- Chinese Industrial Production: Monday, 2:00. The indicator improved to 6.9% in February, up from 6.2% a month earlier. China’s manufacturing sector has been crippled by the coronavirus and the forecast for February stands at -3.0%.

- RBA Monetary Policy Meeting Minutes: Tuesday, 0:30. The minutes provide details of the bank’s policy meeting earlier in March. At that meeting, the RBA lowered the benchmark rate from 0.75% to 0.50%. A pessimistic assessment by policymakers in the minutes could weigh on the Aussie.

- House Price Index: Tuesday, 0:30. The index rebounded in Q3 after six straight quarterly declines, with a gain of 2.4%. This easily beat the forecast of 0.5%. The upwards swing is expected to continue in Q4, with an estimate of 4.5%.

- MI Leading Index: Tuesday, 23:30. The Melbourne Institute index continues to point to weak economic conditions, with two straight readings of 0.1%. We now await the February data.

- Employment Reports: Thursday, 0:30. Job creation has been slowing, as the January reading came in at 13.5 thousand, down sharply from 28.9 thousand in the previous release. The downswing is expected to continue in February, with an estimate of 8.5 thousand. The unemployment rate is projected to remain unchanged at 5.3%.

.

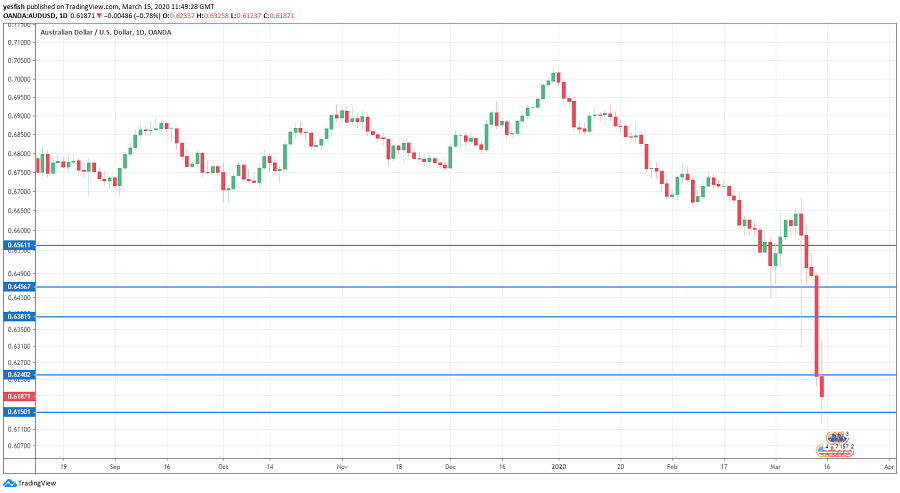

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.6560.

0.6456 is next.

0.6380 (mentioned last week) has switched to resistance. The line had held in support since 2009.

0.6240 is next.

0.6150 was tested last week. This line is currently a weak support level and could break early next week.

The round number of 0.6000, which has psychological significance, is the next support level. This is followed by 0.5900.

0.5820 is the final support line for now.

.