The Australian dollar moved up nicely on upbeat data but was unable to close at the highs. The jobs report is the main event of the week, but the mood in markets may have a significant impact as well. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The RBA left the interest rates unchanged as widely expected and did not rock the boat. The GDP report gave a boost to the Australian dollar with an increase of 1%, better than expected and reflecting robust growth. Also, Australia’s retail sales beat early estimates with an increase of 0.4%. In the US, data was OK but the USD ignored it. Concerns about global trade crept in towards the end of the week as US President Trump adopted a more aggressive approach. The A$, a risk currency, was unable to close at the highs.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

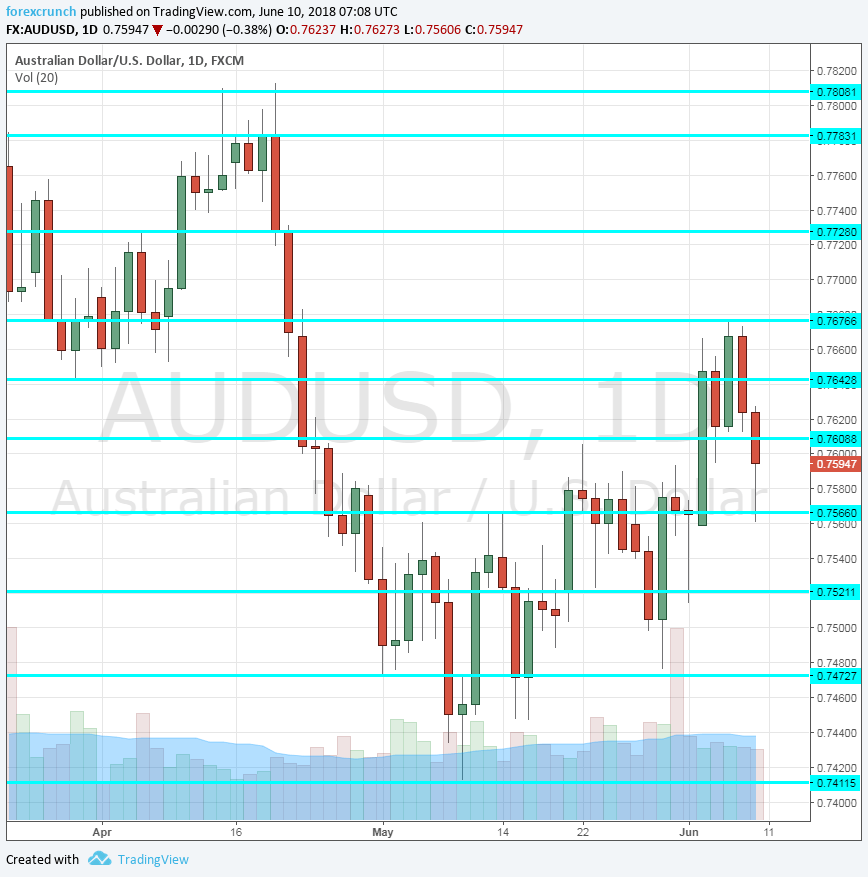

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- NAB Business Confidence: Tuesday, 1:30. National Australia Bank showed an increase to 10 points in its monthly survey of around 350 businesses. A similar score is likely now.

- Home Loans: Tuesday, 1:30. This volatile gauge of the housing sector dropped in the past four months, suffering a slide of 2.2% in March. We will now get the figures for April which are projected to show a drop of 1.7%.

- Westpac Consumer Sentiment: Wednesday, 00:30. The Westpac / Melbourne Institute’s measure of consumer confidence dropped by 0.6% in April, repeating the fall seen in March. The figure for May may be better.

- Phillip Lowe speaks Wednesday, 2:00. The Governor of the Reserve Bank of Australia will speak in Melbourne about “Productivity, Wages, and Prosperity”. The title of the speech implies that hints about monetary policy may appear in it.

- MI Inflation Expectations: Thursday, 1:00. The Melbourne Institute’s measure of inflation fills a vacuum that the government leaves by publishing inflation figures only once per quarter. It showed a gain of 3.7% last time.

- Australian jobs report: Thursday, 1:30. After enjoying an upbeat GDP report, this week features another top-tier figure: the employment report. After reporting an increase of 22.6K in April, a similar gain of 19.2K positions is on the cards for May. The unemployment in the land down under is forecast to remain at 5.6%, a healthy level.

- Chinese Industrial Production: Thursday, 2:00. Australia’s No. 1 trading partner has enjoyed a growth rate of 7% y/y in industrial output in April, above averages. The same level is on the cards for May.

- Luci Ellis speaks Friday, 3:30. The RBA Assistant Governor will speak in Sydnay and will also answer questions from the audience. The gathering is around infrastructure, so she may skip comments about monetary policy.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD began the week on the upside, eventually hitting the 0.7675 resistance line (mentioned last week). However, the pair lost ground towards the end of the week.

Technical lines from top to bottom:

0.7730 capped the pair in early April. 0.7675 provides some support in March and is another stepping stone.

Further below, 0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7610 was the peak of an upwards move in late May.

0.7560 is the next level to watch after it was the recovery level in early May. 0.7520 was a swing low in late May.

0.7430 was an initial low in late April and it is followed by 0.7410, an old line from 2017. Further down, 0.7375 is notable.

I am bearish on AUD/USD

The Australian economy looks good, but the risk-off sentiment triggered by the looming trade wars could weigh heavily on the Australian Dollar.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!