- Westpac Consumer Sentiment: Tuesday, 23:30. Consumer confidence in the economy remains weak, as the slowdown in the Chinese economy has hurt the Australia economy. The indicator declined by1.9% in December, its third decline in the past four months. Will we see a rebound in January?

- CB Leading Index: Wednesday, 15:30. The index, based on 7 economic indicators, recorded a small gain of 0.2% in October. We will now receive the November data.

- MI Inflation Expectations: Thursday, 0:00. This is a useful gauge for tracking inflation, as inflation expectations often translate into actual inflation readings. The index has posted strong gains of 4.0% in the past two readings.

- Employment Report: Thursday, 0:30. Employment change sparkled in November, as the economy created 39.9 thousand jobs, crushing the estimate of 14.5 thousand. The December forecast stands at 11.2 thousand. The unemployment rate is expected to remain unchanged at 5.2 percent.

- Manufacturing PMI: Thursday, 22:00. The manufacturing sector has been hurt by the U.S.-China trade war and the PMI has posted back-to-back readings below the 50-level, which separates contraction from expansion. We now await the December reading.

- Services PMI: Thursday, 22:00. The services sector has also been in decline, with two straight readings of 49.5 pts. Will we see an improvement in the January release?

AUD/USD Technical Analysis

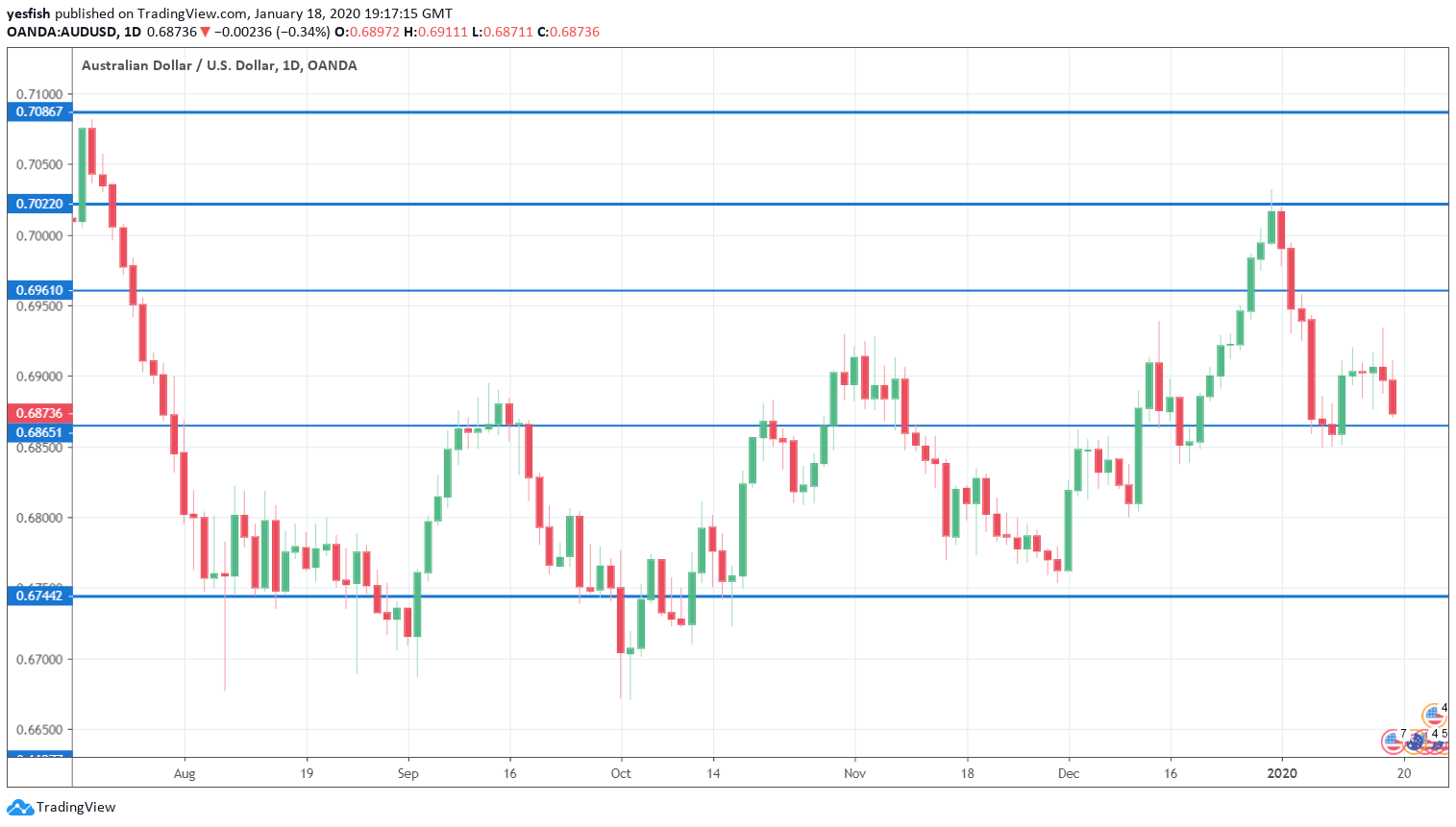

Technical lines from top to bottom:

We start with resistance at 0.7250.

0.7165 has held firm since early April.

0.7085 has been a resistance line since July. This is followed by 0.7022.

0.6960 has acted in resistance since the first week in January, when AUD/USD went on a sharp slide.

0.6865 (mentioned last week) is an immediate support level. It could see action early in the week.

0.6744 is next.

0.6627 has held in support since March 2009.

0.6456 is the final support line for now.

I am bearish on AUD/USD

It’s been a rough start to the New Year, as the Australian dollar is down over 2 percent. Risk appetite has improved since the flare-up between the U.S. and Iran, but the Aussie hasn’t been able to reverse its January slide.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!