- Construction Work Done: Wednesday, 1:30. This quarterly indicator has posted three successive declines, pointing to weakness in the construction sector. In Q1, the indicator dropped by 1.9%, well below the forecast of a 0.1% gain. Another decline is expected in Q2, with an estimate of -1.0%.

- Private Capital Expenditure: Thursday, 1:30. The all-important quarterly measure reflects investment levels and is closely watched by the Reserve Bank of Australia. The indicator declined by 1.7% in Q1, marking its third decline in four quarters. The forecast for Q2 stands at 0.4%.

- Building Approvals: Friday, 1:30. Building approvals tends to show strong fluctuation, making accurate forecasts difficult. The June reading of -1.2% was much weaker than the forecast of 0.2%. The July estimate stands at zero.

- Chinese Manufacturing PMI: Saturday, 1:00. The Chinese manufacturing sector continues to struggle, as the bitter trade war with the U.S. has taken its toll on the Chinese economy. The July release came in at 49.7, just short of the 50-level, which separates contraction and expansion. No change is expected in the August release.

*All times are GMT

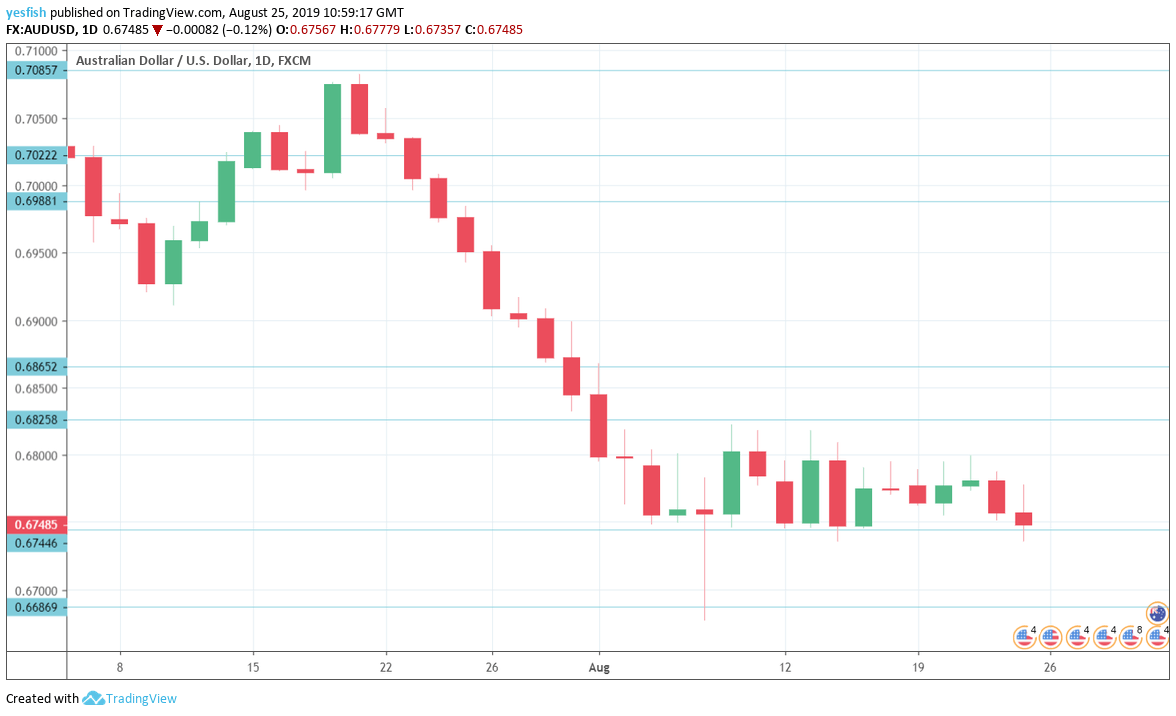

Technical lines from top to bottom:

We start with resistance at 0.7165. This line has held since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 is next.

0.6825 (mentioned last week) is the next resistance line. It was under pressure last week.

0.6744 remains relevant. It was tested in support during the week and ended the week as a weak support line.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 follows.

0.6341 has held in support since 2003.

I remain bearish on AUD/USD

Investor risk appetite has dampened, as there are growing concerns that the U.S. could be heading into a recession. This will lower sentiment towards risk currencies like the Aussie. Trade tensions remain high between the U.S. and China, as both nations are set to slap the other with additional tariffs. These moves will likely hurt the Australian economy, particularly the manufacturing sector.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!