- Chinese Manufacturing PMI: Tuesday, 1:00. The Chinese manufacturing sector improved to 50.2 in November, a shade above the 50-level, which separates expansion from contraction. Little change is expected in the December release, with an estimate of 50.1 pts.

- Chinese Caixin Manufacturing PMI: Thursday, 1:45. This index follows the official manufacturing PMI. The indicator improved to 51.8 in November, its highest level since 2013. The estimate for December stands at 51.6 pts.

- Commodity Prices: Thursday, 5:30. After an extended streak of gains, commodity prices have declined in the past two readings. In November, the indicator declined by 5.0 percent. Will we see a rebound in the December release?

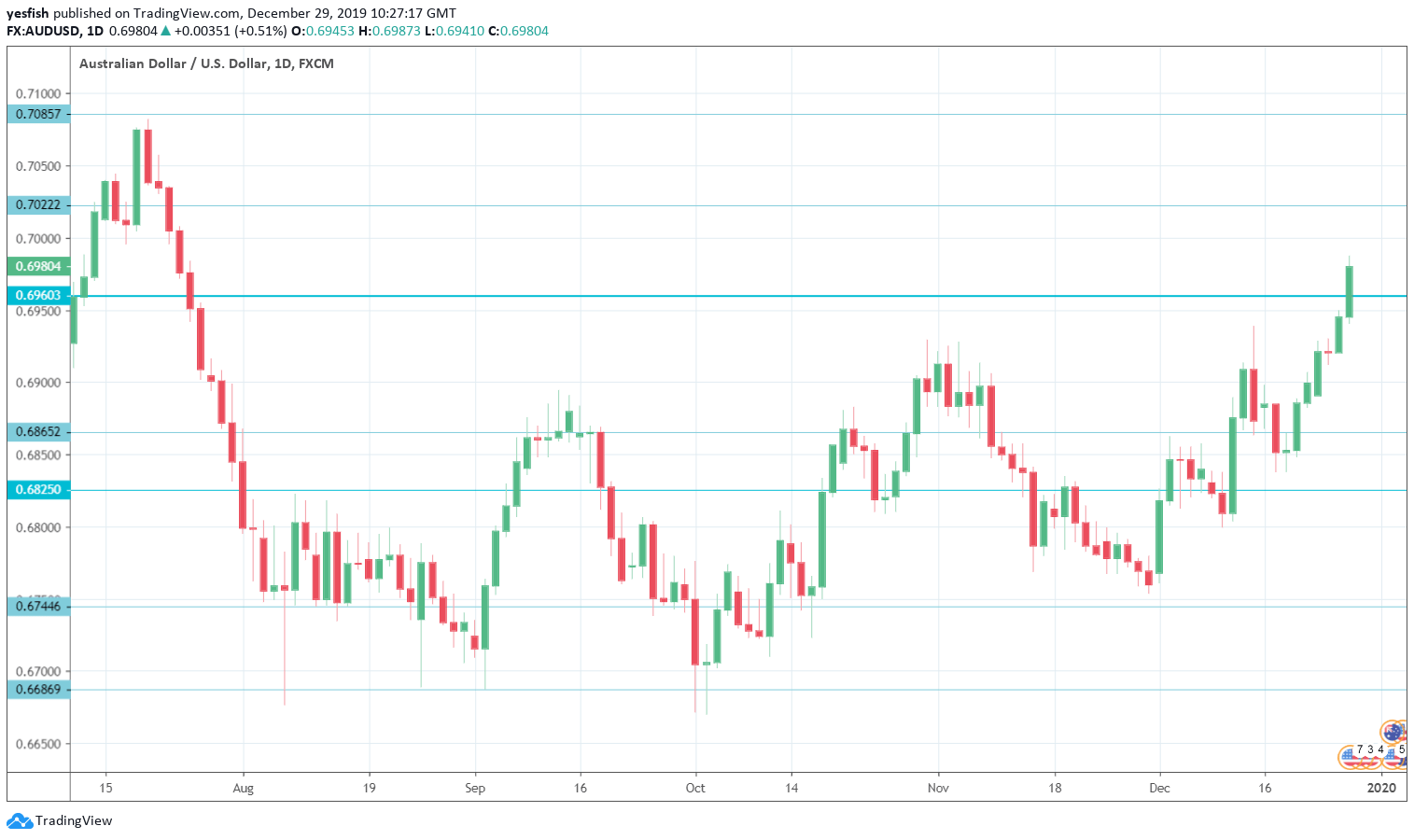

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7340. This is followed by 0.7250.

0.7165 has held firm since early April.

0.7085 has been a resistance line since July. This is followed by 0.7022.

0.6960 has switched to support level following gains by AUD/USD last week. It is a weak line.

0.6865 (mentioned last week) is the next support level.

0.6744 is next.

0.6686 was tested in the first week of October.

0.6627 has held in support since March 2009. It is the final support line for now.

I remain bullish on AUD/USD

The trade agreement between the U.S. and China, although limited in scope, should boost the Chinese economy. This is good news for Australia, as China is Australia’s number one trading partner. Risk appetite remains strong for now, which is bullish for minor currencies like the Aussie. If AUD/USD can break above the symbolic 70 level, it could gain momentum and continue to move upwards.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!