The Australian dollar eventually trod water as the page turned onto June. Will it pick a direction now? A busy week features the rate decision and the GDP report. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australian data mostly disappointed with capital expenditure rising by only 0.4% and building approvals plunging by 5%. The US Dollar gained some ground on an upbeat jobs report which showed 223K jobs gained and also on some safe haven flows related to the Italian crisis. Chinese data came in line with expectations, not moving the needle too much.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

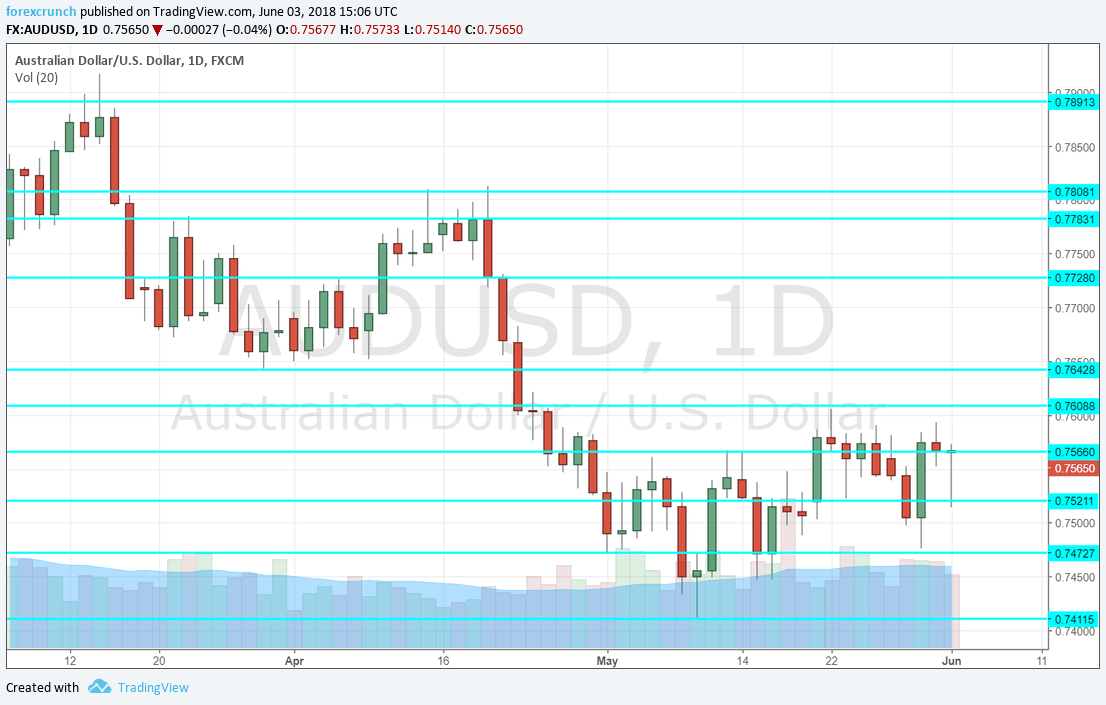

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- MI Inflation Gauge: Monday, 1:00. The Melbourne Institute’s measure of inflation fills the gap for the government that publishes price development only on a quarterly basis. After a rise of 0.5% in April, a slower pace may be seen for May.

- Retail Sales: Monday, 1:30. Australian consumers did not increase nor decrease their buying March, a disappointing outome. A rise of 0.3% is now expected in this important economic gauge.

- Company Operating Profits: Monday, 1:30. This quarterly figure provides another view of the health of the economy. After a rise of 2.2% in Q4 2017, another increase of 3.1% is on the cards.

- ANZ Job Advertisements: Monday, 1:30. The Australia New Zealand Bank’s measure of job ads precedes the official jobs report. A fall of 0.2% was reported in April. We will now get the figures for May.

- AIG Services Index: Monday, 22:30. The Australian Industry Group’s gauge for the services sector stood at 55.2 points in April, reflecting OK growth in this forward-looking index. A similar figure is likely.

- Current Account: Tuesday, 1:30. Australia’s current account deficit widened in Q4 2017 to no less than 14 billion. Throughout 2017, the figures came out below expectations. A narrower deficit of 9.9 billion is on the cards for Q1 2018.

- Rate Decision: Tuesday, 4:30. The Reserve Bank of Australia has not changed its interest rate since mid-2016. This time is unlikely to be different with Phillip Lowe and his colleagues expected to hold the Cash Rate at 1.50%. The RBA has recently raised its growth forecasts but remains in rush to increase rates. It will be interesting to see if the Bank mentions global trade tensions in its statement.

- Michele Bullock talks Tuesday, 23:00. The RBA Assistant Governor will speak in Melbourne and may shed light on how the RBA sees recent developments, adding some insights into the recent RBA decision.

- Australian GDP: Wednesday, 1:30. Australia publishes its GDP report late, but only once, unlike the US with two revisions. The economy of the land down under disappointed with a slow growth rate of 0.4% q/q in the last quarter of 0.4%. A pickup in activity is likely for the first quarter of 2018. A considerably stronger growth rate is forecast now: 0.8%.

- AIG Construction Index: Wednesday, 22:30. AIG’s construction index had a similar score to the gauge for the services sector. Also here, no big changes are expected after April’s 55.4 points result.

- Trade Balance: Thursday, 1:30. Contrary to the current account, Australia enjoyed three consecutive months of trade surpluses, with the recent figure standing at 1.53 in March. A more modest surplus of 1.03 billion is projected for April.

*All times are GMT

AUD/USD Technical Analysis

Once again, Aussie/USD did not go anywhere fast with a fall to the 0.7520 level (discussed last week) being only temporary.

Technical lines from top to bottom:

0.7730 capped the pair in early April. 0.7675 provides some support in March and is another stepping stone.

Further below, 0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7610 was the peak of an upwards move in late May.

0.7560 is the next level to watch after it was the recovery level in early May. 0.7520 was a swing low in late May.

0.7430 was an initial low in late April and it is followed by 0.7410, an old line from 2017. Further down, 0.7375 is notable.

I am bearish on AUD/USD

While the Australian dollar weathered the recent USD strength, this cannot last forever. Recent daa have been weak and the greenback could resume its strength.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!