- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. The RBA minutes will provide details of the policy meeting held earlier this month. The bank maintained the cash rate of 0.25%, where it has been pegged since March, in a response to the economic meltdown caused by the Covid-19 pandemic. A positive tone from the minutes could give a boost to the Aussie, which has looked strong in the second quarter of the year.

- MI Leading Index: Wednesday, 00:30. The Melbourne Institute Index tends to have a muted impact on AUD/USD, as most of the data has been previously released. The indicator has posted three consecutive declines, including a sharp drop of 1.5% in April. We now await the May data.

- Jobs Report: Thursday, 1:30. The economy was hammered in April, shedding a staggering 594 thousand jobs. This was worse than the estimate of -575 thousand. A much smaller decline of 75 thousand jobs is projected for May. The unemployment rate climbed from 5.2% to 6.2% in April and is expected to hit 7.0% in May.

- Retail Sales: Friday, 1:30. Consumers are holding tight to their purse strings due to severe economic conditions. Retail sales have plunged by over 17% in the past two months, and another drop is likely in the upcoming release.

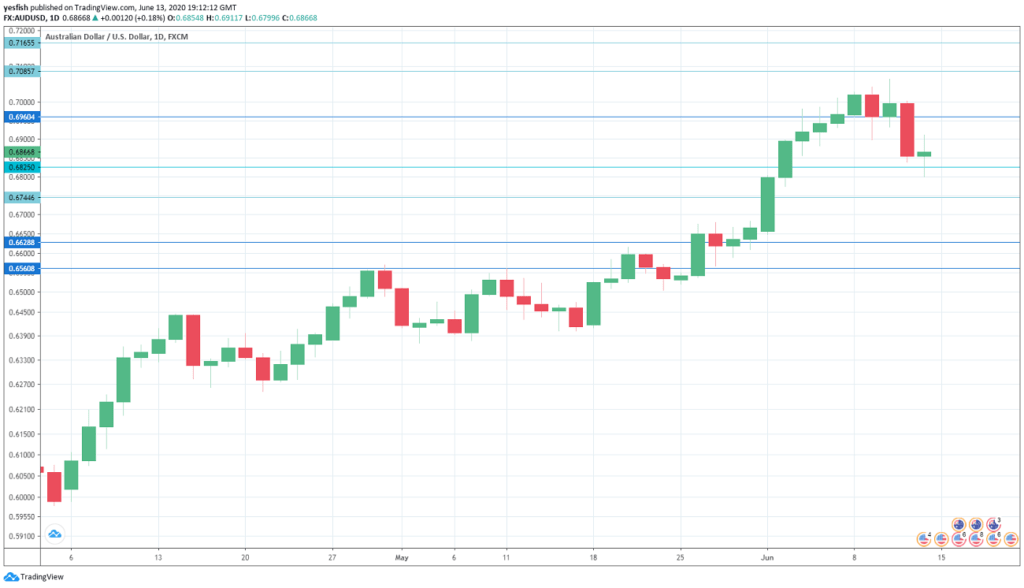

After heading higher for three straight weeks, AUD/USD reversed directions last week, falling 1.4 percent. The upcoming week has four events, including employment reports and retail sales. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

In Australia, the National Australian Bank business confidence barometer remains deep in negative territory, indicating pessimism. The indicator came in at -20 in May, but has been moving higher. Westpac consumer sentiment gained ground for a second straight month, with a reading of 6.3 percent.

.

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7340. This is followed by 0.7250.

0.7165 has held firm since early April.

0.7085 has some breathing room after AUD/USD lost ground last week.

0.6960 is protecting the 0.70 line, which has psychological significance.

0.6825 (mentioned last week) is under pressure in support.

0.6744 was a low point in January.

0.6627 has provided support since late May.

0.6560 is the final support level for now.

.

I remain neutral on AUD/USD

It was an off week for the Aussie, which has performed well in the second quarter. The country’s economy has been hit hard by the global slowdown, but the Chinese economy is showing signs of recovery, which is good news for the currency.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!