The Australian dollar made an attempt to recover but never went too far. What’s next? Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Reserve Bank of Australian left the rates unchanged and the statement almost untouched. Nevertheless, the Aussie liked it as it stood out against the RBNZ’s dovishness. Australian retail sales came out better than expected at 0.4% and also supported the Aussie. Trade tensions slightly eased as China said it would not fire the first shot in the trade war and German Chancellor Merkel opened the door to lower car tariffs. US data was quite upbeat.

Update: The risk-on mood in markets helped the Australian Dollar move up early in the week, moving towards the round level of 0.75. Stocks drive the pair. The Aussie fell on the news that the US is moving forward with the $200 worth of Chinese goods. The risk off atmosphere weighed on the pair.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

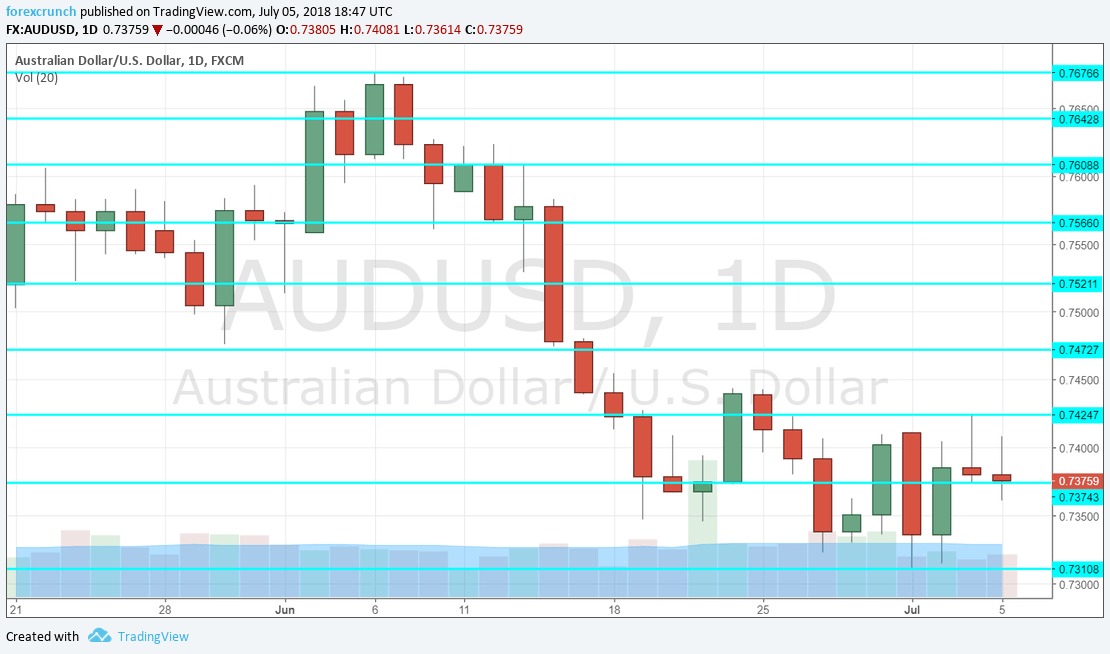

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Michele Bullock talks Sunday, 3:10. The RBA Assistant Governor speaks in Shanghai and talks about technology. Nevertheless, she may comment on monetary policy.

- NAB Business Confidence: Tuesday, 1:30. The National Australia Bank’s survey of 350 businesses dropped sharply from 11 to 6 points but remains positive. We will now get the figure for July.

- Westpac Consumer Sentiment: Wednesday, 00:30. Consumer confidence advanced by 0.3% in June after two drops beforehand. The number for July will likely show a moderate increase.

- Home Loans: Wednesday, 1:30. The volume of loans for homes dropped in the five months in a row, with a slide of 1.4% in April. A bounce could be seen in the figure for May.

- MI Inflation Expectations: Thursday, 1:00. The Melbourne Institute’s measure of future inflation provides some information about the price development as the government releases official CPI numbers only once per quarter.

- Chinese Trade Balance: Friday, 2:00. Australia’s No. 1 trade partner enjoys a broad trade balance which stood at 24.9 in May. We could see a broader surplus in June. For Australia, China’s imports often matter more than the bottom line.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD started the week by climbing above the 0.7325 level mentioned last week and made its way up.

Technical lines from top to bottom:

0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7610 was the peak of an upwards move in late May.

0.7560 is the next level to watch after it was the recovery level in early May. 0.7520 was a swing low in late May.

0.7470 was an initial low in late April and it is followed by 0.7425 was the recovery level in July 2018. Further down, 0.7375 is notable.

0.7310 is the low of July 2018. 0.7250 served as a pivotal line in early 2017 and the last line to watch is 0.7160 that was the swing low back then.

I remain bearish on AUD/USD

Without any real relief on the trade front, it is hard to see any upside for the Australian Dollar.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!