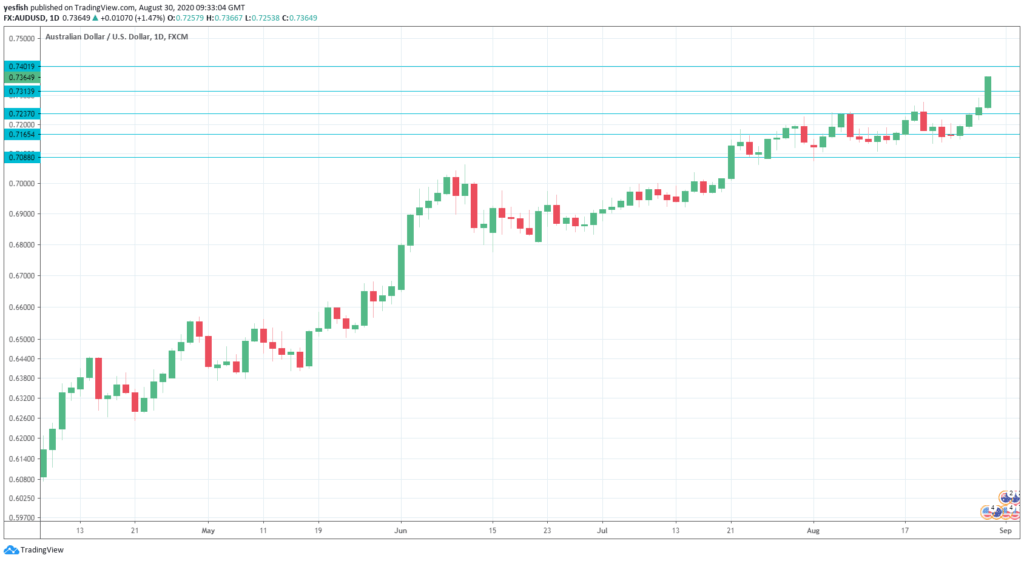

AUD/USD Technical Analysis