The Australian dollar enjoyed a second consecutive week, but the rally met its limits. What’s next? Australia’s jobs report and wage data stand out. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Reserve Bank of Australia left the interest rate unchanged as expected. The rate statement and the quarterly inflation report did not shed new light on any change in interest rates, but it seems that the RBA is content with the current economic situation. The US Mid-Term elections resulted in a split government as expected. The greenback initially dropped but then recovered.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

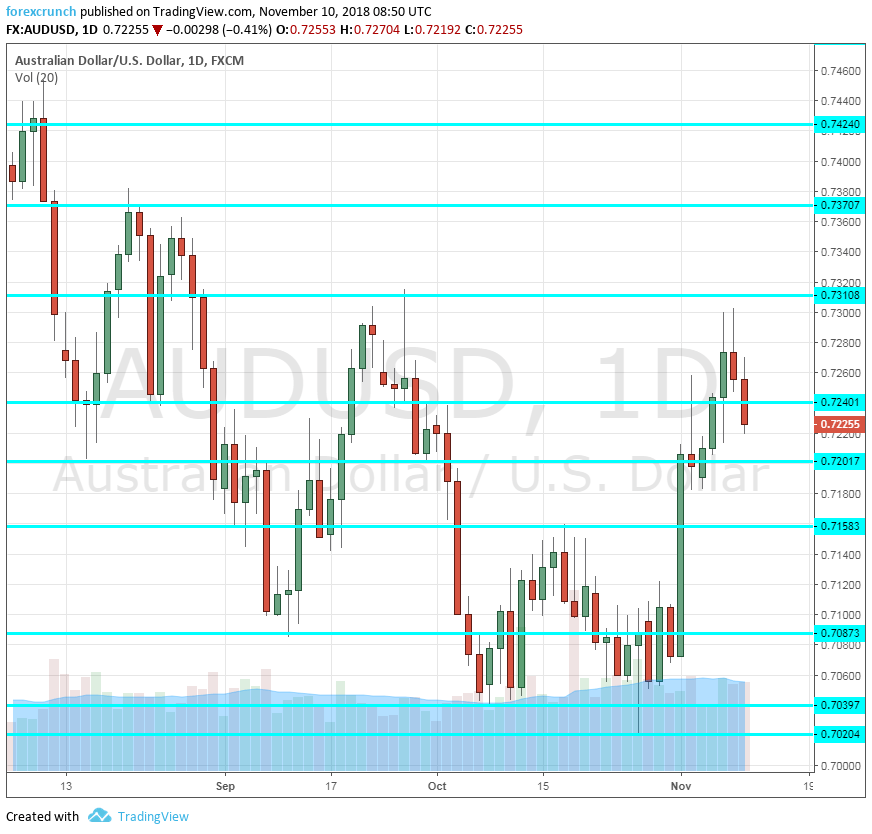

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- NAB Business Confidence: Monday, 00:30. The National Australia Bank’s monthly survey of around 350 businesses rose to 6 points in September, up from 4, but below levels seen earlier in the year. A similar score is likely now. Any positive number reflects improving conditions.

- Westpac Consumer Sentiment: Tuesday, 23:30. Westpac’s survey of around 1,200 consumers has bounced by 1% in October after two months of declines. We will now get figures for November.

- Wage Price Index: Wednesday, 00:30. With improving job markets, the focus in developed countries moves to wages. Australian salaries increased by 0.6% in Q2 2018 and a similar rise is forecast for Q3. While wages are moving at a slightly faster pace in comparison to inflation, it is far from being inflationary.

- MI Inflation Expectations: Thursday, 00:00. The Melbourne Institute’s gauge of inflation expectations fills the gap: the government publishes price data only once per quarter. An annual increase of 4% was reported last time.

- Australian jobs report: Thursday, 00:30. Australia saw only a small gain in jobs in September: 5.6K, a disappointing outcome that weighed on the Aussie. And while the unemployment rate dropped to 5%, it went hand in hand with a drop in the participation rate, so it does not bode well for the economy. A substantial increase of 20.3K is expected for October with the unemployment rate moving up to 5.1%.

- Guy Debelle speaks: Thursday, 00:30. The RBA Assistant Governor will be talking in Melbourne and the focus is on the housing sector, which has seen some struggles lately. It will be interesting to hear what the central bank thinks about the situation in Sydney.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD moved up early on and nearly reached the 0.7310 level (mentioned last week). It then lost some ground.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and the pair attempted to reach it in mid-September.

The round number of 0.7200 was a temporary low. 0.7150 was a stepping stone on the way down in early September. 0.7020 was the low point in late October and the last defense before the round number of 0.70.

The round number of 0.70 is closely watched by many market participants. Close by, 0.6970 played a role back in January 2017. Below, the only noteworthy level is only 0.6825 that supported the pair in late 2016 and early 2017.

I am bearish on AUD/USD

The US Dollar, backed by a hawkish central bank, has more room to run. Australia is still sensitive to the trade war between China and the US and the domestic jobs report may dsiappoint.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!