The Aussie sagged last week, as AUD/USD declined by 1.8 percent. The upcoming week has two events. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

The NAB Business Confidence gauge showed deep pessimism in April, with a read of -45 points. Still, this was an improvement over the previous reading of -66 points. There was better news from Westpac Consumer Sentiment, which posted a strong gain of 16.4% of May. This marked a strong rebound after the April slide of -17.7 percent. Employment numbers were dismal in April. The economy shed 594.3 thousand jobs and the unemployment rate soared to 6.2 percent, up from 5.2% a month earlier.

In the U.S., inflation tanked in April, as the economy continues to buckle under the weight of the Corvid-19 pandemic. CPI declined by 0.8%, down from -0.4% a month earlier. The core read fell by 0.4%, down from -0.1% in the previous release. Both figures missed their estimates. Unemployment claims continue to fall and dropped below 3 million last week, with a release of 2.98 million. Still, this missed the estimate of 2.5 million. Retail sales were a bloodbath in April – the headline figure fell by 16.4%, while the core read declined by 17.2 percent. Analysts had projected declines of -12.0% for the headline and 16.4 for the core releases.

- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. The RBA minutes will provide details of the policy meeting earlier this month. At that meeting, policymakers held the cash rate at 0.25 percent, noting the uncertainty over the outlook for the economy.

- MI Leading Index: Wednesday, 0:30. The Melbourne Institute index fell sharply in March, with a decline of 0.8%, pointing to a sputtering economy. The April release is next.

.

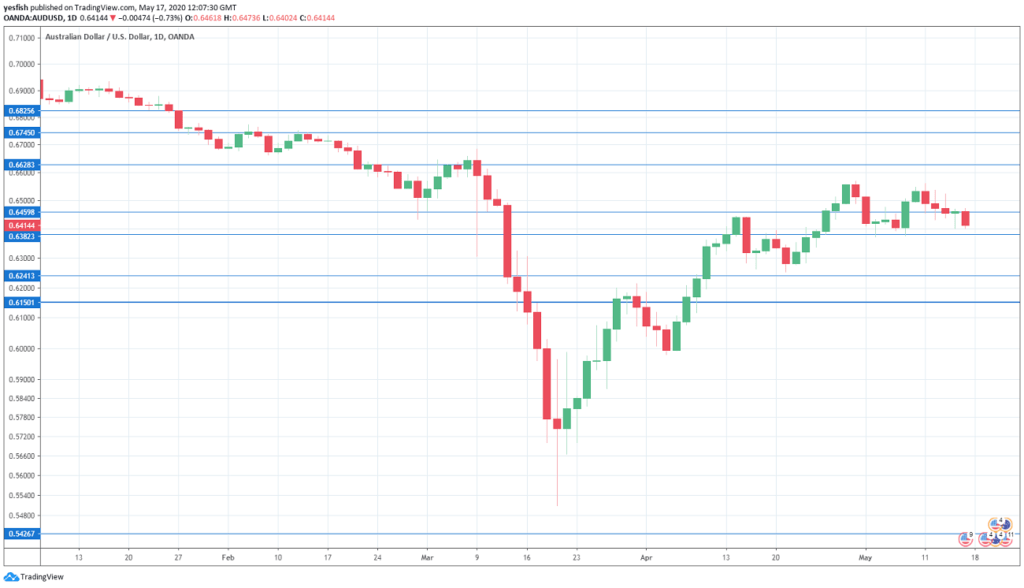

AUD/USD Technical Analysis

Technical lines from top to bottom:

0.6825 supported the pair in late 2016 and early 2017.

0.6744 was a low point in January.

0.6627 has held in resistance since early March. 0.6560 is next.

0.6456 remains relevant and is the next resistance line.

0.6380 (mentioned last week) remains a weak support level. This line could see action early in the week.

0.6240 is next.

0.6150 has provided support since early April. It is the final support level for now.

I am neutral on AUD/USD

Australia is very dependent on trade with China, and the huge slowdown in China has also taken a heavy toll on the Australian economy. In the near-term, the outlook for the Australian dollar is negative.

Follow us on Sticher or iTunes

Further reading:

Safe trading!