The Australian dollar had another down-week, mostly due to the crash in stocks. What’s next? The jobs report stands out. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The stock market crashes of Monday and also Thursday dominated the headlined and triggered a sell-off of the Australian dollar. The Aussie also suffered from disappointing retail sales and a trade balance deficit. The RBA continued expressing concerns about a strong A$ but did not raise its tone too much. The fall of the Aussi is already significant.

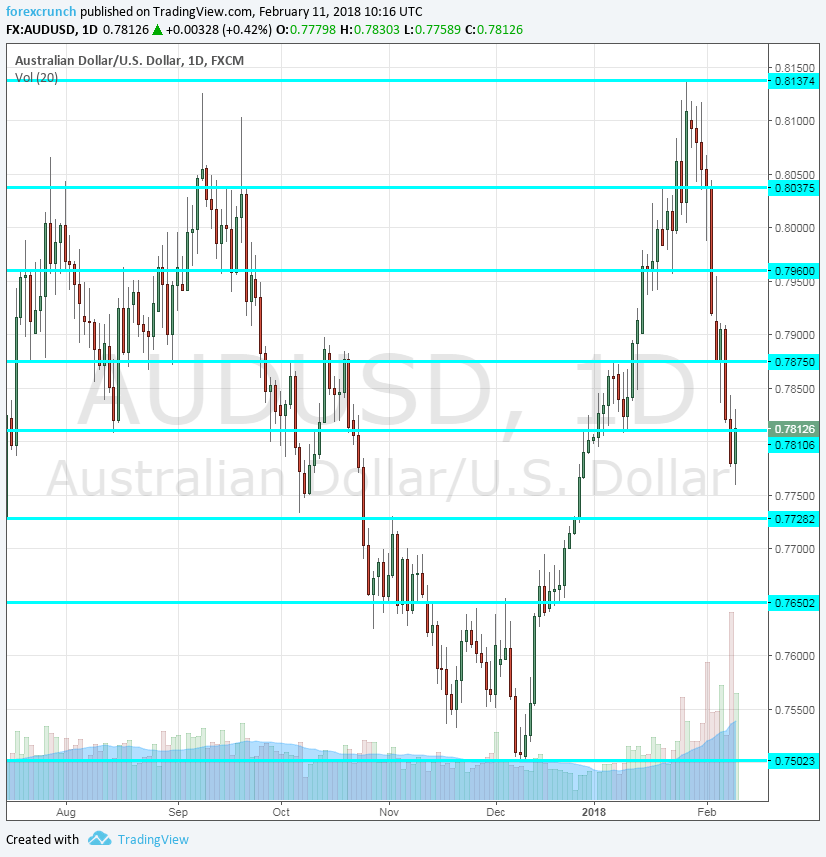

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Luci Ellis talks, Monday, 21:50. The RBA Assistant Governor speaks in Sydney and may comment on recent market turbulence, on the Aussie dollar and inflation, all market-moving topics.

- NAB Business Confidence: Tuesday, 00:30. This monthly survey of around 350 businesses has jumped to 11 points in December, the highest since July. A similar figure is likely now.

- Westpac Consumer Sentiment: Tuesday, 23:30. Westpac’s survey of 350 customers has seen a rise of 1.8% back in January, a second consecutive advance. A drop may be seen in the February report.

- MI Inflation Expectations: Thursday, 00:00. The Melbourne Institute has shown stable inflation expectations in the past three months, at 3.7%. Will they drop now?

- Jobs report Thursday, 00:30. Australia gained 34.7K jobs in December in an excellent jobs report. This time, a more modest rise of 15.2K is expected while the unemployment rate is predicted to remain unchanged at 5.5%. Watch out for changes in full-time vs. part-time jobs.

- Phillip Lowe talks Thursday, 22:30. The Governor of the RBA will make yet another public appearance, this time at an official testimony. Lowe will have the chance to talk about the jobs report and to address any fluctuations in markets.

AUD/USD Technical Analysis

Aussie/USD was unable to challenge the 0.8130 level mentioned last week. It then turned south and even closed below 0.7940 in the last minutes of trade.

Technical lines from top to bottom:

0.8290 was the peak in May 2015 and may come into play. It is followed by the round number of 0.82.

0.8130 was the high point in 2017 and was challenged early in the year. 0.8040 capped the pair in August and also temporarily in January, on its way up.

0.7960 was a swing low back in January and guards the 0.80 level. 0.7875 served as resistance on the way up.

07810 was the previous trough of 2018 and remains a battle line. 0.7730 held the pair back in November.

Lower, 0.7650 worked as resistance in several occasions in late 2017. The last line to watch is the round 0.75 level.

I remain bearish on AUD/USD

The stock market crash may not be over quite yet. In addition, we may see a drop in jobs after a few excellent reports. All in all, the Aussie remains vulnerable.

Our latest podcast is titled When everything sells off, where is the money going to?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!