- Construction Work Done: Wednesday, 1:30. The quarterly report on the construction sector will provide some insights into the current slowdown. The indicator has posted six straight declines, and Q4 came in at -3.0%, worse than the estimate of -1.0%. The downward trend is expected to continue, with an estimate of -1.5 percent.

- Private Capital Expenditure: Thursday, 1:30. The all-important quarterly measure reflects investment in the private sector and it is closely watched by the Reserve Bank of Australia. The indicator has failed to post any gains since 2018 and declined by 2.8% in Q4. Analysts had expected a gain of 0.5%. Little change is projected for Q1 of 2020, with a forecast of 2.7 percent.

- Private Sector Credit: Friday, 1:30. More credit to the private sector results in enhanced economic activity. Credit levels jumped 1.1% in February, crushing the estimate of 0.3%. Another gain is expected in March, with an estimate of 0.6%.

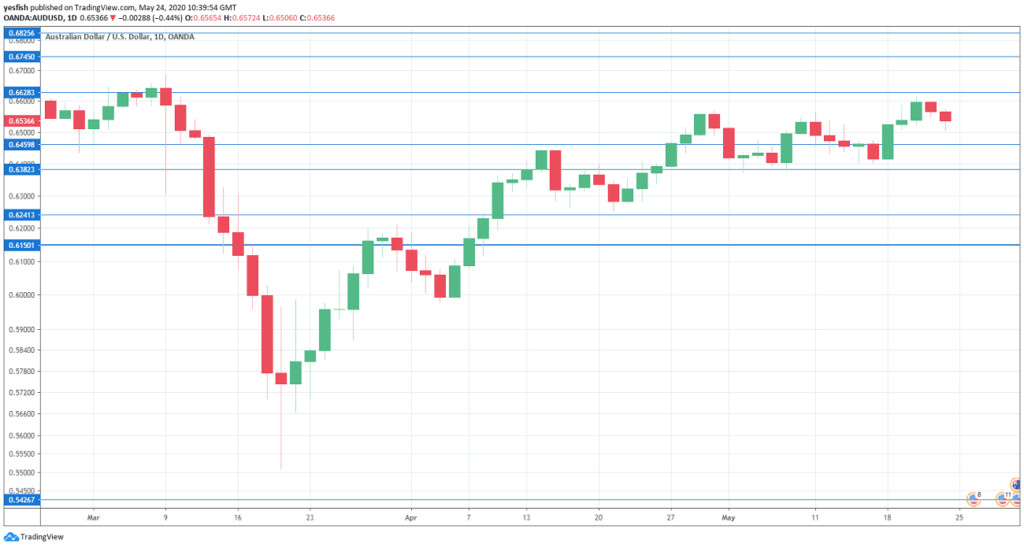

AUD/USD Technical Analysis

.

Technical lines from top to bottom:

0.6825 supported the pair in late 2016 and early 2017.

0.6744 was a low point in January.

0.6627 has held in resistance since early March.

0.6560 is an immediate resistance line.

0.6456 is providing support.

0.6380 (mentioned last week) was tested in the first week of May.

0.6240 is the final support level for now.

.