The Australian dollar enjoyed a comeback week alongside stocks. Hopes for a deal between the US and China certainly helped. What’s next? The RBA stands out in the upcoming week. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Global stocks made a comeback and the risk-on atmosphere triggered demand for the Aussie. US President Trump tweeted about a successful conversation with Chinese President Xi Jinping. Towards the end of the week, hopes for a deal were cooled down by officials. Australian CPI slightly disappointed with 0.4% q/q on both the headline and the core figures, but overall inflation is stable. The trade balance beat expectations with a broad surplus but retail sales slightly slipped.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

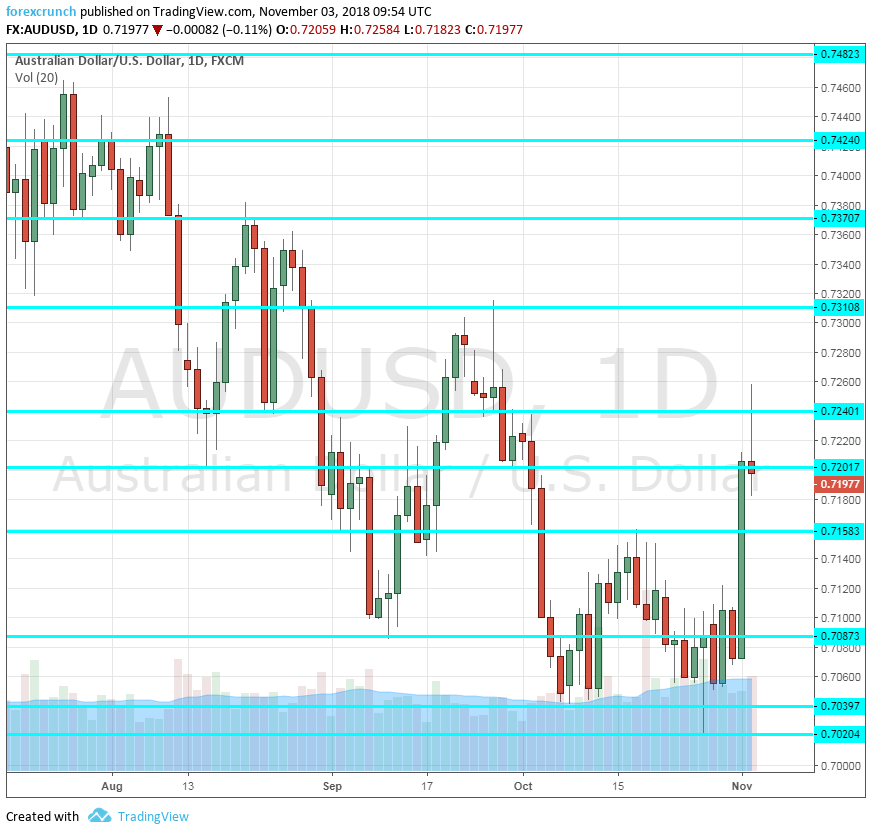

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- AIG Services Index: Sunday, 21:30. The Australian Industry Group’s gauge of the services sector stood at 52.5 points in September, only slightly above the 50-point gauge that separates expansion from contraction. A similar score is likely now.

- MI Inflation Gauge: Monday, 00:00. The Melbourne Institute’s inflation measure is a useful filler as the authorities release official CPI data only once per quarter. The gauge advanced by 0.3% in September. We will now get fresh figures for October, the first month of Q4.

- ANZ Job Advertisements: Monday, 00:30. ANZ’s employment measure comes out before the official jobs report. A drop of 0.8% was recorded in September and we may see a bounce now.

- Australian rate decision: Tuesday, 3:30. The Reserve Bank of Australia has not changed interest rates since mid-2016. It maintains the neutral stance but does express some concerns about global growth, the housing market, and other issues. On the other hand, the employment situation is OK. It will be interesting to see if the RBA changes its stance given the recent inflation data.

- AIG Construction Index: Tuesday, 21:30. AIG’s second publication for the week is for the construction sector. It has not been doing so well of late. The latest figure for Septembre stood at 49.3, below the 50-point threshold and pointing to contraction.

- RBA Monetary Policy Statement: Friday, 00:30. The quarterly report by the central bank has, at times, provided hints for future monetary policy. It provides a broader view of the economy than the short rate statement. Any hints about changes in interest rates will be scrutinized by markets.

- Home Loans: Friday, 00:30. Loans to households dropped by 2.1% in August, a disappointing outcome. Another fall, this time of 1.1% is projected for September. Concerns about the housing sector are growing.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD had a slow start to the week. The surge above resistance at 0.7150 (mentioned last week) proved decisive.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and the pair attempted to reach it in mid-September.

The round number of 0.7200 was a temporary low. 0.7150 was a stepping stone on the way down in early September. 0.7020 was the low point in late October and the last defense before the round number of 0.70.

The round number of 0.70 is closely watched by many market participants. Close by, 0.6970 played a role back in January 2017. Below, the only noteworthy level is only 0.6825 that supported the pair in late 2016 and early 2017.

I am neutral on AUD/USD

The .RBA may pour some cold water on the Aussie’s rise. On the other hand, the US Mid-Terms could hurt the US Dollar. All in all, the picture is balanced.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!