AUD/USD showed little change for a second straight week. The upcoming week has seven events. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

It was a quiet week in Australia, with no major events. Manufacturing PMI improved from 42.8 to 49.8, just shy of the 50.0 line, which separates contraction from expansion. Services PMI shot up, from 25.5 in May to 53.2 in June.

In the U.S., manufacturing improved sharply, as Manufacturing PMI climbed from 39.8 to 49.6 points. The estimate stood at 50.0, which separates contraction from expansion. Durable goods orders sparkled in May. The headline figure climbed 4.0%, rebounding after a decline of 7.4 percent. The core reading surged 15.8%, rebounding from a read of -17.2% beforehand.

Final GDP for the first quarter showed a decline of 5.0%, unchanged from the advance estimate. Unemployment claims dropped from 2.43 million to 2.12 million, which was within expectations. The news was not as good on the consumer front, personal spending declined by 13.6%, after a decline of 7.5% beforehand.

- Chinese Manufacturing PMI: Tuesday, 1:00. Investors keep a close eye on key Chinese indicators, as China is Australia’s largest trading partner. Manufacturing PMI has been just above the 50.0 level for the past two months, which separates contraction from expansion. The estimate for June stands at 50.4 points.

- Private Sector Credit: Tuesday, 1:30. Borrowing levels sagged in April, falling from 1.1% to 0.0%. This fell short of the forecast of 0.6 percent. Little change is expected in May, with an estimate of 0.1percent.

- AIG Manufacturing Index: Tuesday, 22:30. The Australian Industry Group index improved to 41.6 in May, improving from 35.8 beforehand. Will the uptick continue?

- Building Approvals: Wednesday, 1:30. Building approvals tend to show strong fluctuation from month-to-month. After a huge gain of 19.9% in February, the indicator has posted two successive declines. Another drop is expected in May, with an estimate of -6.0 percent.

- Trade Balance: Thursday, 1:30. Australia’s trade surplus narrowed to A$8.80 billion in April, down from A$10.60 billion. Still, this beat the estimate of A$7.50 billion. The surplus is expected to climb to A$9.00 billion in May.

- AIG Construction Index: Thursday, 22:30. The construction sector continues to show sharp contraction. The PMI improved to 24.9 in May, up from 21.6 beforehand. We now await the June data.

- Retail Sales: Friday, 1:30. Retail sales is a market-mover which is closely monitored by investors. After two declines of around 17%, retail sales rebounded in April, with a strong gain of 16.3 percent. An identical gain is projected for the May release.

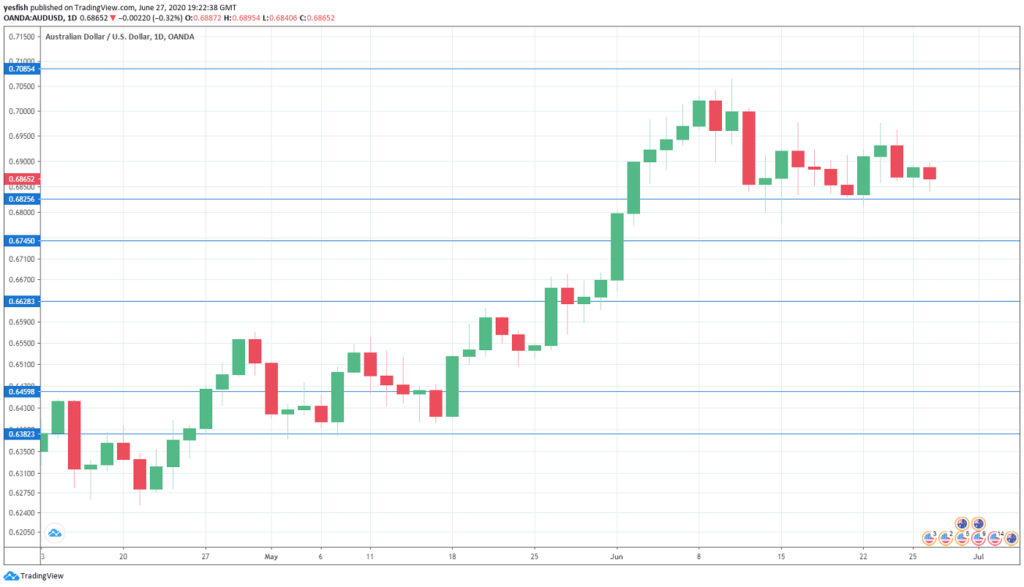

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7250.

0.7165 has held firm since early April. 0.7085 is next.

0.6960 is protecting the 0.70 line, which has psychological significance.

0.6825 (mentioned last week) is an immediate support line.

0.6744 was a low point in January.

0.6627 has provided support since late May.

0.6560 is the final support level for now.

I am neutral on AUD/USD

The Australian currency has jumped almost 12% in the second quarter, but has shown limited movement in the past two weeks. In the current environment of severe economic conditions, investors will be exercising caution before buying risk currencies like the Aussie.

Follow us on Sticher or iTunes

Further reading:

Safe trading!