- NAB Business Confidence: Tuesday, 1:30. The National Australia Bank indicator plunged to -66 in March, followed by -46 in April. This points to sharp pessimism in the business sector. We’re likely to see another reading deep in negative territory this week.

- Westpac Consumer Sentiment: Wednesday, 00:30. Consumer sentiment bounced back in May, with an excellent gain of 16.4 percent. This follows back-to-back declines. Will the upturn continue in June?

- MI Inflation Expectations: Thursday, 1:00. This Melbourne Inflation is closely watched, as inflation expectations can translate into actual inflation figures. The April gain of 3.4% was well off the 4.6% clip seen a month earlier. Inflation levels have been soft, and this could be reflected in a smaller gain in May compared to April.

The Aussie enjoyed a superb week, as AUD/USD soared 4.5 percent. The upcoming week has three events with a focus on confidence surveys. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

Inflation was down sharply in May, as the Melbourne Institute inflation gauge fell 1.2%. This points to subdued economic activity. On a brighter note, the current surplus improved to A$8.4 billion, up sharply from 1.0 billion beforehand. This figure beat the estimate of A$6.3 billion. The RBA held steady, keeping the cash rate at an ultra-low 0.25 percent. If the Aussie continues to rally, we could see some intervention from the central bank. The economy contracted by 0.3% in Q1, the first decline since 2016. Analysts had expected a decline of 0.4%. Finally, the trade surplus fell to A$8.8 billion, down from A$10.6 billion beforehand.

.

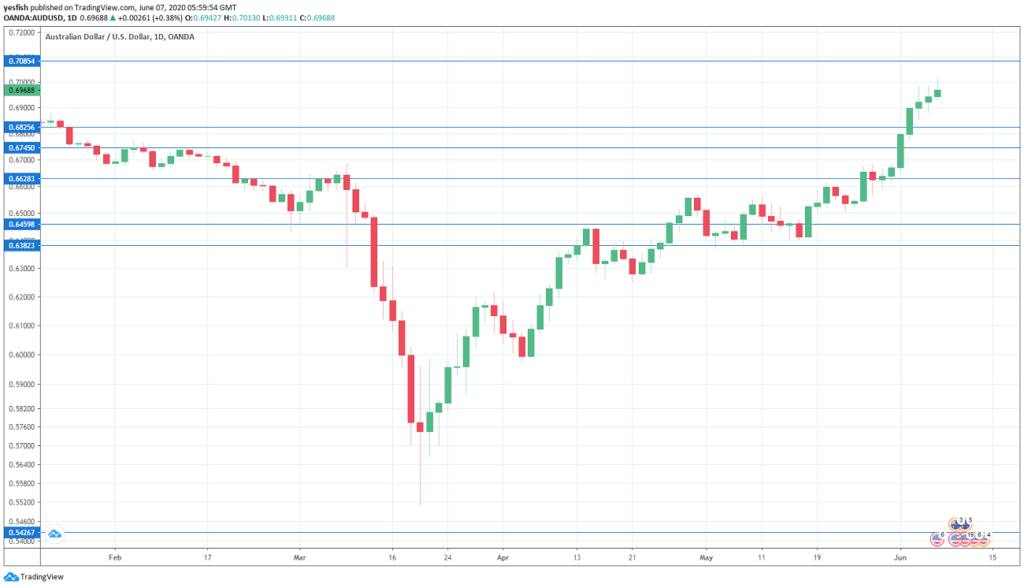

AUD/USD Technical Analysis

Technical lines from top to bottom:

With AUD/USD posting strong gains last week, we begin at higher levels:

We start with resistance at 0.7340. This is followed by 0.7250.

0.7165 has held firm since early April.

0.7085 could come under pressure if AUD/USD continues to move higher.

0.6960 is protecting the 0.70 line, which has psychological significance.

0.6825 (mentioned last week) supported the pair in late 2016 and early 2017.

0.6744 was a low point in January.

0.6627 is the final support level for now.

.

I am neutral on AUD/USD

Investors are often wary of risk currencies in uncertain times, but the Aussie is on fire, with gains of 13% in the second quarter. This rally has been helped by broad U.S dollar weakness rather than strong Australian data. The country’s economy has been hit hard by the slowdown in China, so we could see a downward correction in the near term.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!