The Australian dollar initially lost ground but recovered quite quickly. Can it regain the 0.80 level? A lot depends on the central bank, with its meeting minutes. China remains on holiday and this may impact trading volumes. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia’s jobs report met expectations with a gain of 16K and an unemployment rate of 5.5%. The RBA tried to nudge the Aussie lower: Governor Lowe said that a weaker Aussie is better than a stronger one. Yet the big drama came from the US, where the inflation report initially sent the dollar lower only to see a sharp reversal afterward, as share prices resumed their rally. However, the greenback made a comeback on Friday, eroding the gains of the pair.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Michele Bullock speaks, Monday, 22:15. The Assistant Governor at the Reserve Bank of Australia will speak in Sydney early in the week and may also mention the exchange rate.

- RBA Meeting Minutes: Tuesday, 00:30. These are the minutes from the Bank’s first meeting of 2018, where they left the rates unchanged and made only subtle changes to the wording of the statement. The minutes may reveal deeper insights about future policy.

- MI Leading Index: Tuesday, 23:30. The Melbourne Institute’s composite index advanced by 0.3% in December. We may see a more moderate rise now.

- Construction Work Done: Wednesday, 00:30. This quarterly measure is quite volatile, but still, provides a good outlook on the construction sector. After a jump of 15.7% in Q3 2017, a fall of 10.1% is on the cards now.

- Wage Price Index: Wednesday, 00:30. Wage growth is becoming more and more important all over the world. A healthy labor market should see pressures on salaries. An increase of 0.5% was recorded in Q3, and the same rise is on the cards now.

- CB Leading Index: Wednesday, 15:30. The Conference Board’s composite index rose by 0.3% last time, just like MI’s figures. Also here, the gauge will likely rise at a more moderate pace.

AUD/USD Technical Analysis

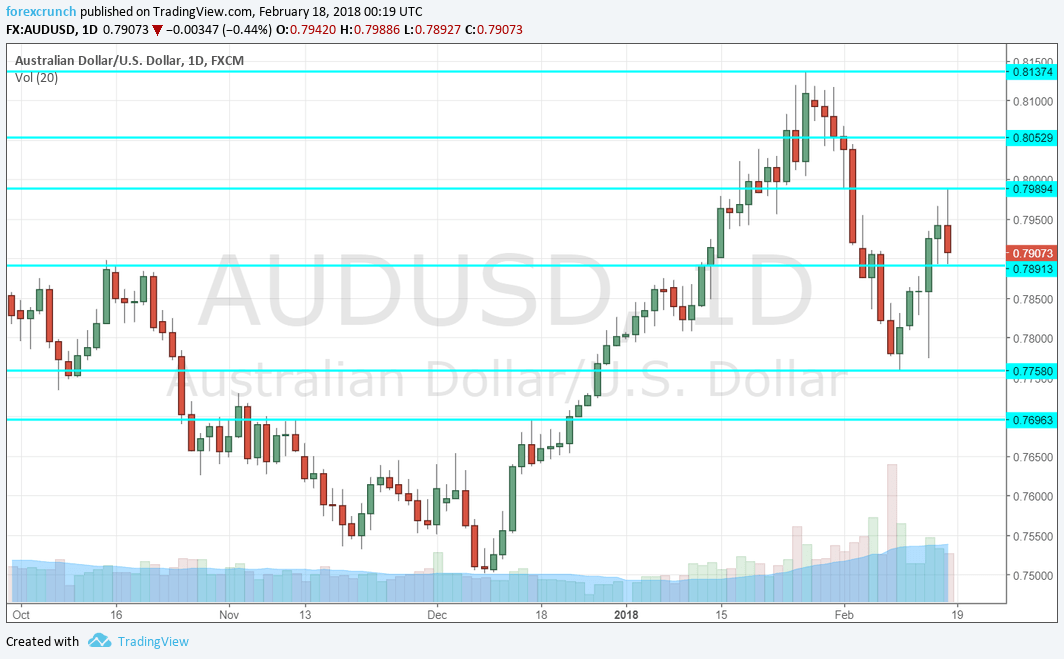

Aussie/USD initially fell to lower ground but rose and challenged the 0.7980 level that was mentioned last week before closing a bit lower.

Technical lines from top to bottom:

0.8290 was the peak in May 2015 and may come into play. It is followed by the round number of 0.82.

0.8130 was the high point in 2017 and was challenged early in the year. 0.8050 capped the pair in August and also temporarily in January, on its way up.

0.7990 was the high point in February and protects the 0.80 level. 0.7890 worked as support in February and resistance in October.

0.7760 was the low point in mid-February and works as support. The round level of 0.77 was resistance in December.

Lower, 0.7650 worked as resistance in several occasions in late 2017. The last line to watch is the round 0.75 level.

I remain bearish on AUD/USD

Stocks are still sensitive and the RBA may try to push the Aussie lower.

Our latest podcast is titled Volatility is back with a vengeance and the perky pound

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!