AUD/USD was almost unchanged last week, as the pair was content to stay close to the 0.6960 line. The upcoming week has five events, including Australian job data and Chinese GDP. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

Australian inflation levels rebounded in May, with a gain of 0.6%. This followed two consecutive declines. The RBA maintained rates at 0.25%, where they have been pegged since March. There has been some speculation that the RBA might be under pressure to raise rates due to the sharp increase in the exchange rate. However, in its rate statement, the bank said that it had no plans to change its accommodative policy.

In the US, the services sector showed a strong rebound in June. The ISM Non-Manufacturing PMI jumped to 57.1, up from 45.4 beforehand. This reading showed significant expansion. Unemployment claims continue to fall, albeit at a slow rate. Last week’s reading was 1.31 million, down from 1.42 million. The Producer Price Index disappointed. The headline read came in at -0.2%, while Core PPI declined by -0.3%.

- NAB Business Confidence: Monday, 1:30. The National Australia Bank indicator has been improving, but remains deep in negative territory. In May, the indicator rose to -20, up from -46 beforehand. Will the upward trend continue in June?

- Westpac Consumer Sentiment: Wednesday, 00:30. After a sharp decline in March, consumer confidence has rebounded. The indicator gained 6.3% in May, after an excellent gain of 16.4% a month earlier. We now await the June data.

- MI Inflation Expectations: Thursday, 1:00. The Melbourne Institute indicator is a useful gauge of inflation, since inflation expectations can translate into actual inflation figures. In May, the indicator ticked lower to 3.3%, down from 3.4% a month earlier. Will we see a similar reading in June?

- Employment Report: Tuesday, 4:30. The labor market has been a disaster in the wake of Covid-19. In May, the economy shed 227.7 thousand jobs, much worse than the forecast of 105.0 thousand. Analysts are projecting a strong rebound in June, with an estimate of 100.0 thousand.

- Chinese GDP: Thursday, 2:00. China’s economy contracted by 6.8% in Q1 reflecting the devastating impact of the coronavirus pandemic on the world’s second-largest economy. Better news is expected in Q2, with an estimate of 2.2%.

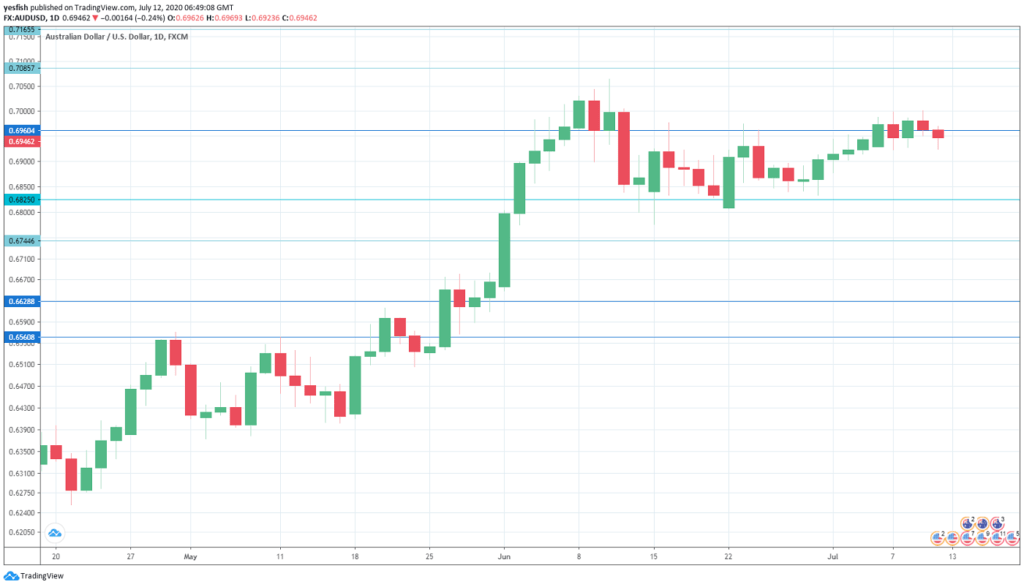

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7250.

0.7165 has held firm since early April. 0.7085 is next.

0.6960 is protecting the 0.70 line, which has psychological significance. This line is under pressure.

0.6825 (mentioned last week) has some breathing room in support.

0.6744 was a low point in January.

0.6627 has provided support since late May. It is the final support line for now.

I am bullish on AUD/USD

AUD/USD had an excellent Q2, with gains of 12.0 percent. The currency has shown that it can weather the Covid-19 pandemic and severe global economic conditions, so investors may feel comfortable holding onto the currency.

Follow us on Sticher or iTunes

Further reading:

Safe trading!