The Australian dollar extended its gains ahead of Christmas, enjoying the greenback’s weakness and the previous week’s jobs report. Is there more in store for the holiday week? There is only one event on the agenda. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Australian dollar extended the gains related to the excellent jobs report. In addition, the RBA meeting minutes were good enough to support the Aussie. In the US, the greenback “sold the fact” of the tax bill and data was mixed, with a small downgrade of GDP growth.

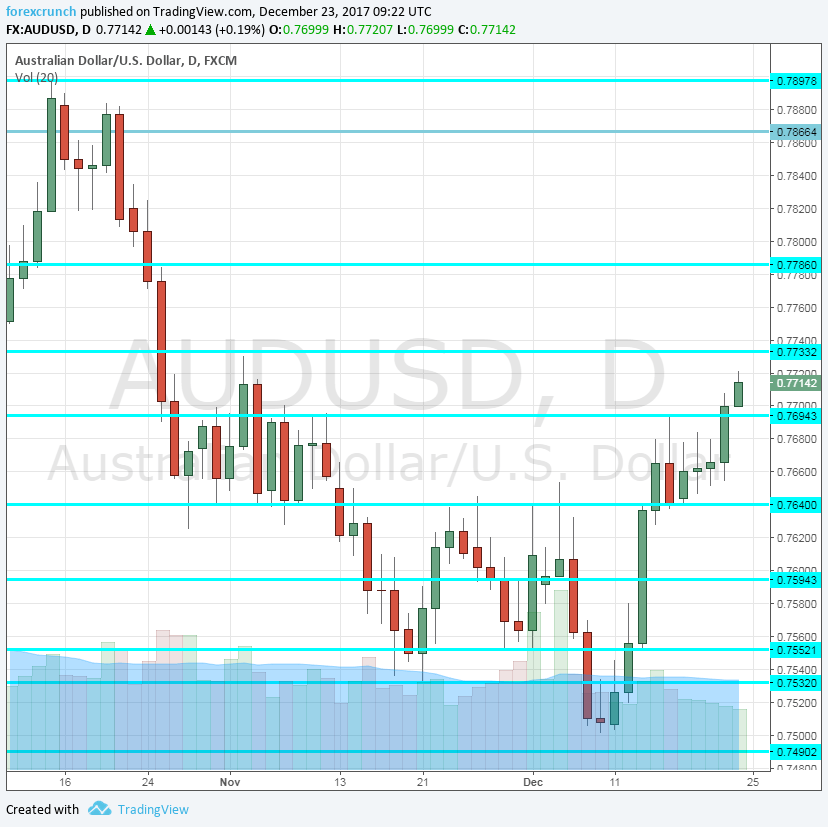

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Private Sector Credit: Friday, 00:30. The expansion of credit has been steady in recent months, expanding at a moderate pace. After 0.4% in October, the same outcome is on the cards again.

AUD/SD Technical Analysis

The Aussie was initially capped by the round 0.77 level (mentioned last week) and was forced to retreat. Yet a late surge sent it across the line.

Technical lines from top to bottom:

The psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

0.7860 served as support during September and is another line to watch. 0.7785 was a stepping stone on the way up.

Below, we find 0.7730, that was a high point in June 2017 and also beforehand, working as resistance in November. The round number of 0.77 capped the pair in mid-December. 0.7640 worked as resistance in November.

0.7595 was a swing high in early December and capped the pair. 07550 provided support in late November.

0.7530 is the cycle low, very close to the previous line and the last stop before the round number of 0.75.

Even lower, we find 0.7440 and then 0.7375.

I am neutral on AUD/USD

The holiday week may see volatile moves on low liquidity and trading volume but could also see the pair consolidating its gains before 2018 commences.

Our latest podcast is titled What does 2018 have in store for financial markets?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!