- Manufacturing PMI: Monday, 23:00. The PMI has managed only one read this year above the 50-level, which separates expansion from contraction. The index slowed to 42.8 in May, down from 45.6 beforehand. We now await the June data.

- Services PMI: Monday, 23:00. The services sector is in deep-freeze, as the PMI has fallen deep into contraction territory. The index came in at 25.5 in May and another weak figure is expected in the June release.

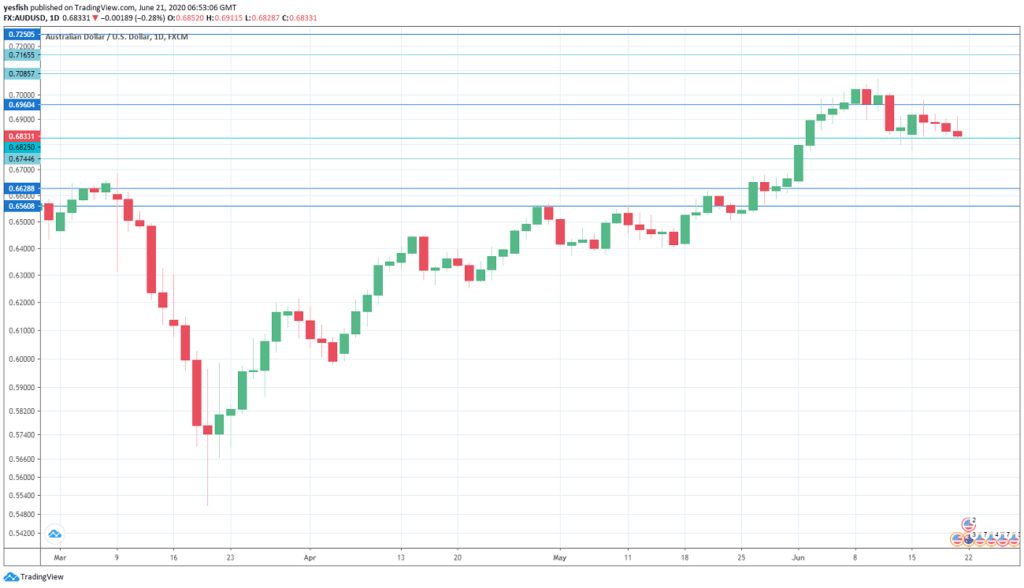

AUD/USD made a push for the 70 level, but was unable to consolidate and ended the week unchanged. The upcoming week has two events. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

The RBA released the minutes of its June policy meeting. At the meeting, policymakers maintained current policy settings, including holding the cash rate at 0.25 percent. Unemployment surged for a second straight month, as the economy shed 227.7 thousand jobs, worse than the forecast of 105.0 thousand. The unemployment rate jumped to 7.1 percent, up from 6.2 percent beforehand. There was better news on the consumer front, as retail sales jumped 16.3% in April, after two successive declines of close to 18 percent each.

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7340. This is followed by 0.7250.

0.7165 has held firm since early April. 0.7085 is next.

0.6960 is protecting the 0.70 line, which has psychological significance.

0.6825 (mentioned last week) is an immediate support line.

0.6744 was a low point in January.

0.6627 has provided support since late May.

0.6560 is the final support level for now.

.

I remain neutral on AUD/USD

The Australian dollar has performed well in Q2, but the risk currency remains vulnerable as Covid-19 has ravaged the worldwide economy.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!