AUD/USD posted slight gains last week, as the pair tested the symbolic 70 line. The upcoming week has four events, including the RBA minutes and retail sales. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

The National Bank of Australia Business Confidence survey improved to 1 in June, up sharply from -20 beforehand. This marked the first reading in positive territory since October 2019. A reading above zero indicates improving conditions. The Melbourne Inflation Expectations gauge ticked lower to 3.2%, down from 3.3% beforehand.

On the employment front, the economy produced 210.8 thousand jobs in June, after shedding 227.7 thousand jobs a month earlier. The strong reading crushed the estimate of 106.0 thousand. However, the unemployment rate rose to 7.4%, up from 7.1%. In China, GDP rebounded in Q2 with a gain of 3.2%. This follows a read of -6.8 percent in Q1.

In the US, industrial production jumped 5.4% in June, its largest monthly gain since 1959. Retail sales rose by 7.5%, while the core reading climbed by 7.3%. Both indicators beat the forecast of 5.0%. New unemployment claims dipped slightly to 1.3 million, but the total number of claims is above 32 million, as the employment situation remains grim. Finally, consumer confidence became more pessimistic, as UoM Consumer Sentiment fell to 73.2 in July, down from 78.9 beforehand.

- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. The RBA will release the minutes of last week’s policy meeting. The tone of the minutes could affect the movement of AUD/USD.

- MI Leading Index: Wednesday, 00:30. This Melbourne Institute indicator is a useful gauge of economic activity. In May, the index rebounded after three successive declines, with a gain of 0.2%.

- Retail Sales: Wednesday, 1:30. Consumer spending has recovered nicely, with gains of 16.3% and 16.9% in April and May, respectively. Will we see a repeat performance in June?

- NAB Quarterly Business Confidence: Thursday, 1:30. Business confidence took a hit in the second quarter, slipping to -11. The indicator has not managed to record a gain since Q2 of 2019.

.

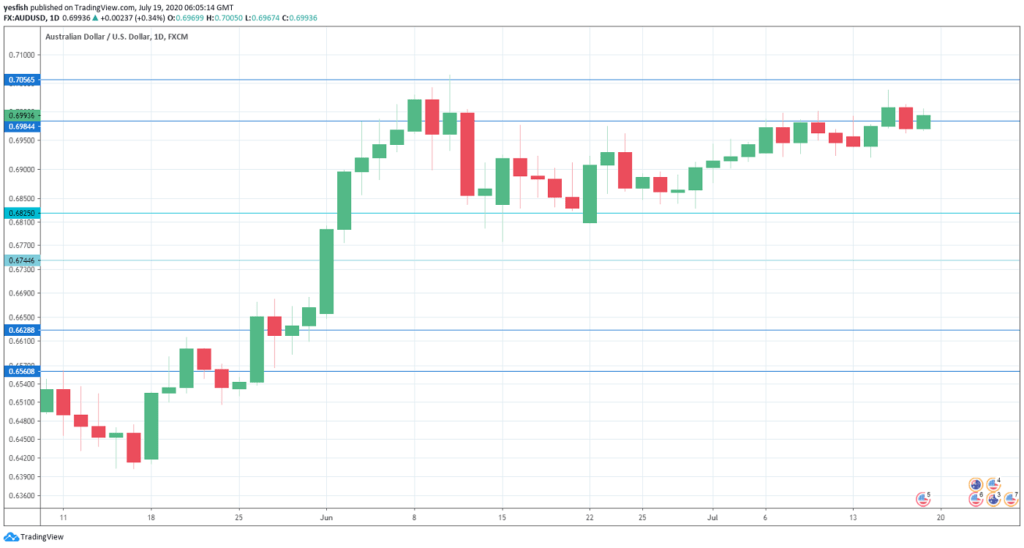

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7250.

0.7165 has held firm since early April. 0.7056 is next.

0.6983 is an immediate support line.

0.6825 (mentioned last week) has some breathing room in support.

0.6744 was a low point in January.

0.6627 has provided support since late May. It is the final support line for now.

I remain bullish on AUD/USD

AUD/USD has slowly clawed up to the psychologically important 70-mark. It could break above this line during the week, which would give the pair some positive momentum.

Follow us on Sticher or iTunes

Further reading:

Safe trading!