- AIG Manufacturing Index: Sunday, 21:30. The index slipped below the 50-level in November and remained in contraction territory in December. With the manufacturing sector continuing to struggle, we could continue to see readings below the 50-level.

- MI Inflation Gauge: Monday, 0:00. This indicator helps analysts track on inflation on a monthly basis, as CPI is only released once each quarter. Inflation climbed 0.3% in December, its highest level since July. Will the upward trend continue in January?

- Building Approvals: Monday, 0:30. Building approvals continues to show strong swings. After a decline of 8.1% decline in October, the indicator roared back with a strong gain of 11.8%. This crushed the estimate of 2.1%. Another decline is expected in December, with a forecast of -5.0%.

- Chinese Caixin Manufacturing PMI: Tuesday, 3:30. The official manufacturing PMI in December came in at 50.0, the level which separates contraction from expansion. The Caixin PMI is projected to be slightly stronger, with an estimate of 51.0 points.

- RBA Rate Decision: Tuesday, 3:30. The RBA is expected to maintain the benchmark rate at 0.75%, where it has been pegged since October. Investors will be keeping a close eye on the rate statement, as the tone of the statement could have a significant impact on the movement of AUD/USD.

- AIG Construction Index: Sunday, 21:30. The index slipped to 38.9 in December, indicating sharp contraction in the construction industry. Will the downturn continue in January?

- Retail Sales: Thursday, 0:30. This key consumer spending indicator jumped 0.9% in November, its strongest gain since November 2017. Analysts are braced for a decline of 0.2% in December.

- Trade Balance: Thursday, 0:30. Australia continually posts monthly trade surpluses. The surplus improved to A$5.80 billion in November, up from A$4.50 billion a month earlier. The estimate for December stands at A$5.60 billion.

- AIG Services Index: Sunday, 21:30. The services index came in at 48.7 in December, which points to contraction. We now await the January release.

- RBA Monetary Policy Statement: Thursday, 0:30. The quarterly report by the central bank has, at times, provided hints for future monetary policy. It provides a broader view of the economy than the short rate statement. Any hints about changes in interest rates will be scrutinized by markets.

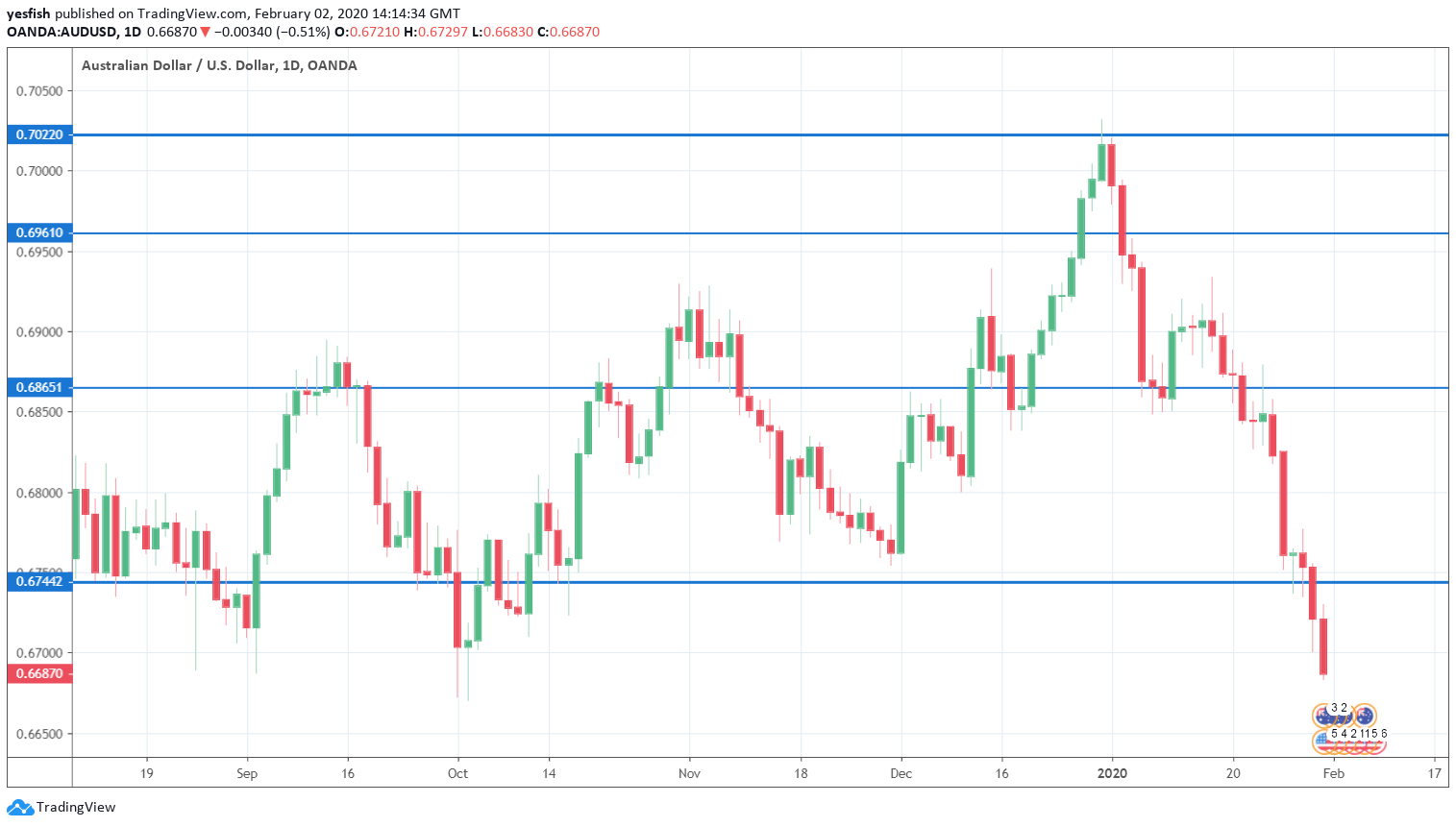

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7022.

0.6960 has acted in resistance since the first week in January, when AUD/USD went on a sharp slide.

0.6865 (mentioned last week) is the next resistance line.

0.6744 has switched to support following losses by AUD/USD last week.

0.6627 has held in support since March 2009. 0.6456 is next

0.6380 is the final support line for now.