- MI Inflation Gauge: Monday, 1:00. The Melbourne Institute indicator pointed to an improvement in inflation in March, with a small gain of 0.2%. In the previous month, inflation declined by 0.2%. Will we see an improvement in the April data?

- Building Approvals: Monday, 1:30. This construction indicator jumped 19.9% in February, crushing the estimate of 3.1 percent. In January, the indicator plunged by 15.3%. Another sharp drop is expected in February, with a forecast of -15.0%.

- AIG Construction Index: Monday, 22.:30. The index continues to point to contraction, with readings well below the 50-level. In March, the index slowed to 37.9, down from 42.7 in the previous reading. We now await the April data.

- RBA Rate Decision: Tuesday, 5:30. At the April meeting, the RBA maintained the cash rate at 0.25 percent. No change is expected at the upcoming meeting, but it will be interesting to see the stance of the bank in the rate statement, given the sharp economic deterioration due to Corvid-19.

- Retail Sales: Wednesday, 1:30. Retail sales jumped 8.2% in February, as consumers engaged in a wave of ‘panic buying’ due to the lockdown which has severely restricted movement of residents. Another gain of 8.2% is projected for March.

- AIG Services Index: Wednesday, 22:30. The index has slowed for five straight sessions and slipped to 38.7 in March, pointing to a significant contraction in the services sector. Will the downturn continue in April?

- Trade Balance: Thursday, 1:30. Australia continues to record trade surpluses. The February surplus narrowed to A$4.36 billion, down from A$5.21 billion in January. This marked the smallest surplus since December 2018. A rebound is expected in March, with an estimate of A$6.40 billion.

- RBA Monetary Policy Statement: Friday, 1:30. The quarterly report by the central bank has, at times, provided hints for future monetary policy. It provides a broader view of the economy than the short rate statement. Any hints about changes in interest rates will be scrutinized by markets.

.

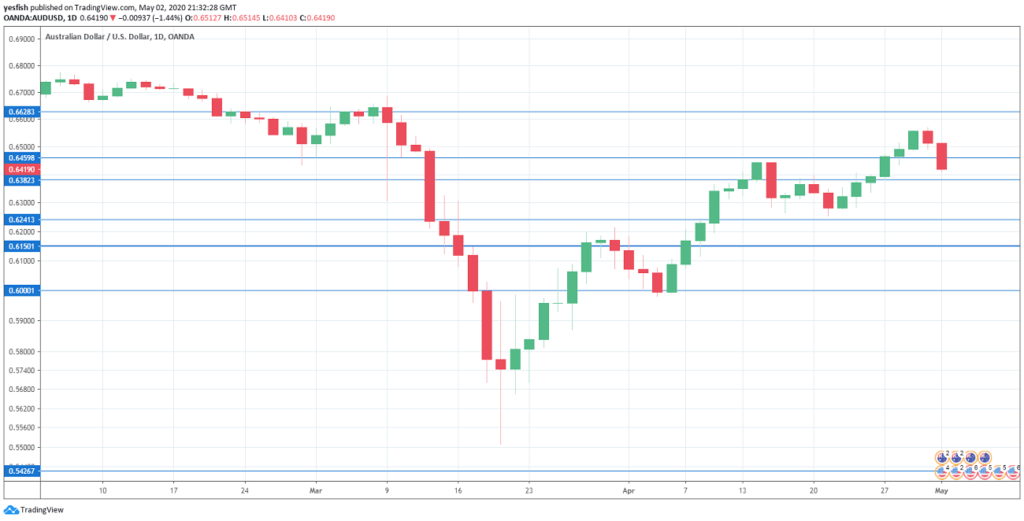

AUD/USD Technical Analysis

Technical lines from top to bottom:

0.6627 has held in resistance since early March. 0.6560 is next.

0.6456 remains relevant and is the next resistance line.

0.6380 (mentioned last week) is an immediate support level. It could see further action early in the week.

0.6240 is next.

0.6150 has provided support since early April.

The round number of 0.6000, which has psychological significance, is the final support level for now.

.