The Australian dollar certainly conquered the 0.80 level and closed the above 0.81. Will it continue even higher? The upcoming week features the key Australian CPI release and a key Chinese survey. What’s next for the Aussie? Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Australian dollar certainly took advantage of the US dollar weakness. US Treasury Secretary Steven Mnuchin said that a weak dollar is good for the US, adding fuel to the fire. If the Aussie had some doubts about the 0.80 level, this talk sent above the next two resistance levels and above 0.81. Australia’s neighbor, New Zealand, reported a disappointing CPI and some think we could see the same in Australia, but that hasn’t stopped the Aussie.

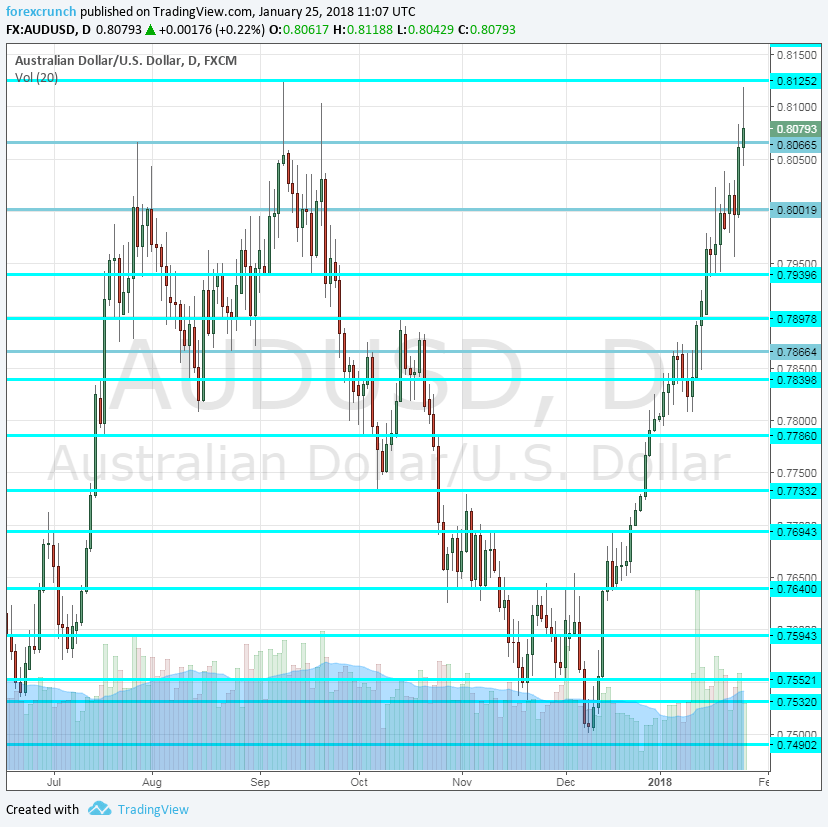

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- NAB Business Confidence: Tuesday, 00:30. This survey of 350 businesses has been quite volatile in recent months, but the latest figure of 6 points has been at the lower end of the range, even if it is above 0, indicating improving business conditions.

- CPI: Wednesday, 00:30. Australia publishes its inflation report only once per quarter, making the publication have a stronger impact. This time, it is released ahead of the RBA meeting in early February, the first one for 2018 as the Bank takes a break in January. In Q3, headline CPI was up 0.6% q/q while the Trimmed Mean CPI lagged behind with 0.4% q/q. The recent miss on New Zealand’s CPI caused some analysts to lower expectations for Australia’s inflation numbers. However, the consensus is actually for strong figures: 0.7% on the headline and 0.5% on the core.

- Private Sector Credit: Wednesday, 00:30. Credit has been expanding at a growing pace in the past two months, accelerating to 0.5% in December. However, this is not very different than the numbers we have seen in during 2017. Another rise of 0.5% is on the cards.

- AIG Manufacturing Index: Wednesday, 22:30. The Australian Industry Group has shown a minor slowdown in growth in the manufacturing sector, standing at 56.3 points. A similar number is likely now.

- Building Approvals: Thursday, 00:30. The number of building consents is usually quite volatile and this was clearly demonstrated in the 11.7% leap recorded for November. The figure for December could be negative: a fall of 7.5% is forecast.

- Import Prices: Thursday, 00:30. Prices of imported goods feed into consumer prices and impact the RBA. In Q3, prices of imported goods dropped by 1.6%, a second consecutive fall. Another drop in Q4 will lead to a dampening of inflation expectations. Prices are expected to rise by 1.5%.

- Chinese Caixin manufacturing PMI: Thursday, 1:45. This independent measure of the Chinese economy advanced to 51.5 points in December, indicating stronger growth in the world’s No. 2 economy and Australia’s No. 1 trading partner. A repeat of the same score is on the cards.

- Commodity Prices: Thursday, 5:30. The Aussie’s value is correlated to quicker moves in commodity prices, but this monthly measure provides a wider measure. In December, prices dropped by 5.9% y/y, a bigger drop than beforehand. We could see a better outcome now, as commodity prices have been on the up recently.

- PPI: Friday, 00:30. The Producer Price Index is more useful when it is published before the CPI, serving as a warm-up. Nevertheless, this gauge of inflation in the pipeline is noteworthy. A rise of 0.2% was seen in Q3.

AUD/USD Technical Analysis

Aussie/USD hugged the 0.80 level (mentioned last week). It hen moved to higher ground and paused under 0.8130.

Technical lines from top to bottom:

0.8290 was the peak in May 2015 and may come into play. It is followed by the round number of 0.82.

0.8130 was the 2017 high and remains a top line. It is followed by 0.8065, which capped the pair’s rise beforehand.

The psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

Quite close by, we find 0.79, a round number that capped the pair in October and also in January. 0.7860 served as support during September and is another line to watch.

0.7810 worked as a cushion for the pair in January. Below, we find 0.7730, that was a high point in June 2017 and also beforehand, working as resistance in November.

The round number of 0.77 capped the pair in mid-December. 0.7640 worked as resistance in November. 0.7595 was a swing high in early December and capped the pair.

I remain bullish on AUD/USD

We already said that everything is going in favor of the Aussie. While inflation numbers can hurt the Aussie, a not-so-great outcome is mostly priced in and is unlikely to make a long-term change.

Our latest podcast is titled Dollar downfall and America’s economy

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!