The Australian dollar stabilized on higher ground, enjoying an upbeat jobs report and a focus on others’ troubles. The Reserve Bank of Australia stands out in the upcoming week. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia enjoyed a gain of no less than 32.8K jobs in October and the unemployment stuck to 5%. The encouraging figures supported the Aussie. In the US, data was somewhat disappointing with small misses on retail sales and inflation. On the other hand, talks between the US and China are making some progress and this is positive for the A$. The Australian Dollar also benefitted from a focus on Brexit, which hurt the pound, impacted the euro and also moved the safe-haven yen, but left the Aussie unscathed. Late in the week, several Fed officials such as Clarida, Kaplan, and Harker, expressed concerns about the global economy and seemed in no rush to raise interest rates. The US Dollar suffered.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

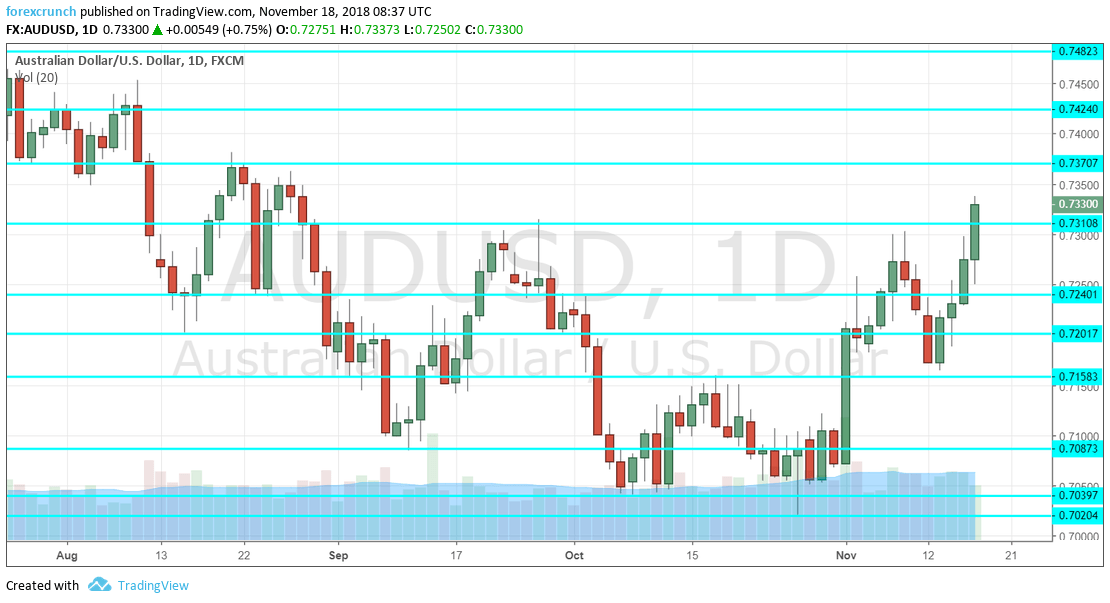

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Monetary Policy Meeting Minutes: Tuesday, 00:30. The Reserve Bank of Australia left the interest rate unchanged in November, at the same rate of 1.50% seen since mid-2016. While the statement was mostly left unchanged as well, the meeting minutes could reveal further information about the central bank’s thinking. Comments on the labor market, the housing sector, and global trade could have an impact.

- Phillip Lowe Speaks: Tuesday, 8:20. The Governor of the RBA will make a public appearance in Melbourne and will talk about “Trust and Prosperity.” Prosperity is clearly related to the economy and monetary policy. Any comments about the current economic situation in the land down under could impact the Aussie.

- MI Leading Index: Tuesday, 23:30. The Melbourne Institute’s composite indicator is based on nine economic figures, mostly published. Nevertheless, it provides a good overview of the economy. The indicator dropped in the September by 0.1% and may move up now.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD initially found some support at 0.7150 (mentioned last week) before moving higher and challenging 0.73.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and the pair attempted to reach it in mid-September.

The round number of 0.7200 was a temporary low. 0.7150 was a stepping stone on the way down in early September. 0.7020 was the low point in late October and the last defense before the round number of 0.70.

The round number of 0.70 is closely watched by many market participants. Close by, 0.6970 played a role back in January 2017. Below, the only noteworthy level is only 0.6825 that supported the pair in late 2016 and early 2017.

I am bulish on AUD/USD

The upbeat Australian job market may continue supporting the Australian Dollar for some time. In addition, China and the US are making progress, and this is good news for Australia, which depends on trade.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!