The Australian dollar extended its gains, flirting with the 0.80 level but not conquering it just yet, as Australian data was positive and the US dollar suffered a sell-off. What’s next? There are very few figures lined up this week but that doesn’t mean a lack of action. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Australian economy enjoyed another great jobs report: 34.7K positions were gained, better than expected once again. China’s yearly growth came out slightly above expectations at 6.9% and that is another encouraging number. Things are going in favor of the Aussie. The greenback suffered further selling but gave a fight. The government shutdown happened after markets had closed, so the full impact hasn’t been felt quite yet.

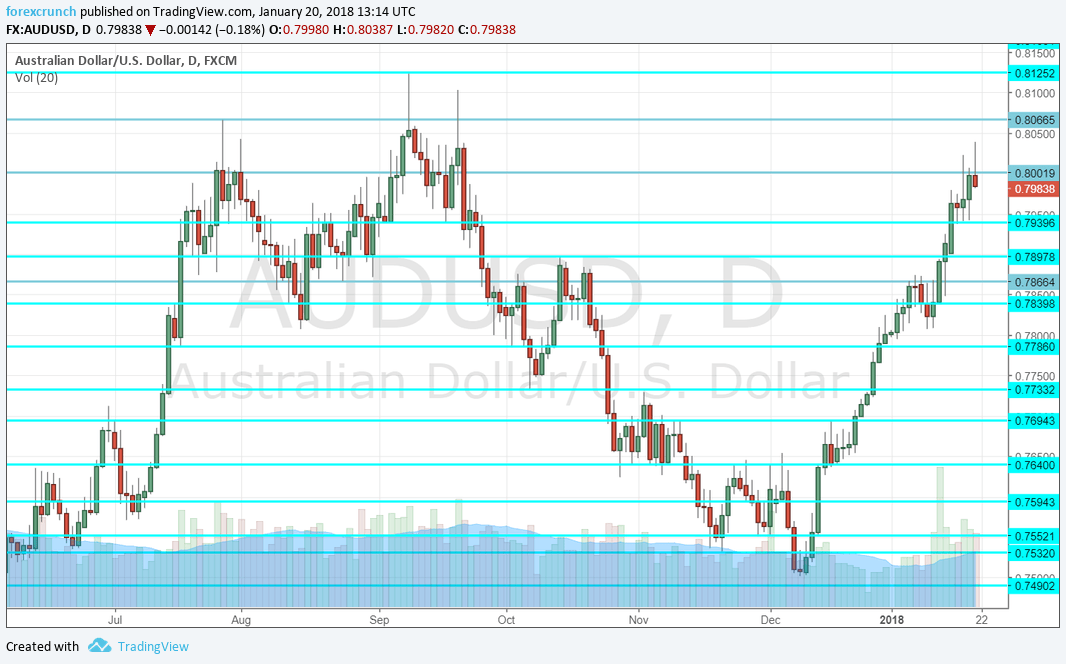

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- MI Leading Index: Tuesday, 23:30. The Melbourne Institute’s composite index rose by a marginal 0.1% in December, showing cautious growth. We will now get the first read for 2018.

- CB Leading Index: Wednesday, 3:30. The Conference Board’s index showed a better outcome: 0.3%, but that was for November. The index, based on 7 indicators, may rise at a more moderate pace in December.

AUD/USD Technical Analysis

Aussie/USD consolidated its gains above the 0.7940 level (mentioned last week). It then extended its gains above 0.80 but closed just below this level.

Technical lines from top to bottom:

0.8290 was the peak in May 2015 and may come into play. It is followed by the round number of 0.82.

0.8130 was the 2017 high and remains a top line. It is followed by 0.8065, which capped the pair’s rise beforehand.

The psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

Quite close by, we find 0.79, a round number that capped the pair in October and also in January. 0.7860 served as support during September and is another line to watch.

0.7810 worked as a cushion for the pair in January. Below, we find 0.7730, that was a high point in June 2017 and also beforehand, working as resistance in November.

The round number of 0.77 capped the pair in mid-December. 0.7640 worked as resistance in November. 0.7595 was a swing high in early December and capped the pair.

I remain bullish on AUD/USD

Everything is going in favor of the Aussie $: the economy is doing well and so is that of its main trading partner, China. In the US, the pinch of the government shutdown has yet to be felt.

Our latest podcast is titled Oil on a roll and some bitcoin bashing

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!