- NAB Business Confidence: Tuesday, 0:30. Business confidence in the economy remains weak, as the slowdown in the Chinese economy has hurt the Australia economy. The indicator slipped to zero in November, down from 2 pts a month earlier. Will we see a rebound into positive territory in December?

- MI Leading Index: Tuesday, 23:30. The Melbourne Institute indicator has been steady, with three straight readings at -0.1%. It is based on 9 economic indicators. We now await the December release.

- Inflation Reports: Wednesday, 0:30. Consumer inflation is released each quarter, magnifying the impact of each release. The headline release came in at 0.5% in Q3 and is expected to tick up to 0.6% in the fourth quarter. Trimmed Mean CPI, which excludes the most volatile items included in CPI, is projected to stay unchanged at 0.4%.

- Private Sector Credit: Friday, 0:30. Business and consumer borrowing levels remain weak, which reflects weakness in consumer spending. After back-to-back gains of 0.1%, the forecast for December stands at 0.2%.

- Chinese Manufacturing PMI: Friday, 1:00. The manufacturing sector has stalled, with two consecutive readings of 50.2 points. These readings are barely above the 50-level, which separates expansion from contraction. Little change is expected in January, with an estimate of 50.1 pts.

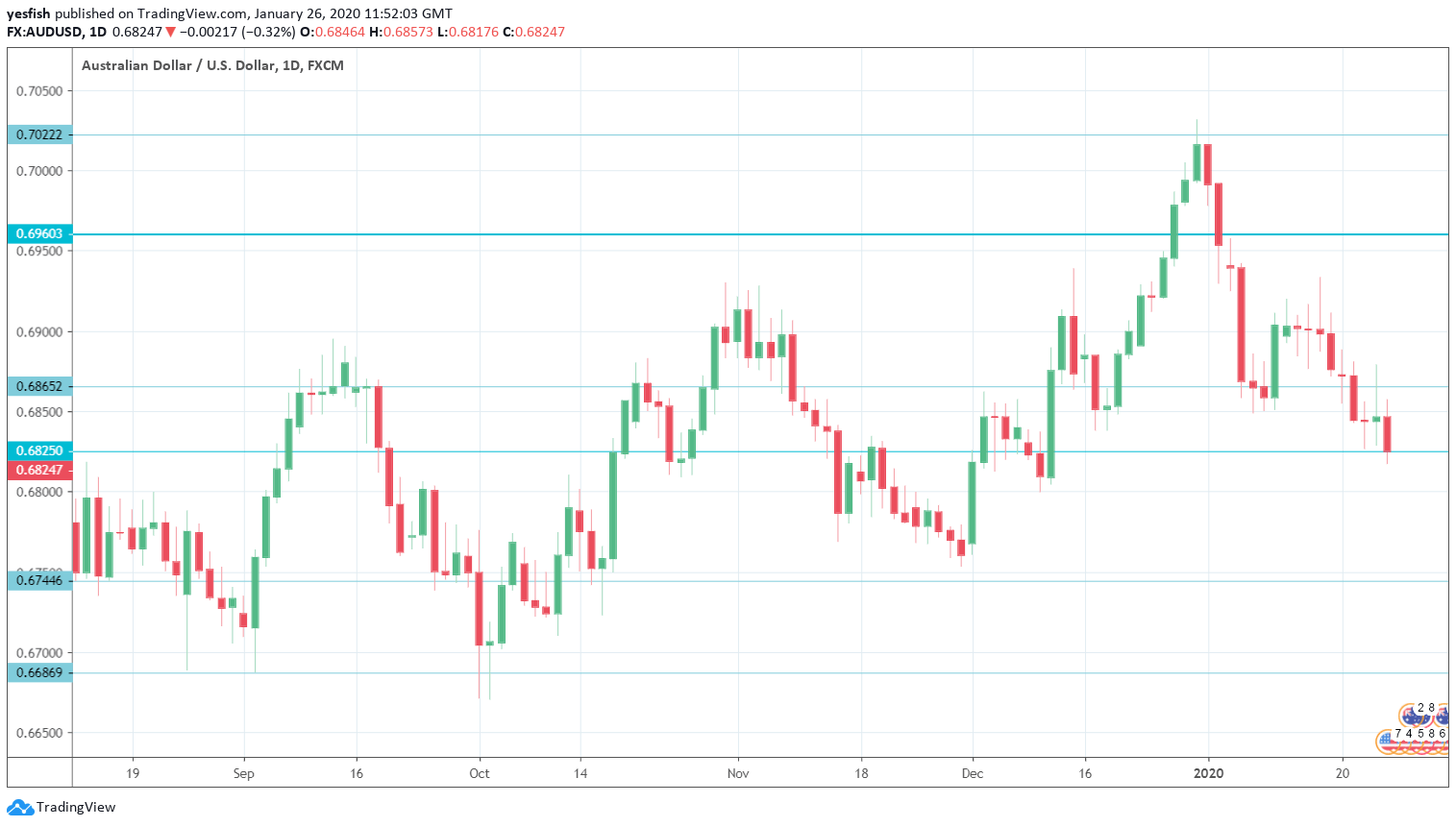

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7250.

0.7165 has held firm since early April.

0.7085 has been a resistance line since July. This is followed by 0.7022.

0.6960 has acted in resistance since the first week in January, when AUD/USD went on a sharp slide.

0.6865 (mentioned last week) switched to a resistance role after considerable losses by AUD/USD last week. It is a weak line.

0.6744 is providing support.

0.6627 has held in support since March 2009.

0.6456 is the final support line for now.

I remain bearish on AUD/USD

The Aussie continues to lose ground in January. The coronavirus in China has spread outside of the country, and investors are snapping up safe-haven assets, while staying away from riskier assets such as the Australian dollar.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!